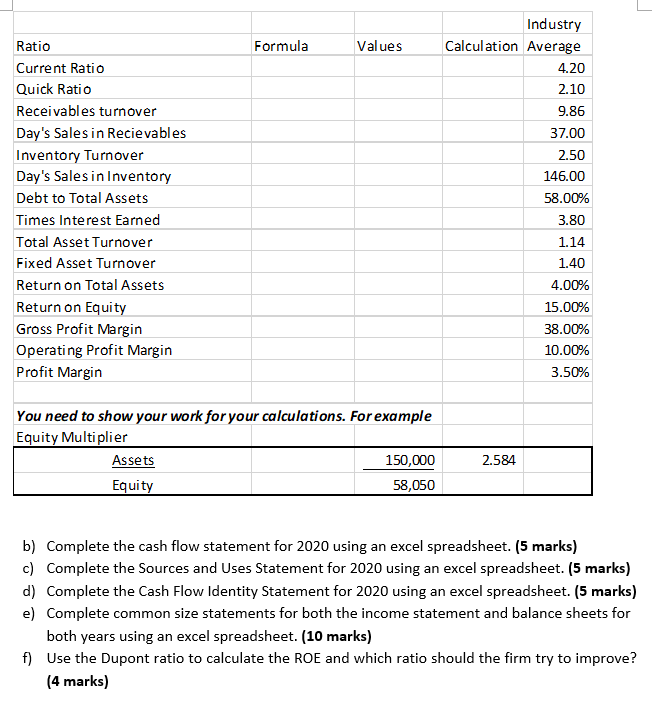

Question: Industry Calculation Average Ratio Formula Values Current Ratio 4.20 Quick Ratio 2.10 Receivables turnover 9.86 37.00 Day's Sales in Recievables Inventory Turnover Day's Salesin Inventory

Industry Calculation Average Ratio Formula Values Current Ratio 4.20 Quick Ratio 2.10 Receivables turnover 9.86 37.00 Day's Sales in Recievables Inventory Turnover Day's Salesin Inventory 2.50 146.00 Debt to Total Assets 58.00% Times Interest Earned 3.80 Total Asset Turnover 1.14 Fixed Asset Turnover 1.40 Return on Total Assets 4.00% 15.00% 38.00% Return on Equity Gross Profit Margin Operating Profit Margin Profit Margin 10.00% 3.50% You need to show your work for your calculations. For example Equity Multiplier Assets 150,000 2.584 Equity 58,050 b) Complete the cash flow statement for 2020 using an excel spreadsheet. (5 marks) c) Complete the Sources and Uses Statement for 2020 using an excel spreadsheet. (5 marks) d) Complete the Cash Flow Identity Statement for 2020 using an excel spreadsheet. (5 marks) e) Complete common size statements for both the income statement and balance sheets for both years using an excel spreadsheet. (10 marks) f) Use the Dupont ratio to calculate the ROE and which ratio should the firm try to improve? (4 marks) Industry Calculation Average Ratio Formula Values Current Ratio 4.20 Quick Ratio 2.10 Receivables turnover 9.86 37.00 Day's Sales in Recievables Inventory Turnover Day's Salesin Inventory 2.50 146.00 Debt to Total Assets 58.00% Times Interest Earned 3.80 Total Asset Turnover 1.14 Fixed Asset Turnover 1.40 Return on Total Assets 4.00% 15.00% 38.00% Return on Equity Gross Profit Margin Operating Profit Margin Profit Margin 10.00% 3.50% You need to show your work for your calculations. For example Equity Multiplier Assets 150,000 2.584 Equity 58,050 b) Complete the cash flow statement for 2020 using an excel spreadsheet. (5 marks) c) Complete the Sources and Uses Statement for 2020 using an excel spreadsheet. (5 marks) d) Complete the Cash Flow Identity Statement for 2020 using an excel spreadsheet. (5 marks) e) Complete common size statements for both the income statement and balance sheets for both years using an excel spreadsheet. (10 marks) f) Use the Dupont ratio to calculate the ROE and which ratio should the firm try to improve? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts