Question: Individual Task The Capital Asset Pricing Model (CAPM) has dominated academic literature and greatly influenced the practical world of finance and business for almost half

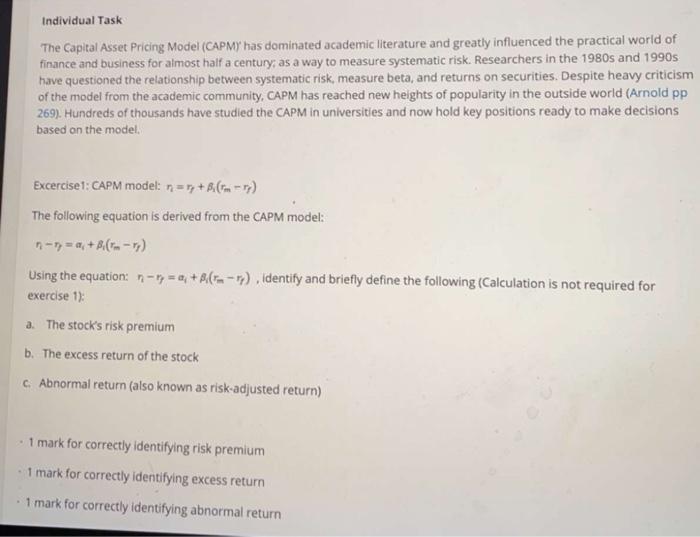

Individual Task The Capital Asset Pricing Model (CAPM) has dominated academic literature and greatly influenced the practical world of finance and business for almost half a century, as a way to measure systematic risk. Researchers in the 1980s and 1990s have questioned the relationship between systematic risk, measure beta, and returns on securities. Despite heavy criticism of the model from the academic community, CAPM has reached new heights of popularity in the outside world (Arnold pp 269). Hundreds of thousands have studied the CAPM in universities and now hold key positions ready to make decisions based on the model Excercise1: CAPM model: n=r,+B(r) The following equation is derived from the CAPM model: n-n=a+A(-) Using the equation: n-n=a+A(-), identify and briefly define the following (Calculation is not required for exercise 1): a. The stock's risk premium b. The excess return of the stock c. Abnormal return (also known as risk-adjusted return) 1 mark for correctly identifying risk premium 1 mark for correctly identifying excess return 1 mark for correctly identifying abnormal return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts