Question: Individuals Schedule X - Single table [ [ If taxable income is over:,But not over:,The tax is: ] , [ $ 0 , $

Individuals

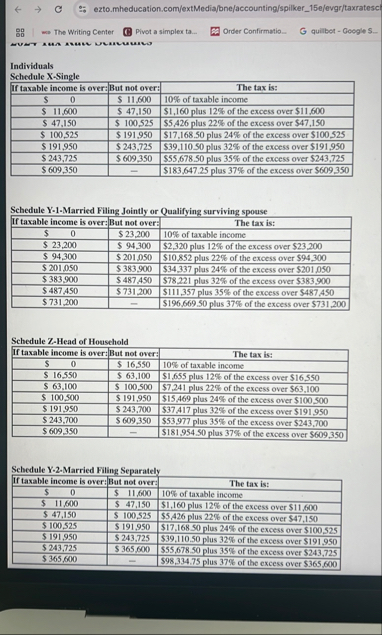

Schedule XSingle

tableIf taxable income is over:,But not over:,The tax is:$ $ of taxable income$ $ $ plus of the excess over $$ $ $ plus of the excess over $$ $ $ plus of the excess over $$ $ $ plus of the excess over $$ $ $ plus of the excess over $$ $ plus of the excess over $

Schedule YMarried Filing Jointly or Qualifying surviving spouse

tableIf taxable income is over:,But not over:,The tax is:$ $ of taxable income$ $ $ plus of the excess over $$ $ $ plus of the excess over $$ $ $ plus of the excess over $$$$ plus of the excess over $$$ $ plus of the excess over $$$ plus of the excess over $

Schedule ZHead of Household

tableIf taxable income is over:,But not over:,The tax is:$ $ of taxable income$ $ $ plus of the excess over $$ $ $ plus of the excess over $$ $ $ plus of the excess over $$ $ $ plus of the excess over $$ $ $ plus of the excess over $$ $ plus of the excess over $

Schedule YMarried Filing Separately

tableIf taxable income is over:,But not over:,The tax is:$ $ of taxable income$ $ $ plus of the excess over $$ $ $ plus of the excess over $$$ $ plus of the excess over $$ $ $ plus of the excess over $$ $ $ plus of the excess over $$ $ plus of the excess over $

Required information

Problem LO Algo

The following information applies to the questions displayed below

Eva received $ in compensation payments from JAZZ Corporation during Eva incurred $ in business expenses relating to her work for JAZZ Corporation JAZZ did not reimburse Eva for any of these expenses. Eva is single and deducts a standard deduction of $ Based on these facts, answer the following questions:

Use Tax Rate Schedule for reference.

Note: Leave no answer blank. Enter zero if applicable. Round your intermediate and final answers to the nearest whole dollar amount.

Problem Part c Algo

c Assume that Eva is considered to be a selfemployed contractor. What are her selfemployment tax liability and additional Medicare tax liability for the year?

tableSeltemployment tax liability,$Additional medicare tax liability,$Problem Part d Algo

d Assume that Eva is considered to be a selfemployed contractor. What is her regular tax liability for the year?

tableRegular tax liability,$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock