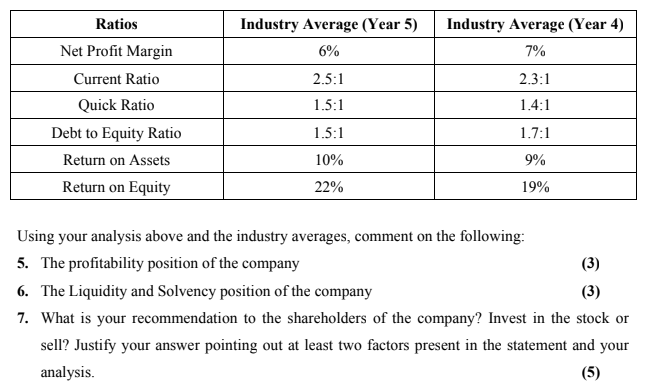

Question: Industry Average (Year 5) 6% Ratios Net Profit Margin Current Ratio Quick Ratio Debt to Equity Ratio Return on Assets Return on Equity Industry Average

Industry Average (Year 5) 6% Ratios Net Profit Margin Current Ratio Quick Ratio Debt to Equity Ratio Return on Assets Return on Equity Industry Average (Year 4) 7% 2.3:1 1.4:1 2.5:1 1.5:1 1.5:1 1.7:1 10% 9% 19% 22% Using your analysis above and the industry averages, comment on the following: 5. The profitability position of the company (3) 6. The Liquidity and Solvency position of the company (3) 7. What is your recommendation to the shareholders of the company? Invest in the stock or sell? Justify your answer pointing out at least two factors present in the statement and your analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts