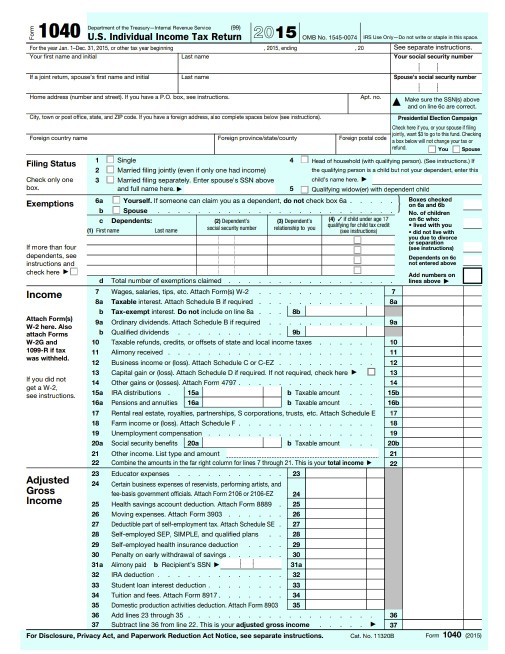

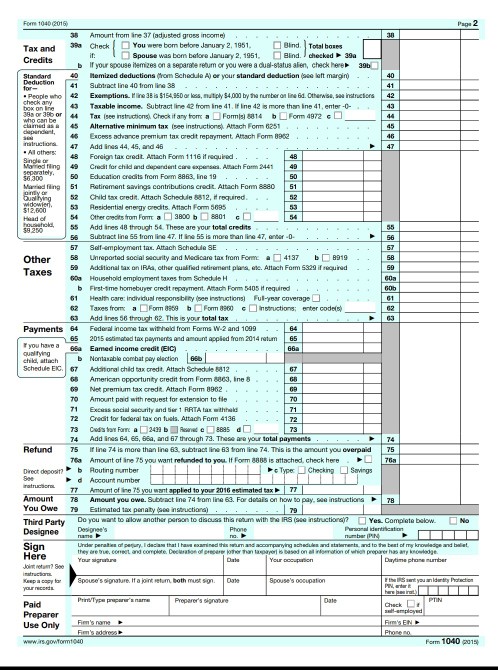

Question: Individual Tax Return Problem 1 Required: .Use the following information to complete Keith and Jennifer Hamilton's 2015 federal income tax return. If information is missing,

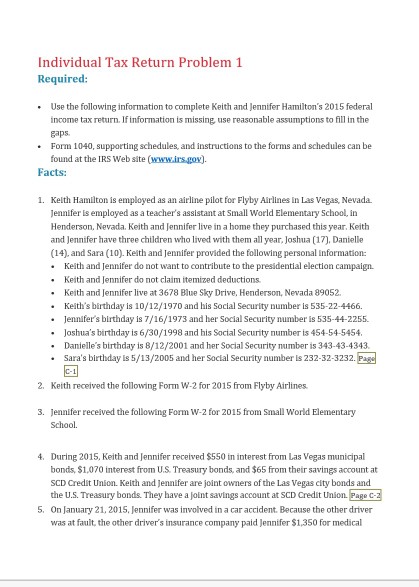

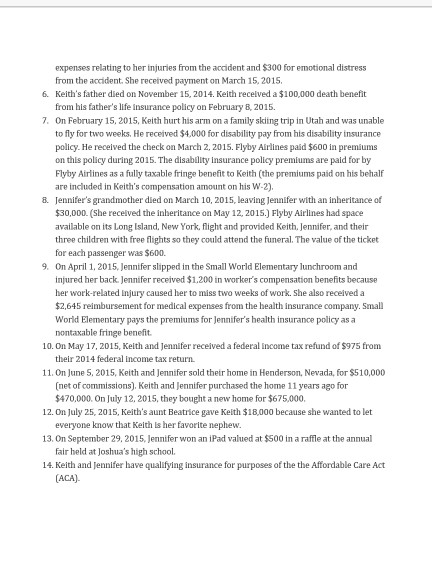

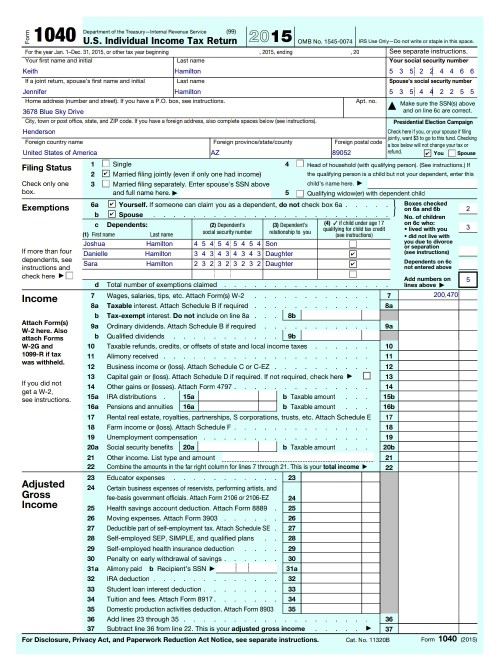

Individual Tax Return Problem 1 Required: .Use the following information to complete Keith and Jennifer Hamilton's 2015 federal income tax return. If information is missing, use reasonable assumptions to fill in the gaps Form 1040, supporting schedules, and instructions to the forms and schedules can be found at the IRS Web site (www.irsgov). Facts: 1. Kelth Hamilton is employed as an airline pilot for Flyby Airlines in Las Vegas, Nevada Jennifer is employed as a teacher's assistant at Small World Elementary School, in Henderson, Nevada. Keith and Jennifer live in a home they purchased this year. Keith and Jennifer have three children who lived with them all year Joshua (17), Danielle (14), and Sara (10). Keith and Jennifer provided the following personal information Keith and Jennifer do not want to contribute to the presidential election campaign. . Keith and Jennifer do not claim itemized deductions . Keith and Jennifer live at 3678 Blue Sky Drive, Henderson, Nevada 89052 Keith's birthday is 10/12/1970 and his Social Security number is 535-22-4466. Jennifer's birthday is 7/16/1973 and her Social Security number is 535-44-2255. Joshua's birthday is 6/30/1998 and his Social Security number is 454-54-5454, Danielle's birthday is 8/12/2001 and her Social Security number is 343-43-4343 Sara's birthday Is 5/13/2005 and her Social Security number is 232-32-3232. Pa8 2 Keith received the following Form W-2 for 2015 from Flyby Airlines. Jennifer received the following Form W-2 for 2015 from Small World Elementary School. 3. 4. During 2015, Keith and Jennifer received $550 in interest from Las Vegas municipal bonds, $1,070 interest from US. Treasury bonds, and $65 from their savings account at SCD Credit Union. Keith and Jennifer are joint owners of the Las Vegas city bonds and the U.S. Treasury bonds. They have a joint savings account at SCD Credit Union. Page C2 5. On January 21, 2015, Jennifer was involved in a car accident. Because the other driver was at fault, the other driver's insurance company paid Jennifer $1,350 for medical Individual Tax Return Problem 1 Required: .Use the following information to complete Keith and Jennifer Hamilton's 2015 federal income tax return. If information is missing, use reasonable assumptions to fill in the gaps Form 1040, supporting schedules, and instructions to the forms and schedules can be found at the IRS Web site (www.irsgov). Facts: 1. Kelth Hamilton is employed as an airline pilot for Flyby Airlines in Las Vegas, Nevada Jennifer is employed as a teacher's assistant at Small World Elementary School, in Henderson, Nevada. Keith and Jennifer live in a home they purchased this year. Keith and Jennifer have three children who lived with them all year Joshua (17), Danielle (14), and Sara (10). Keith and Jennifer provided the following personal information Keith and Jennifer do not want to contribute to the presidential election campaign. . Keith and Jennifer do not claim itemized deductions . Keith and Jennifer live at 3678 Blue Sky Drive, Henderson, Nevada 89052 Keith's birthday is 10/12/1970 and his Social Security number is 535-22-4466. Jennifer's birthday is 7/16/1973 and her Social Security number is 535-44-2255. Joshua's birthday is 6/30/1998 and his Social Security number is 454-54-5454, Danielle's birthday is 8/12/2001 and her Social Security number is 343-43-4343 Sara's birthday Is 5/13/2005 and her Social Security number is 232-32-3232. Pa8 2 Keith received the following Form W-2 for 2015 from Flyby Airlines. Jennifer received the following Form W-2 for 2015 from Small World Elementary School. 3. 4. During 2015, Keith and Jennifer received $550 in interest from Las Vegas municipal bonds, $1,070 interest from US. Treasury bonds, and $65 from their savings account at SCD Credit Union. Keith and Jennifer are joint owners of the Las Vegas city bonds and the U.S. Treasury bonds. They have a joint savings account at SCD Credit Union. Page C2 5. On January 21, 2015, Jennifer was involved in a car accident. Because the other driver was at fault, the other driver's insurance company paid Jennifer $1,350 for medical

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts