Question: Industrial Engineering. Economic Analysis for Engineers. Problem # 1 : Lifecycle Cost of an Electric Vehicle A client is interested in acquiring a BoriCar electric

Industrial Engineering.

Economic Analysis for Engineers.

Problem #: Lifecycle Cost of an Electric Vehicle

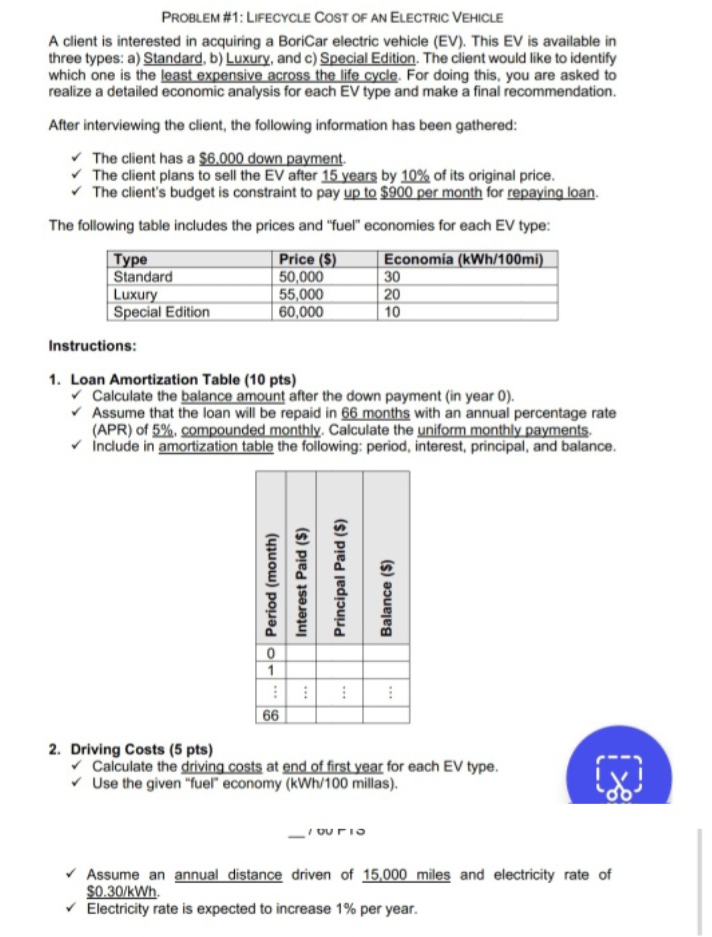

A client is interested in acquiring a BoriCar electric vehicle EV This EV is available in three types: a Standard, b Luxury, and c Special Edition. The client would like to identify which one is the least expensive across the life cycle. For doing this, you are asked to realize a detailed economic analysis for each EV type and make a final recommendation.

After interviewing the client, the following information has been gathered:

The client has a $ down payment.

The client plans to sell the EV after years by of its original price.

The client's budget is constraint to pay up to $ per month for repaying loan.

The following table includes the prices and "fuel" economies for each EV type:

tableTypePrice $Economia kWhmiStandardLuxurySpecial Edition,

Instructions:

Loan Amortization Table

Calculate the balance amount after the down payment in year

Assume that the loan will be repaid in months with an annual percentage rate APR of compounded monthly. Calculate the uniform monthly payments. Include in amortization table the following: period, interest, principal, and balance.

tablevdots,!

Driving Costs pts

Calculate the driving costs at end of first year for each EV type.

Use the given "fuel" economy kWh millas

UU FIO

Assume an annual distance driven of miles and electricity rate of $

Electricity rate is expected to increase per year.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock