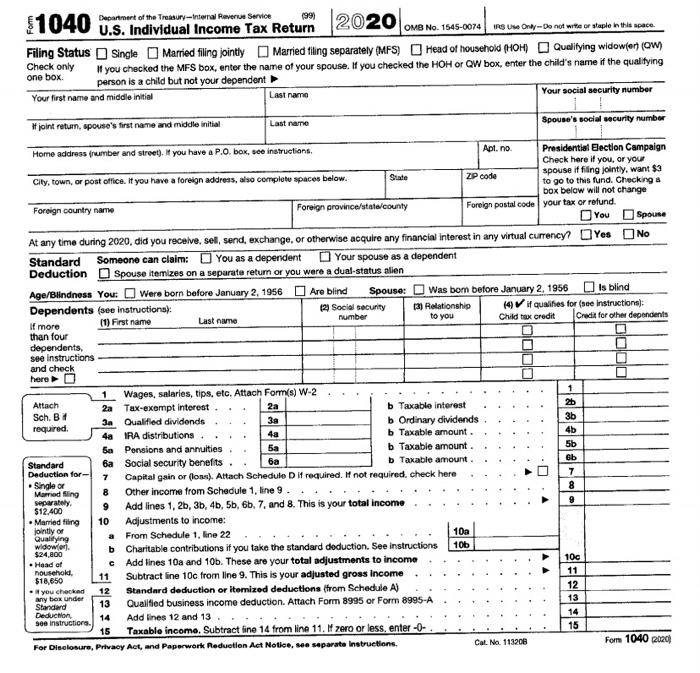

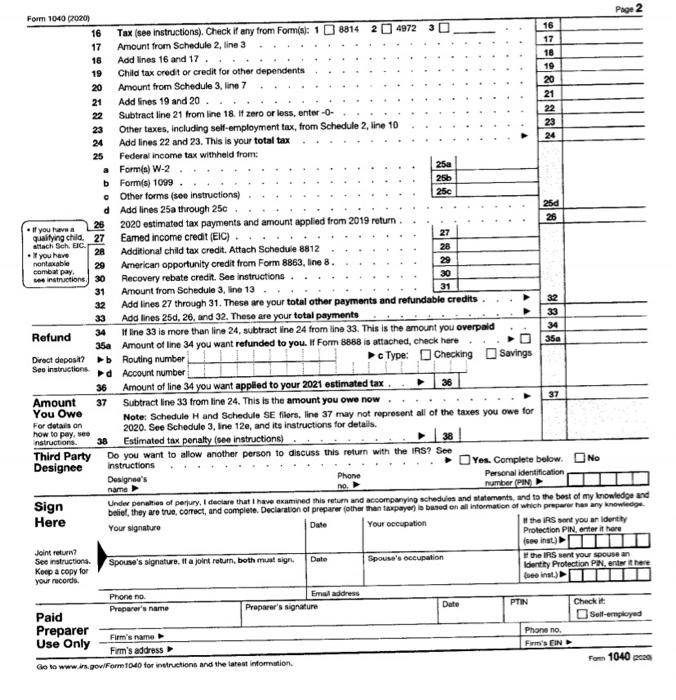

Question: Individual Tax Return forms Individual Tax Return Required: Use the following information to complete Paige Turner's 2020 federal income tax return. If any information is

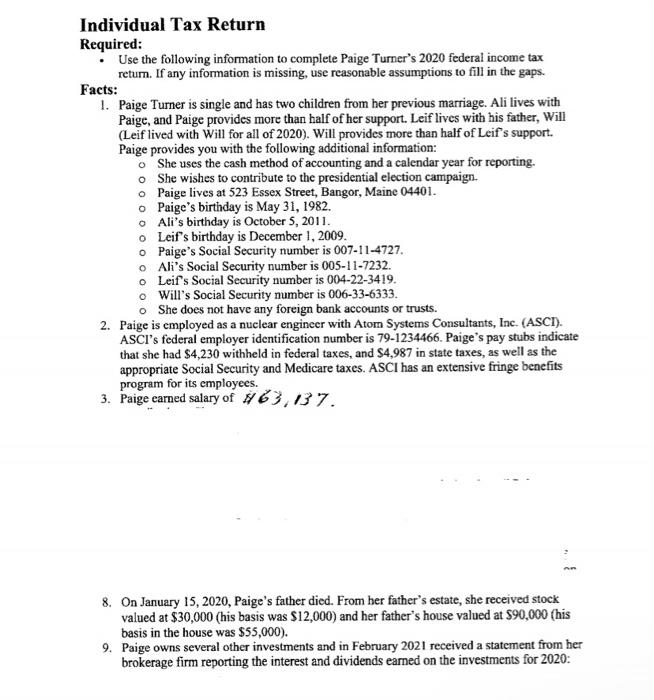

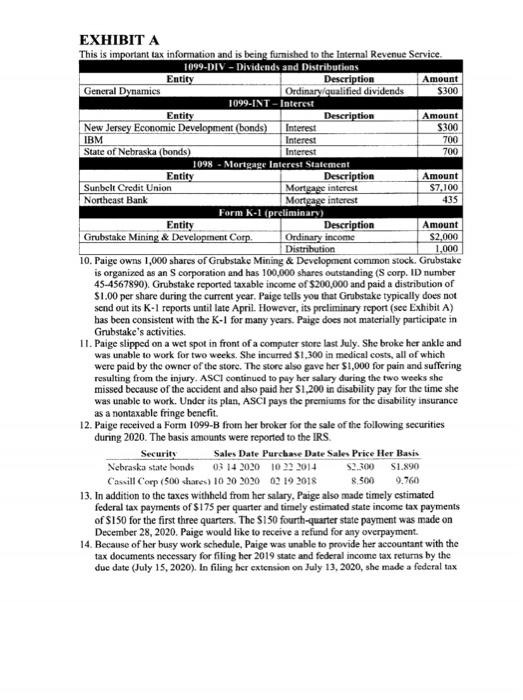

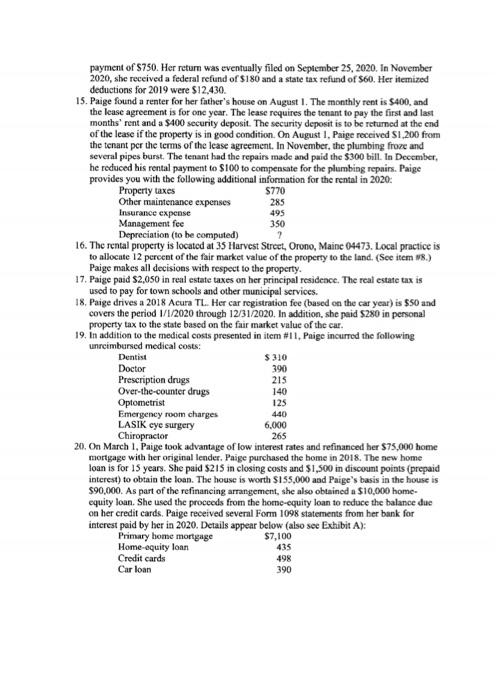

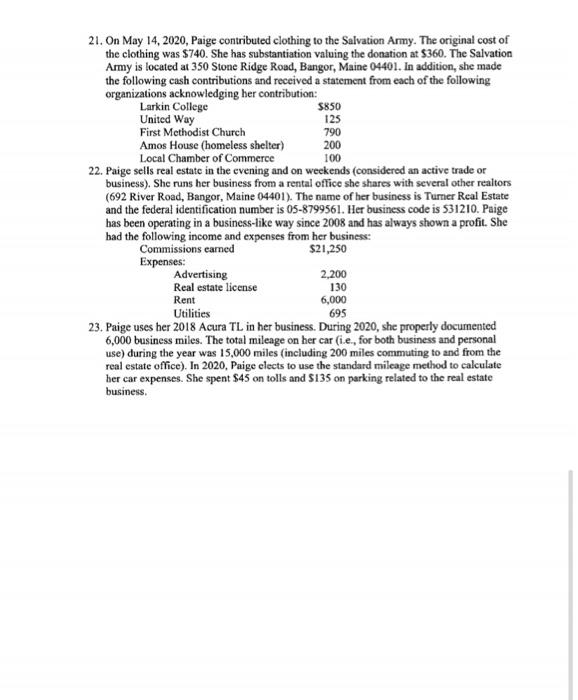

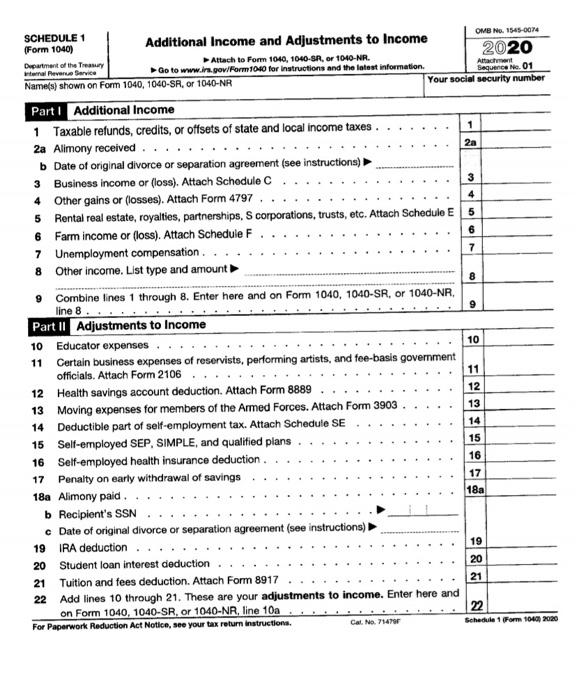

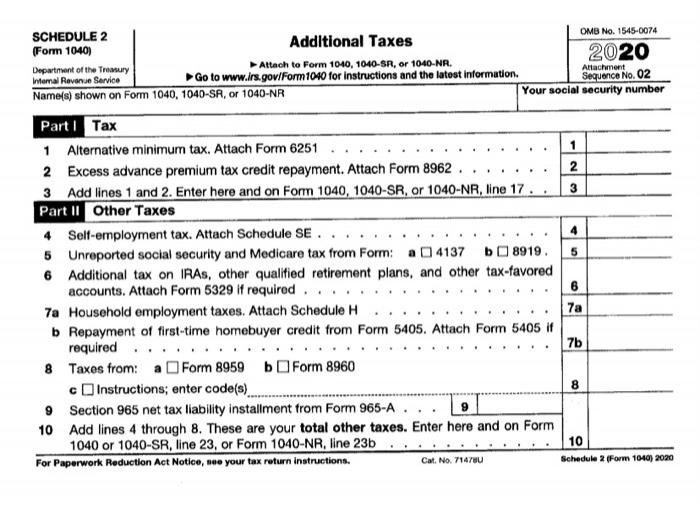

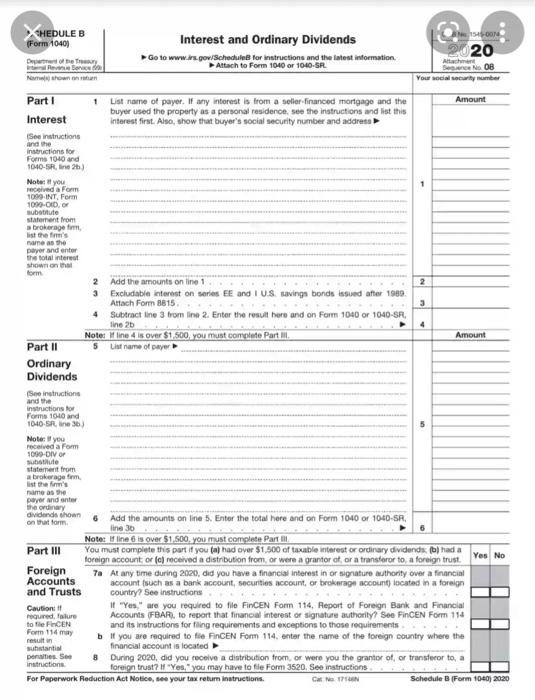

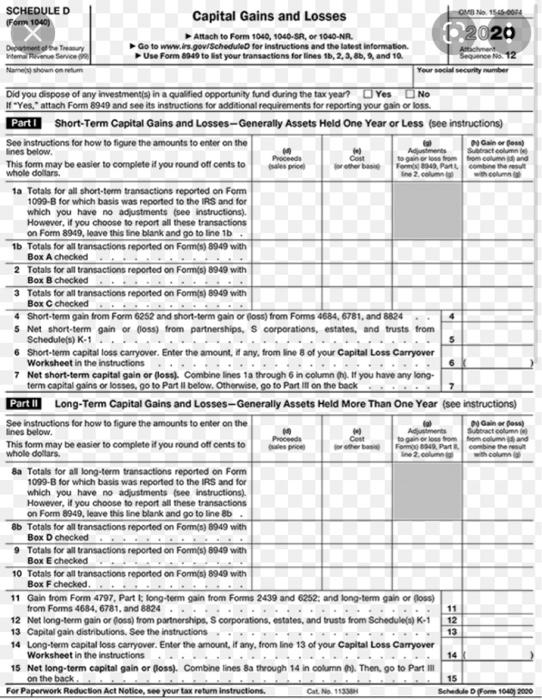

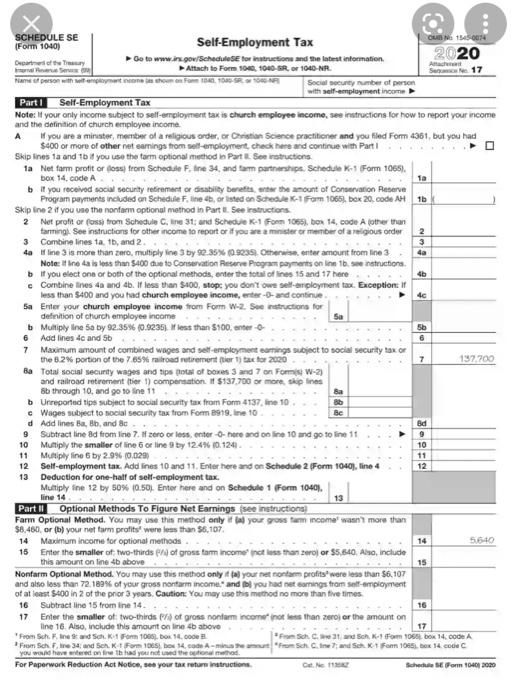

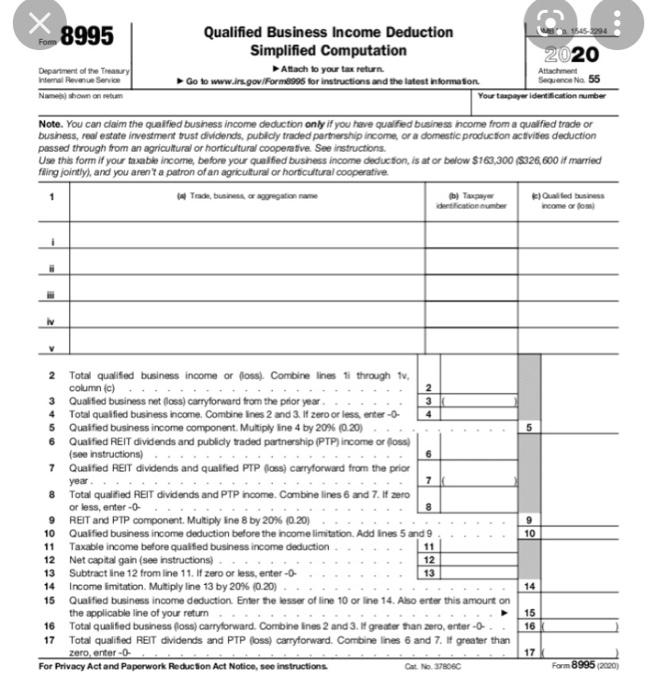

Individual Tax Return Required: Use the following information to complete Paige Turner's 2020 federal income tax return. If any information is missing, use reasonable assumptions to fill in the gaps. Facts: 1. Paige Turner is single and has two children from her previous marriage. Ali lives with Paige, and Paige provides more than half of her support. Leif lives with his father, Will (Leif lived with Will for all of 2020). Will provides more than half of Leif's support. Paige provides you with the following additional information: o She uses the cash method of accounting and a calendar year for reporting. o She wishes to contribute to the presidential election campaign. o Paige lives at 523 Essex Street, Bangor, Maine 04401. o Paige's birthday is May 31, 1982. Ali's birthday is October 5, 2011. o Leif's birthday is December 1, 2009. o Paige's Social Security number is 007-11-4727. o Ali's Social Security number is 005-11-7232. o Leif's Social Security number is 004-22-3419. o Will's Social Security number is 006-33-6333. o She does not have any foreign bank accounts or trusts. 2. Paige is employed as a nuclear engineer with Atom Systems Consultants, Inc. (ASCI). ASCI's federal employer identification number is 79-1234466. Paige's pay stubs indicate that she had $4,230 withheld in federal taxes, and $4,987 in state taxes, as well as the appropriate Social Security and Medicare taxes. ASCI has an extensive fringe benefits program for its employees. 3. Paige earned salary of 163,037. 8. On January 15, 2020, Paige's father died. From her father's estate, she received stock valued at $30,000 (his basis was $12,000) and her father's house valued at $90,000 (his basis in the house was $55,000). 9. Paige owns several other investments and in February 2021 received a statement from her brokerage firm reporting the interest and dividends earned on the investments for 2020: Amount 700 EXHIBIT A This is important tax information and is being furnished to the Internal Revenue Service 1099-DIV- Dividends and Distributions Entity Description General Dynamics Ordinary qualified dividends $300 1099-INT-Interest Entity Description Amount New Jersey Economic Development (bonds) Interest $300 IBM Interest State of Nebraska (bonds) Interest 700 1098 - Mortgage Interest Statement Entity Description Amount Sunbelt Credit Union Mortgage interest $7.100 Northeast Bank Mortgage interest 435 Form K-1 (preliminary) Entity Description Amount Grubstake Mining & Development Corp. Ordinary income $2,000 Distribution 1,000 10. Paige owns 1,000 shares of Grubstake Mining & Development common stock. Grubstake is organized as an Scorporation and has 100.000 shares outstanding (Scorp. ID number 45-4567890). Grubstake reported taxable income of $200,000 and paid a distribution of $1.00 per share during the current year. Paige tells you that Grubstake typically does not send out its K-l reports until late April. However, its preliminary report (see Exhibit A) has been consistent with the K-1 for many years. Paige does not materially participate in Grubstake's activities. 11. Paige slipped on a wet spot in front of a computer store last July. She broke her ankle and was unable to work for two weeks. She incurred $1,300 in medical costs, all of which were paid by the owner of the store. The store also gave her $1,000 for pain and suffering resulting from the injury. ASCI continued to pay her salary during the two weeks she missed because of the accident and also paid her $1,200 is disability pay for the time she was unable to work. Under its plan, ASCI pays the premiums for the disability insurance as a nontaxable fringe benefit. 12. Paige received a Form 1099-B from her broker for the sale of the following securities during 2020. The basis amounts were reported to the IRS Security Sales Date Purchase Date Sales Price Her Basis Nebraska state bonds 0314 2020 10 29 2014 $2.300 S1.890 Casill Corp (500 hores) 10 20 2020 0219 2018 8.500 9.760 13. In addition to the taxes withheld from her salary, Paige also made timely estimated federal tax payments of $175 per quarter and timely estimated state income tax payments of S150 for the first three quarters. The S150 fourth-quarter state payment was made on December 28, 2020. Paige would like to receive a refund for any overpayment. 14. Because of her busy work schedule, Paige was unable to provide her accountant with the tax documents necessary for filing her 2019 state and federal income tax returns by the due date (July 15, 2020). In filing her extension on July 13, 2020, she made a federal tax payment of S750. Her return was eventually filed on September 25, 2020. In November 2020, she received a federal refund of $180 and a state tax refund of $60. Her itemized deductions for 2019 were $12,430. 15. Paige found a renter for her father's house on August 1. The monthly rent is $400, and the lease agreement is for one year. The lease requires the tenant to pay the first and last months' rent and a $400 security deposit. The security deposit is to be returned at the end of the lease if the property is in good condition. On August 1, Paige received 1.200 from the tenant per the terms of the lease agreement. In November, the plumbing froze and several pipes burst. The tenant had the repairs made and paid the $300 bill. In December, he reduced his rental payment to $100 to compensate for the plumbing repairs. Paige provides you with the following additional information for the rental in 2020: Property taxes $770 Other maintenance expenses 285 Insurance expense 495 Management fee 350 Depreciation (to be computed) 16. The rental property is located at 35 Harvest Street , Orono, Maine 04473. Local practice is to allocate 12 percent of the fair market value of the property to the land (See item 1.) Paige makes all decisions with respect to the property. 17. Paige paid $2,050 in real estate taxes on her principal residence. The real estate tax is used to pay for town schools and other municipal services. 18. Paige drives a 2018 Acura TL. Her car registration fee (based on the car year) is $50 and covers the period 1/1/2020 through 12/31/2020. In addition, she paid $280 in personal property tax to the state based on the fair market value of the car. 19. In addition to the medical costs presented in item #11, Paige incurred the following unreimbursed medical costs: Dentist $310 Doctor 390 Prescription drugs 215 Over-the-counter drugs 140 Optometrist 125 Emergency room charges 440 LASIK cye surgery 6,000 Chiropractor 265 20. On March 1, Paige took advantage of low interest rates and refinanced her $75,000 home mortgage with her original lender. Paige purchased the home in 2018. The new home loan is for 15 years. She paid $215 in closing costs and $1,500 in discount points (prepaid interest) to obtain the loan. The house is worth $155.000 and Paige's basis in the house is $90,000. As part of the refinancing arrangement, she also obtained a $10,000 home- equity loan. She used the proceeds from the home-equity loan to reduce the balance due on her credit cards. Paige received several Form 1098 statements from her bank for interest paid by her in 2020. Details appear below (also see Exhibit A): Primary home mortgage $7,100 Home-equity loan 435 Credit cards 498 Car loan 390 100 21. On May 14, 2020, Paige contributed clothing to the Salvation Army. The original cost of the clothing was $740. She has substantiation valuing the donation at $360. The Salvation Army is located at 350 Stone Ridge Road, Bangor, Maine 04401. In addition, she made the following cash contributions and received a statement from each of the following organizations acknowledging her contribution: Larkin College $850 United Way 125 First Methodist Church 790 Amos House (homeless shelter) 200 Local Chamber of Commerce 22. Paige sells real estate in the evening and on weekends (considered an active trade or business). She runs her business from a rental office she shares with several other realtors (692 River Road, Bangor, Maine 04401). The name of her business is Turner Real Estate and the federal identification number is 05-8799561. Her business code is 531210. Paige has been operating in a business-like way since 2008 and has always shown a profit. She bad the following income and expenses from her business: Commissions camed $21,250 Expenses: Advertising 2,200 Real estate license 130 Rent 6,000 Utilities 695 23. Paige uses her 2018 Acura TL in her business. During 2020, she properly documented 6,000 business miles. The total mileage on her car (i.e., for both business and personal use) during the year was 15,000 miles (including 200 miles commuting to and from the real estate office). In 2020, Paige clects to use the standard mileage method to calculate her car expenses. She spent $45 on tolls and 5135 on parking related to the real estate business. $1040 Department of the Treasury-Internal Reverse Service (99) U.S. Individual Income Tax Return 2020 OMB No. 1545-0074 IRS U Only Do not wife or staple in this space. Filing Status Single Married filing jointly Married fling separately (MFS) Head of household (HOH) Qualifying widower (O) Check only # you checked the MFS box, enter the name of your spouse. If you checked the HOH or GW box, enter the child's name if the qualitying one box person is a child but not your dependent Your first name and middle initial Last name Your social security number #joint return, spouse's first name and middle initial Last name Spouse's social security number Home address frumber and street). If you have a P.O.box, see instructions Apt.no Presidential Election Campaign Check here it you, or you spouse if filing jointly, want $3 City, town, or post office. If you have a foreign address, also complete spaces below. State ZP code to go to this fund. Checking a box below will not change Foreign country name Foreign province/stata county Foreign postal code your tax or refund. You Spouse At any time during 2020, did you receive, sel, send, exchange, or otherwise acquire any financial interest in any virtual currency? Yes No Standard Someone can claim: You as a dependent Your spouse as a dependent Deduction Spouse itemizes on a separate return or you were a dual-status alien Age/Blindness You Were born before January 2, 1956 Are blind Spouse: Was bom before January 2, 1956 Is blind Dependents (see instructions): (2) Social Security 13) Relationship (4) if qualifies for (nee Instructions): (1) First name number Last name to you If more Child tax credit Credit for other dependents than four dependents, see instructions and check here 1 Wages, salaries, tips, etc. Attach Form(s) W-2 1 Attach 2a Tax-exempt interest 2a b Taxable interest 2b Sch. B 3a Qualified dividends required. 3b b Ordinary dividends 4a IRA distributions 4a b Taxable amount. 4b sa Pensions and annuities b Taxable amount 5b Standard Ba Social security benefits. ba b Taxable amount 6b Deduction for 7 Capital gain or lons). Attach Schedule D if required. If not required, check here 7 Single or Married sing 8 Other Income from Schedule 1, line 9. 8 separately, 9 9 $12.400 Add lines 1, 2, 3, 4b, 5, 6, 7, and 8. This is your total income Married filing 10 Adjustments to income: jointly or Qualifying a From Schedule 1. line 22 10a widow or $24,000 b Charitable contributions if you take the standard deduction. See instructions 10b Head of c Add lines 10a and 10b. These are your total adjustments to income 100 nousehold 11 $18,650 11 Subtract line 10c from line 9. This is your adjusted gross Income you checked 12 Standard deduction or itemized deductions from Schedule A) 12 any box under Standard 13 13 Qualified business income deduction. Attach Form 8995 or Form 8995-A Deduction 14 Add lines 12 and 13 14 See instructions. 15 Taxable income. Subtract fine 14 from line 11. zero or less, enter - - 15 For Disclosure, Privacy Act, and Paperwork Reduction Act Notice se separate Instructions Cal. No. 113208 Forn 1040 2020 Page 2 25 Form 104020201 16 Tax (see instructions). Check if any from Form(s): 1 8814 2 4972 3 16 17 Amount from Schedule 2 line 3 17 18 Add lines 16 and 17 18 19 Child tax credit or credit for other dependents 19 20 Amount from Schedule 3, line 7 20 21 Add lines 19 and 20. 21 22 Subtract line 21 from line 18. If zero or less, enter-O- 22 23 Other taxes, including self-employment tax, from Schedule 2, line 10 23 24 Add lines 22 and 23. This is your total tax 24 Federal income tax withheld from: . Formis) W-2 250 b Form(s) 1099. 25b o Other forms (see instructions) 250 d Add lines 25a through 250 250 26 If you have a 26 2020 estimated tax payments and amount applied from 2019 return qualitying child. 27 Eamed income credit (EIC) 27 attach Sch. EIC. you have 28 Additional child tax credit. Attach Schedule 8812 28 montaxable 29 American opportunity credit from Form 8863, line 8. 29 combat pay instructions. 30 Recovery rebate credit. See instructions. 30 31 Amount from Schedule 3, line 13 31 32 Add lines 27 through 31. These are your total other payments and refundable credits 32 33 Add lines 25d, 26. and 32. These are your total payments 33 34 Refund 34 If line 33 is more than line 24, subtract ine 24 from line 33. This is the amount you overpaid 35a Amount of line 34 you want refunded to you. If Form 8888 is attached, check here 35a Direct deposit? b Routing number See instruction d Account number Type: Checking Savings 36 Amount of line 34 you want applied to your 2021 estimated tax 36 Amount 37 Subtract line 33 from line 24. This is the amount you owe now 37 You Owe Note: Schedule Hand Schedule SE filers, line 37 may not represent all of the taxes you owe for For details on how to pay, see 2020. See Schedule 3, Ine 12e, and its instructions for details Instructions 38 Estimated tax penalty (see instructions) 38 Third Party Do you want to allow another person to discuss this return with the IRS? Soo Designee instructions Yes. Complete below. No Designea's Personal identification name no number (PIN Sign Under penalties of perjury, I declare that I have examined to return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true correct, and complete. Declaration of prepare other than taxpayer) based on all information of which prepare any knowledge Here Your signature Your occupation #the IRS you an identity Protection PIN, enter it here Joint retur? se inst) See Instructions. Spouse's signature. It a joint return, both must sign. Date Spouse's occupation the IRS sent your spouse an Keep a copy for Identity Protection PIN, enter there your records toe is.) Phone no Email address Preparer's name Preparer's signature Date PTIN Check it Paid Self-employed Preparer Firm's name Phone no. Use Only Firm's address Firm's EIN Go to www.in.gov/Form1040 for victions and the latest information Fonn 1040 Phone Date SCHEDULE 1 OMB No. 1545-0074 Additional Income and Adjustments to Income (Form 1040) 2020 Attach to Form 1040, 1040-SR, or 1040-NR. Department of the Treasury Antact warral Revenue Service Go to www.in.gov/Form 10-40 for Instructions and the latest Information. Sequenca Ne. 01 Name(s) shown on Form 1040,1040-SR, or 1040-NR Your social security number 2a 3 4 5 6 10 Parti Additional Income 1 Taxable refunds, credits, or offsets of state and local income taxes. 1 2a Alimony received b Date of original divorce or separation agreement (see instructions) 3 Business income or (loss). Attach Schedule 4 Other gains or (losses). Attach Form 4797 .. 5 Rental real estate, royalties, partnerships. S corporations, trusts, etc. Attach Schedule E Farm income or loss). Attach Schedule F 6 7 Unemployment compensation ... 7 8 Other income. List type and amount 8 9 Combine lines 1 through 8. Enter here and on Form 1040, 1040-SR, or 1040-NR. line 8... 9 Part II Adjustments to Income 10 Educator expenses 11 Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 .... 11 12 Health savings account deduction. Attach Form 8889 12 13 Moving expenses for members of the Armed Forces. Attach Form 3903 13 14 Deductible part of self-employment tax. Attach Schedule SE 14 15 Self-employed SEP, SIMPLE, and qualified plans 15 16 Self-employed health insurance deduction. 16 17 Penalty on early withdrawal of savings 17 18a Alimony paid. 18a b Recipient's SSN c Date of original divorce or separation agreement (see instructions) 19 IRA deduction 19 20 Student loan interest deduction 20 21 Tuition and fees deduction. Attach Form 8917 21 22 Add lines 10 through 21. These are your adjustments to income. Enter here and on Form 1040, 1040-SR, or 1040-NR, line 10a 22 For Paperwork Reduction Act Notice, see your tax return Instructions, Schedule 1 Form 1049 2020 Cal No. 71479 SCHEDULE 2 OMB No. 1545-0074 Form 1040) Additional Taxes 2020 Department of the Treasury Attach to Form 1040, 1040-SR, or 1040-NR. Internal Revenue Service Attachment Go to www.lrs.gov/Form 1040 for instructions and the latest Information. Sequence No. 02 Name(s) shown on Form 1040, 1040-SR, or 1040-NR Your social security number 1 . 2 . 3 4 5 Part 1 Tax 1 Alternative minimum tax. Attach Form 6251 2 Excess advance premium tax credit repayment. Attach Form 8962 3 Add lines 1 and 2. Enter here and on Form 1040, 1040-SR, or 1040-NR, line 17. Part 11 Other Taxes 4 Self-employment tax. Attach Schedule SE. 5 Unreported social security and Medicare tax from Form: a 4137 b8919 6 Additional tax on IRAs, other qualified retirement plans, and other tax-favored accounts. Attach Form 5329 if required. 7a Household employment taxes. Attach Schedule H b Repayment of first-time homebuyer credit from Form 5405. Attach Form 5405 if required 8 Taxes from: a Form 8959bForm 8960 c Instructions, enter code(s) 9 Section 965 net tax liability installment from Form 965-A. 10 Add lines 4 through 8. These are your total other taxes. Enter here and on Form 1040 or 1040-SR, line 23, or Form 1040-NR, line 23b For Paperwork Reduction Act Notice, see your tax return instructions. Cat No. 71478U 6 7a 7b 8 10 Schedule 2 (Form 1040) 2020 2 SCHEDULE 3 OMB No 1545-0074 Additional Credits and Payments (Form 1040) 2020 Department of the Treasury Attach to Form 1040, 1040-SR, or 1040-NR. Attachment Intomal Revenue Service Go to www.ira.gov/Form 1040 for instructions and the latest information. Sequence No. 03 Name(s) shown on Form 1040, 1040-SR, or 1040-NR Your social security number 1 3 8 9 Part Nonrefundable Credits 1 Foreign tax credit. Attach Form 1116 if required 2 Credit for child and dependent care expenses. Attach Form 2441 2 3 Education credits from Form 8863, line 19. ..., 4 Retirement savings contributions credit. Attach Form 8880 4 5 Residential energy credits. Attach Form 5695 5 6 Other credits from Form: a3800 b 8801 co 6 7 Add lines 1 through 6. Enter here and on Form 1040, 1040-SR, or 1040-NR, line 20 7 Part II Other Payments and Refundable Credits 8 Net premium tax credit. Attach Form 8962 9 Amount paid with request for extension to file (see instructions) 10 Excess social security and tier 1 RRTA tax withheld. 10 11 Credit for federal tax on fuels. Attach Form 4136 11 12 Other payments or refundable credits: a Form 2439 12a b Qualified sick and family leave credits from Schedule(s) H and Form(s) 7202 c Health coverage tax credit from Form 8885 d Other: 12d e Deferral for certain Schedule H or SE filers (see instructions) 120 1 Add lines 12a through 12e... 121 13 Add lines 8 through 121. Enter here and on Form 1040, 1040-SR, or 1040-NR, line 31 13 For Paperwork Reduction Act Notion, noe your tax return instructions. Schedule a Form 1040) 2020 12b 12c Cat No. 7140G YHEDULEA Itemized Deductions th Form 1049 Go to www.ars.goviSchedule for instructions and the latest information Atach to form 40 or 1040 SR. 20 Department of the Try serta Cauter you are luminga retifeddwn Fome the structors for the 18. Aracht Segons N. 07 Non Form 100 TOR Your social culty Medical Caution: Do not include expenses reimbursed or paid by others. and 1 Medical and dental expenses ise restructions 1 Dental 2 Enter amount from Form 1040 or 1040-SR, Ine 11 21 Expenses 3 Multiply line 2 by 75% 10.079 4 Subtract line from ine 1. in 35 more than line 1. on Taxes You 5 State and local taxes Paid State and local income taxes or general sales. You may include either income taxes or genera sales taxes on line 5a, but not both you elect to include general sales tesiristead of income to check this box. O sa b State and local real estate avesse instructions) 5b c State and local personal property taxes 5c d Addines Sa through 5d e Enter the smaller of line 5d or $10.000 55.000 it married sing separately 6 Omer taxes. List type and amount 7 Addines Se and 6 Interest 8 Home mortgage interest and points. If you didn't be all of your home You Paid mortgage loans) to buy, build or improve your home, see Instructions and check this box monggetaret dediny a Home mortgage interest and points reported to you on For 1008 See Instructions ifted wuction Home mortgage interest rot reported to you on Form 1098 See instructions if limited paid to the person from whom you bought the home, see instructions and show that person's rame, dentifying no. and address Bb c Points not reported to you on Form 1098. Soe instructions for special rules BC d Mortgage insurance premium instruction Bd e Add lines Bathrough od Se 9 Investment interest. Attach Form 4962 it required See Instructions 10 Add lines and 9 10 Gifts to 11 Gifts by cash or check you made any gift of $250 or more, see Charity Instructions 11 Como 12 Other than by cash or check. If you made any of $250 or more made gotabene see instructions. You must attach Form 8283 rover $500. 12 13 Carryover from prior year 13 14 Add lines 11 through 13 Casualty and 15 Casualty and theft losses from a federaly declared disaster other than not qualified Theft Losses disaster losses. Attach Form 4584 and enter the amount from line 18 of that form. See Instructions 15 Other 16 Omer-trom ist in instructions. Ust type and amount Itemized Deductions 16 Total 17 Add the amounts in the ta right column torres 4 though 98. Also enter the amount on Itemized Form 1040 or 1040-SR line 12 Deductions 18 If you elect to termice deductions even though they are less than your standard deduction, check this box For Paperwork Reduction Act Notice, see the restructions for Forma 1040 and 1040-SR. CNC Schedule A Form 10102030 HEDULEB 1545001 (Form 1040) Interest and Ordinary Dividends Det 20 Go to www.spov Schedule for instructions and the intestinformation Boneco Attach to Form 1040 or 1040-SR. Attachment BOB Newton Your social amb Part 1 1 List name of payer. If any interest is from a seller-financed mortgage and the Amount buyer used the property as a personal residence, see the instructions and list this Interest Interest first. Also, show that buyer's social security number and address See instructions and the Instructions for Forms 1040 and 1040-526) Note: If you received a Form 1000 INT.Form 100-010, subtitute statement from em name as the payer and enter the total interest shown on the form 2 Add the amounts on line 1 3 Excludable interest on series EE and I US savings bonds issued after 1989 Attach Form 8815 3 4 Subtract line 3 from line 2. Enter the result here and on Form 1040 or 1040-SR. tine? 4 Notes line is over $1.500, you must complete Parti Amount Part II 5 ist name of payer Ordinary Dividends Se instruction and the instructions for Forms 1010 and 1040-Sin 36) Note: you received a Form 1000 DIVO Substitute statement from a brokeragem list the firm's name as the payer and enter the ordinary dividends shown 6 on that form Add the amounts on line 5. Enter the total here and on Form 1040 or 104D-SR, line 30 Note: line 6 is over $1.500, you must complete Part II Part III You must complete this part if you tal had over $1.500 of table interest or ordinary dividends had a foreign account or chreceived a distribution from or were a grantor at or a transforor to a foreign trust Yes No Foreign Ta At any time during 2020, did you have a financial interest in or signature authority over a financial Accounts account such as a bank account, securities account, or brokerage account) located in a foreign and Trusts country See instructions Caution "Yesare you required to file FinCEN Form 114. Report of Foreign Bank and Financial required folur Accounts (FBAR, to report that financial interest or signature authority? See FinCEN Form 114 to the FINCEN and its instructions for filing requirements and exceptions to those requirements Form 114 If you are required to file FinCEN Form 114. enter the name of the foreign country where the substantia financial account is located Domes. See 8 During 2020, did you receive a distribution from or were you the grantor of, or transferorto, a instructions foreign trust? Yes, you may have to fie Form 3520. See instructions For Paperwork Reduction Act Notice, see your tax return instructions. Cat Schedule Form 1040) 2020 mu ODOC SCHEDULEC Profit or Loss From Business 1845-0014 (Form 10401 Sole Proprietorship 2020 Department of the Troy Go to www.in.gov/Schedule for instructions and the latest Information. internal Revenue Service Attach to Form 1040, 1040-SR. 1040-NR, or 1041; partnerships generally must file Form 1085. Sequence No. 09 Name of proprietor Bocal cury number 88 A Principal business or profession, including product or service see instructions B Enter code from one C Business name. I no separate business name. leave blank DE IDENT E Business address including suite or room no.) City, town or post office state and mode F Accounting method: * Cash 2 Accrual Other special G Did you "materially participate in the operation of this business during 20207 "No," se instructions for limit on los No you started or acquired this business during 2020, check here 1 Did you make any payments in 2020 that would require you to file Forms) 1000? Se instructions No Yos, did you or will you like required Forma 10991 Yes No Part 1 Income 1 Gross receipts or sale. See instructions for ine 1 and check the box this income was reported to you on Form W-2 and the Statutory employee" box on that form was checked O 1 2 Returns and allowances 2 3 Subtract line 2 from line 1 4 Cost of goods sold from ine) 4 5 Gross profit. Subtretine 4 from line 3 5 6 Other income, including federal and state gasoline or fuel tax creditor refund e instructions 6 7 Gross income. Add Ines 5 and 7 Part II Expenses. Enter expenses for business use of your home only on line 30. & Advertising 18 Office expense e instructions 18 9 Car and truck expenses 19 Perision and profit-sharing plans 10 instruction 9 20 Rontoret instructions 10 Commissions and fees 10 Vehicles machinery and equipment 200 11 Contract labore Instruction 11 Other Business property 200 12 Depletion 12 21 Repairs and maintenance 21 13 Depreciation and section 179 22 Supplies not included in Part 1 22 expense deduction that 23 included in parte 23 Taxes and licenses. instruction 13 24 Travel and meals 14 Employee benefit program . Travel 24a father than onine 19 14 b Deductible meals 15 Insurance other than health 15 Instructions 16 Interest free instruction 25 Usities 25 Mortgage paid to bals, etc.) 100 20 Wages less employment credits 20 b Other 166 27a Other expenses from line 48 270 17 Legal and professional 17 Reserved for future use. 27b 28 Total expenses before expenses for business use of home. Add lines through 27a 28 22 Tentative profit or loss. Subtract line 28 from line 7 29 30 Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 3829 unless using the simplified method. See Instructions. Simplified method files only: Enter the total square footage of your home: and to the part of your home used for business Use the Simplified Method Worksheet in the instructions to figure the amount to enter on line 30 30 31 Net profit or loss. Subtract line 30 from line 29 . a profit, enter on both Schedule 1 Form 1040), line and on Schedule SE, Iine 2 of you checked the box on line 1, see Instructions). Estates and trusts, enter on Form 1041, line 3. 31 . Ialose, you must go to line 32 * you have a loss, check the box that describes your investment in this activity. See instruction # you checked 32, enter the one on both Schedule 1 Form 1040), line 3, and on Schedule SE, line 2. you checked the box on Ine 1, the line 31 instructions). Estate and trusts, entor on 32 A investment is atrish Form 1041, Ines 22b Some investment is not atrik Nyou checked 32b. you must attach Form 6186. Your loss may be limited For Paperwork Reduction Act Notice, see the separate Instructions. Cat. Ne 11334 Schedule Form 100 2000 SCHEDULED Form 1040) OVEN 1545-0014 Capital Gains and Losses Attach to Form 1040, 1040-SR, or 1040-NR. Go to www.insgow Schedule for instructions and the latest Information Use Form 849 to list your transactions for lines 15, 2, 3, 86, and 10. (2020 Doment of the Intenservice Rameshown on tum No 12 Your social security number Did you dispose of any investmentis) in a qualified opportunity fund Guring the tax year? Yes NO If "Yes."attach Form 8940 and see its instructions for additional requirements for reporting your gain or loss. Parti Short-Term Capital Gains and Losses - Generally Assets Held One Year or Less (see instructions) See instructions for how to figure the amounts to enter on the Nainers lines below. Adjustments Succo Procede to gain or otrom rom com This form may be easier to complete if you round off cents to se pri for other Form 1940, Parcombine the whole dollars. In 2 column with.com 1a Totals for all short-term transactions reported on Form 1099-B for which basis was reported to the IRS and for which you have no adjustments (see Instructions), However, if you choose to report all these transactions on Form 8949, love this line blank and go to line 1b 16 Totals for all transactions reported on Form(s) 8949 with Box A checked 2 Totals for all transactions reported on Form(s) 8949 with Box B checked 3 Totals for all transactions reported on Forms) 8949 with Box C checked 4 Short-term gain from Form 6252 and short-term gain or loss) from Forms 4684, 6781, and 8824 4 5 Net short-term gain or loss) from partnerships, Scorporations, estates, and trusts from Schedule(s) K-1 5 6 Short-term capital loss carryover. Enter the amount it any, from line 8 of your Capital Loss Carryover Worksheet in the instructions 6 7 Net short-term capital gain or loss). Combine Ines ta through 6 in column. If you have any long- term capital gains or losses, go to Part II below. Otherwise, go to Part Ill on the back Partil Long-Term Capital Gains and Losses - Generally Assets Held More Than One Year (see instructions) See instructions for how to figure the amounts to enter on the Gain lines below. Adiments Stact column Prede COM This form may be easier to complete it you round off cents to to gain or loostromom.com and e price Form. Pat combine the whole dollars. Ine2.com with colum Sa Totals for all long-term transactions reported on Form 1099-B for which basis was reported to the IRS and for which you have no adjustments (see Instructions). However, if you choose to report all these transactions on Form 8949, leave this line blank and go to line 8b. 8b Totals for all transactions reported on Forms) 8949 with Box D checked 9 Totals for all transactions reported on Form) 8049 with Box E checked 10 Totals for all transactions reported on Formis) 8949 with Box F checked. 11 Gain from Form 4797, Part t long-term gain from Forms 2439 and 6252, and long-term gain or floss) from Forms 4684,6781, and 8824 11 12 Not long-term gain or (066) from partnerships, Scorporations, estates, and trusts from Schedule(s) K-1 12 13 Capital gain distributions. See the instructions 13 14 Long-term capital loss carryover. Enter the amount, if any, from line 13 of your Capital Loss Carryover Worksheet in the instructions 14 15 Net long-term capital gain or loss). Combine lines 8a through 14 in column. Then go to Parti on the back 15 For Paperwork Reduction Act Notice, see your tax return instructions. Cat No. 153 Schedule D Form 1046 2000 SCHEDULE E Supplemental Income and Loss ON Form 1040 From rental real estate, royalties, partnerships Scorretons, sest, REMICA, 2021 Anach to Form 1040, 040-SA, 1040-NR. 1041 elementario Go to www.irs.gov/Schedule for instructions and the latest information Nam | www i warm. Your security number 13 DOO Parti Income or Loss From Rental Real Estate and Royalties Note: you are iness at renting personal property Schedule C. See instructions. If you are an individual report tamancome or stron Form 4835 on page 2. in 40 A Did you make any payments in 2020 that would require you to flie Formis, 1099? See instructions Yes No B "Yes." did you or will you file required Fomis10992 Yes No 1a Physical address of each property ftrent.city state.ZIP code A B c 1b Type of Property 2 For each rental real estate property listed Fair Rental Personal use QJV from list below) above, report the number of fair rental and Days Days A personal use days. Check the QJV box only you meet the requirements to file as a A B qualified joint venture. See instructions Type of Property 1 Single Family Residence 3 Vacation Short-Term Rental 5 Land 7 Self-Rental 2 Multi-Family Residence 4 Commercial 6 Royalties Other describe Income: Properties: B C Rents received 3 4 Royalties received 4 Expenses: 5 Advertising 5 6 Auto and travel (see instructions 7 Cleaning and maintenance 7 Commissions. . 9 Insurance 9 10 Legal and other professional fees 10 11 Management fees 11 12 Mortgage interest paid to banks, et see instructions 12 13 Other interest 13 14 Repairs. 15 Supplies 15 16 Taxes 16 17 Utities 17 18 Depreciation expense or depletion 18 19 Other list 19 20 Total expenses. Add lines 5 through 19 20 21 Subtract line 20 from line front and/or 4 royalties result is a floss. see instructions to find out if you must file Form 6190 21 22 Deductible rental real estate loss after imitation, if any. on Form 8582 sem instructions 23a Total of all amounts reported on line 3 for all rental properties 23a Total of all amounts reported on line 4 for all royalty properties 23 Total of all amounts reported on line 12 for all properties 23c d. Total of all amounts reported on line 18 for all properties 23d e Total of all amounts reported online 20 for all properties 23e 24 Income. Add positive amounts shown on line 21. Do not include any losses 24 25 Losses. Add royalty losses from line 21 and rental real estate losses from line 22. Enter total loses here 25 26 Total rental real estate and royalty income or loss). Combine ines 24 and 25. Enter the result here. I Parts . IV. and line 40 on page 2 do not apply to you also enter this amount on Schedule 1 Form 10401. line 5. Otherwise, include this amount in the total on line 61 on page 2 26 For Paperwork Reduction Act Notice, see the separate anstructions 11346 Sharm 10402020 . 6 SCHEDULE SE (Form 1040) ON 15450014 Self-Employment Tax 2020 Departe Go to www.ingow ScheduleSE for intruction and the latest information Attach to Form 100 1040 SR or 1080-NR. Al Se 17 Nameson with more than om Social security of person with self-employment incom Part 1 Self-Employment Tax Note: If your only income subject to self-employment tax is church employee income, se instructions for how to report your income and the definition of church employee income A you are a minister, member of a religious order, or Christian Science practitioner and you filed Form 4361, but you had $400 or more of other net earnings from seamployment, check here and continue with Part 1 Skip lines 1a and to you use the form optional method in Part Il Sonstructions la Netfarm profit or loss from Schedule F. tine 34, and farm partnerships Schedule K+ Form 1065). box 14. code A Ta bif you received social security retirement or isbiy benefits, enter the amount of Conservation Reserve Program payments included on Schedule F. Ineb, or listed on Scree K-1 Form 1065, box 20 code AH 10 Skipino 2 if you use the nonform optional method in Part I See Instructions 2 Net profit or fostrom Schedule Cine 31: und Schedule 1 Form 1065), box 14 code A other than tarming See instructions for the income to report or if you are a minister or member of religious order 2 3 Combine lines ta, 1b, and 2 3 da line 3 is more than zero, multiply line 3 by 92.35% 0.9235Omenisenter amount from line 3 4a Note: Ineta is less than $400 due to Conservation Reserve Program payments online bestructions bif you elect one or both of the optional methods, enter the total of lines 15 and 17 hore 4b c Combine tines 4a and db. If less than $400, stop: you don't owe self-anployment ta. Exception: less than $400 and you had church employee income, enter-B- and continue 40 5a Enter your church employee income from For W-2 Svenstructions for definition of church employee income Sa b Multiply Inesa by 92.35% (0.9235) less than $100 anter- 5b 6 Add lines 4c and Sb 7 Maximum amount of combined wages and self-employment comings subject to social security tax or the 3.2% portion of the 7.65% railroad retirement tier 1 tax for 2020 7 137.700 Ba Total social security wages and tips total of boxes 3 and 7 on Forms W-2) and railroad retirement for 1) compensation. If $137.700 or more skip lines 5 through 10, and go to line 11 Ba b Urreported tips subject to social security tax from Form 4137, line 10 8b c Wages subject to social security tax from Form 19. line 10 Bc d Add lines Ba B, and 8c 9 Subtract line 8d from line 7.1 200 or less enter-O-here and on line 10 and go to line 11 10 Multiply the smaller of line 6 or line 9 by 12.4% 10.124 11 Multiply line 6 by 2.9% (0.029) 12 Self-employment tax. Add Ines 10 and 11. Enter here and on Schedule 2 (Form 1040), line 4 13 Deduction for one-half of self-employment tax Multiply line 12 by 50% 10.50). Enter here and on Schedule 1 Form 1040). 1 line 14 13 Part II Optionat Methods To Figure Net Earnings see instructions Farm Optional Method. You may use this method only it all your gross form income' was more than $8,460, or (b) your netfarm profits were less than 56.107 14 Maximum income for optional methods 14 5640 15 Enter the smaller of two-thirds of gross form income incess than 200 or $5.640 As, include this amount on line 4b above 15 Nonfarm Optional Method. You may use this method only all your net rontam profits were less than 56,107 and also less than 72.19% of your gross notarm income, and you had net samnings from self-employment of at least $400 in 2 of the prior 3 years. Caution: You may use this method no more than five times 16 Subtract line 15 from ine 14. 16 17 Enter the smaller of two-thirds of gross nontam income not less than 200 or the amount on line 16. Also include this amount online b above 17 From Schnen Sch. 1 Form 100 x 1000B SC. Son K-Form 108 box 14.00A From Sch Fine 34 and 5K Form 1065, box 14 code A- and Sex For 10651. Box 14.CC you have red on fire thad you need the method For Paperwork Reduction Act Notice, see your tax return instructions Cet e Schom 0402020 8-98 1845-2294 From 8995 Department of the Treasury Attachment Qualified Business Income Deduction Simplified Computation 2020 Attach to your tax return Internal Revenue Service Go to www.irs govi Forms for instructions and the latest Information Se Na 55 Name shown on tum Your tapar identification number Note. You can claim the qualified business income deduction only if you have qualified business ncome from a qualified trade or business, real estate investment trust dividends, publicly traded parmership income, or a domestic production activities deduction passed through from an agricultural or horticultural cooperative See instructions. Use this form if your taxable income before your qualified business income deduction is at or below $163,300 (5326,600 If married filing jointly), and you aren't a patron of an agricultural or horticultural cooperative of Trease, business or pronome thay Gualted buses delication number Income 2 2 2 3 4 5 6 8 Total qualified business income or fol. Combine lines 11 through 1, column (c) 3 Qualified business net floss) carryforward from the prior year 4 Total qualified business income. Combine Ines 2 and 3. If zero or less enter- 5 Quaified business income component. Multiply ine 4 by 20% (0.20) 6 Qualified REIT dividends and publicly traded partnership (PTP) income or foss (see instructions) 7 Qualified REIT dividends and qualified PTP (0) Carryforward from the price year 7 8 Total qualified REIT dividends and PTP income. Combine lines 6 and 7. I 2010 or less, entero 9 REIT and PTP component. Multiply ine 8 by 20% (020) 10 Qualified business income deduction before the ncome limitation Add ines 5 and 9 11 Taxable income before qualified business income deduction Net capital gain (see instructions Subtractine 12 from line 11. If zero or less, enter-O 14 Income limitation Multiply line 13 by 20% (0.20) 15 Qualified business income deduction Enter the lesser of tine 10 or line 14. Also enter this amourt on the applicable line of your return Total qualified business foss) carryforward. Combine lines 2 and 3. I greater than 2010, enter- 17 Total qualified REIT dividends and PTP (os) carryforward. Combine lines 6 and 7. I greater than For Privacy Act and Paperwork Reduction Act Notice, see instructions Cat No 3706C 10 12 13 11 12 13 14 15 16 16 zero, enter-O- 17 Form 8995 2000 8582 Passive Activity Loss Limitations Seepwate instructions Attachte Form 1040 1040-SR, or 1041 Go to www.ra.gewFormes for hatructions and the latest information 20 Department of the Tre Ne Show 858 Tb 2a 8A Part 1 2020 Passive Activity Loss Caution: Complete Worksheets 1, 2 and 3 before completing Part I. Rental Real Estate Activities With Active Participation For the definition of active participation, see Special Allowance for Rental Real Estate Activities in the instructions) ta Activities with net income enter the amount from Worksheet 1 columna ta b Activities with net loss (enter the amount from Worksheet 1 column o Prior years' unallowed losses enter the amount from Woricsheet 1. column 1c d Combine lines 1a, 1b and 1c 1d Commercial Revitalization Deductions From Rental Real Estate Activities 21 Commerce revitalization deductions from Worksheet 2 column Prior year unallowed commercial revitalization deductions from Worksheet 2, column) Add Ines 2a and 2 All Other Passive Activities 30 Activities with net income (eritur the amount from Worksheet 3 columna b Activities with net loss (enter the amount trom Worksheet 3 column (b) Prior years' unallowed losses enter the amount from Workshot 3 columns 3c d Combine lines 3a 3b, and 30 3d 4 Combine lines 1d, 2c, and 3d. If this line is zero or more, stop here and include this form with your retum; al losses are allowed, including any prior year unallowed losses entered on line 10, 2b, or 30 Report the losses on the forms and schedules normally used 4 Ifline 4 is a loss and Line 1d is a loss, go to Partil Line 2c is a loss and ine 1d is aro or more), skip Part Il and go to Partill. Line 3d is a loss and lines 1 and 2 are zero or more skip Parts Iland Ill and go bine 15. Caution: If your filing status is married fing separately and you ived with your spouse at any time during the year, do not complete Part Il or Part III. Instead, go to Ine 15 Part Il Special Allowance for Rental Real Estate Activities With Active Participation Note: Exer al numbers in Part Il as positive amounts. Soe instructions for an example. 5 Enter the smaller of the loss on line 1d or the loss on line 4 6 Enter $150.000. If married fing separately see instructions 6 7 Erter modified adjusted gross income, but not less than mo. See instructions Note: If fine 7 is greater than or equal to line 6, skip lines 8 and 9 enter - on line 10. Otherwise, go to line 8 8 Subtractine 7 from ine 6 Multiply line 8 by 50% (050). Do not enter more than $25,000. It marted fing separately, see instructions 10 Enter the smaller of line 5 or line 9 10 Ifline 2c is a loss, Partill. Otherwise, go to line 15 Part II Special Allowance for Commercial Revitalization Deductions From Rental Real Estate Activities Note: Enteral numbers in Partillas positive amounts See the acample for Patil in the instructions 11 Enter $25,000 reduced by the amount, if any, on line 10. It married fing separately. See restructions 12 Enter the loss from line 4 13 Reduce line 12 by the amount on line 10 13 14 Enter the smallest of line 2c (treated as a positive amourt). Ine 11, cine 13 14 Part IV Total Losses Allowed 15 Add the income, if any, on lines fa and 3a and enter the total 16 Total losses allowed from all passive activities for 2020 Add lines 10, 14 and 15. See Instructions to find out how to report the losses on your tax return 16 For Paperwork Reduction Act Notice, chatruction Cat Form8582 000 11 12 CHIM 15 X. 4562 Depreciation and Amortization (Including Information on Listed Property) Attach to your tax return. Go to www.rsgov Form562 for instructions and the latest information Business rachutto which the formes 15460 20 Share 179 Identifying number Name shown on Parti Election To Expense Certain Property Under Section 179 Note: If you have any listed property, complete Part V before you complete Parti. 1 Maximum amount (see instructions) 2 Total cost of section 179 property placed in service se instructions) 3 Threshold cost of section 179 property before reduction in limitation (see instructions 4 Reduction in limitation. Subtract line 3 from line 2. If zero or less, enter-O- 5 Dollar limitation for tax year. Subtract line 4 from line 1. If mo or less enter-O-. married Ring separately. See Instructions 6 Desertonety Com 1 2 3 4 5 -- 9 7 Listed property. Enter the amount from ine 29 7 8 Total elected cost of section 179 property. Add amounts in column (cl. lines 6 and 7 8 9 Tentative deduction. Enter the smaller of line 5 or line 8 10 Carryover of disallowed deduction from line 13 of your 2019 Form 4562 10 11 Business income limitation Enter the smaller of business income inot less than zero or line 5. See instructions 11 12 Section 179 expense deduction. Add lines 9 and 10, but don't enter more than line 11 12 13 Carryover of disallowed deduction to 2021. Add lines 9 and 10, less line 12 13 Note: Don't use Part ll or Partill below for listed property. Instead, use Part V Part 1 Special Depreciation Allowance and Other Depreciation (Don't include listed property. Soo instructions) 14 Special depreciation allowance for qualified property (other than listed property placed in service during the tax year. See Instructions 14 15 Property subject to section 1881) election 15 16 Other depreciation including ACRS 16 Part II MACRS Depreciation Don't include isted property. See instructions.) Section A 17 MACRS deductions for assets placed in service in tax years beginning before 2020 17 18 you are electing to group any assets placed in service during the tax year into one or more general asset accounts, check here Section B-Assets Placed in Service During 2020 Tax Year Using the General Depreciation System Mar Cation of property Peso Comentin Method tol Desconduction 1993.year property b5 year property C 7 year property d 10-year property 15 yow property f 20-year property 925-year property h Residential rental 2015 M property 275 yrs MM Nonresidential real MM /L property MM 5 Section C-Assets Placed in Service During 2020 Tax Year Using the Alternative Depreciation System 20a Classide b 12-year C 30-year Soyre MM SIL d 40-year 40 yrs MM SVL Part IV Summary See instructions 21 Listed property. Enter amount from line 28 21 22 Total. Add amounts from line 12, Ines 14 through 17. Ines 19 and 20 incolumnal and line 21. Enter here and on the appropriate lines of your return. Partnerships and corporations-see instructions 22 23 For assets shown above and placed in service during the current year, enter the portion of the basis attributable to section 203A costs 23 For Paperwork Reduction Act Notice, se separate instructions. Cat Form 45622000 2 SSSSSSS

Step by Step Solution

There are 3 Steps involved in it

To complete Paige Turners 2020 federal income tax return well follow these general steps Step 1 Calculate Total Income 1 WagesSalary 163037 2 Interest ... View full answer

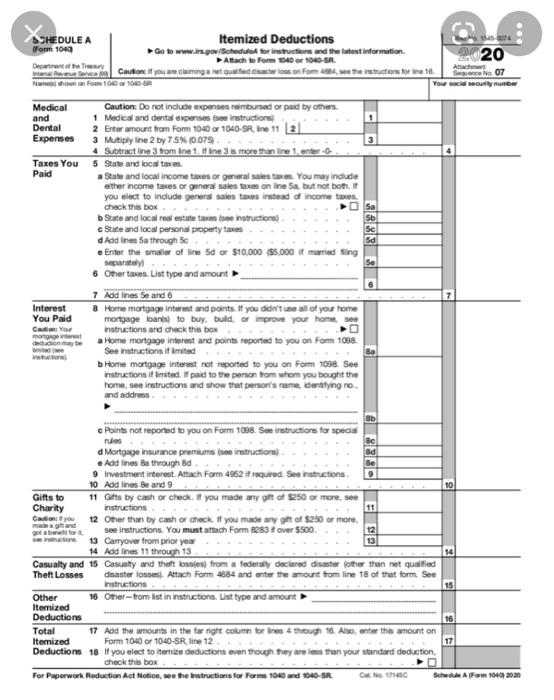

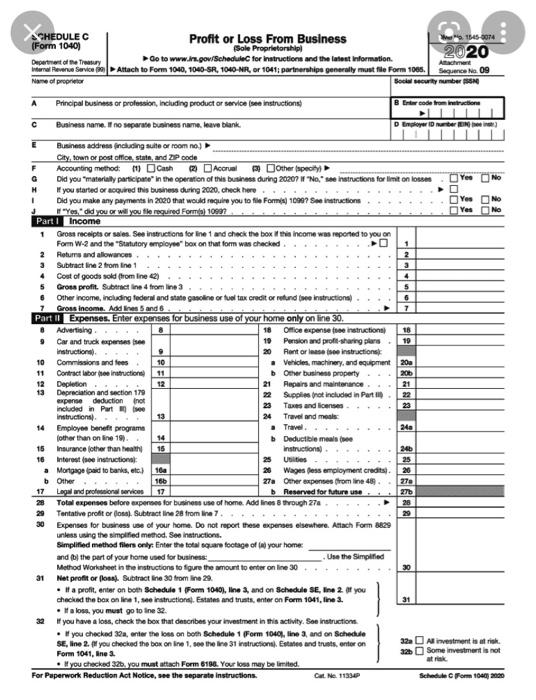

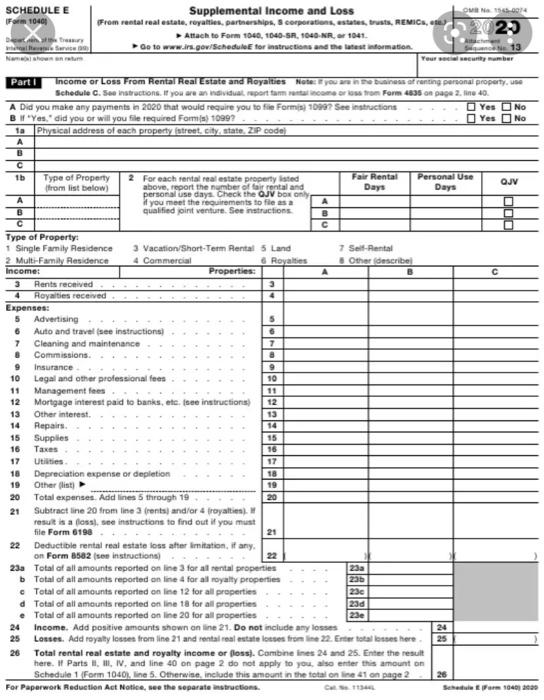

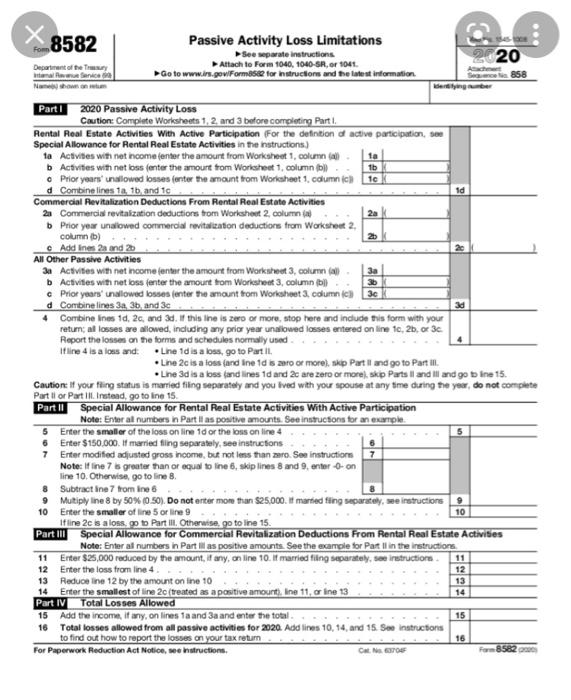

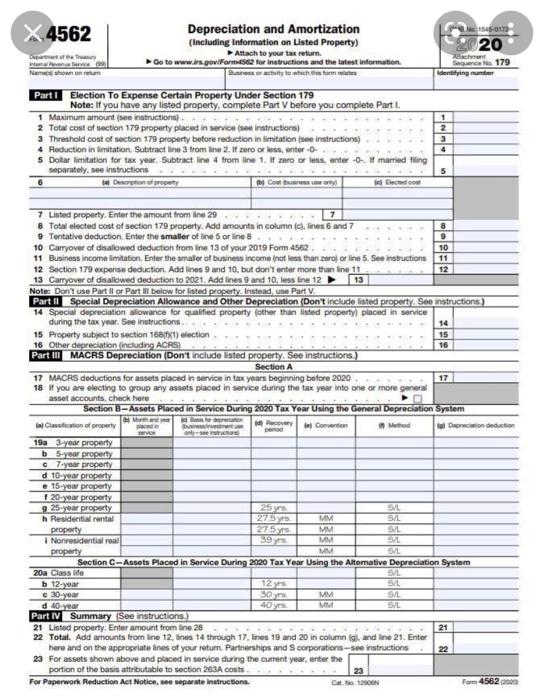

Get step-by-step solutions from verified subject matter experts