Question: ine The or Arhive 1 M platform/mod/quiz/attempt.php?attempt 1706575&page 4 indows MarketplacWindows Media Windows Raising cash stil tou 100 Must Read Book DAFIC Current opportunitie E

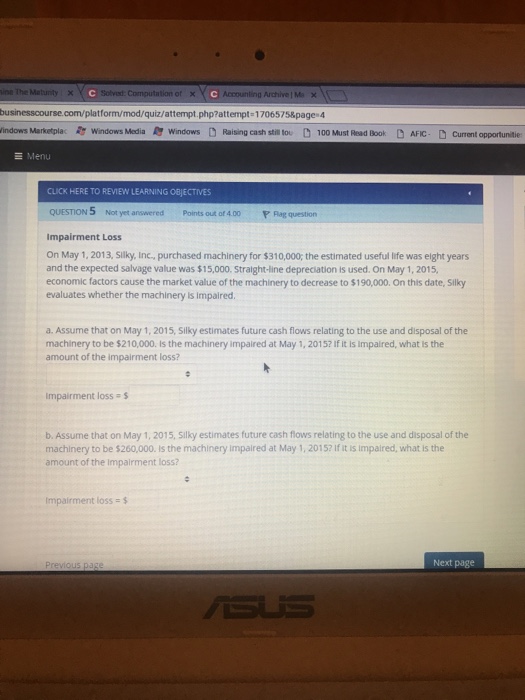

ine The or Arhive 1 M platform/mod/quiz/attempt.php?attempt 1706575&page 4 indows MarketplacWindows Media Windows Raising cash stil tou 100 Must Read Book DAFIC Current opportunitie E Menu CLICK HERE TO REVIEW LEARNING OBJECTIVES QUESTION 5 Not yet answered Points out of 4.00 Impairment Loss P Rag question On May 1, 2013, Slky, Inc, purchased machinery for $310,000; the estimated useful life was eight years and the expected salvage value was $15,000. Straight-line depreciation is used. On May 1, 2015, economic factors cause the market value of the machinery to decrease to $190,000. On this date, Silky evaluates whether the machinery Is impalred a. Assume that on May 1, 2015, Slky estimates future cash flows relating to the use and disposal of the machinery to be $210,000. Is the machinery impaired at May 1, 2015? If it is Impalred, what is the amount of the impairment loss? impairment loss- b. Assume that on May 1, 2015, Silky estimates future cash flows relating to the use and disposal of the machinery to be $260,000. Is the machinery impaired at May 1, 20152 If it is impaired, what is the amount of the Impairment loss? Impairment loss $ Next page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts