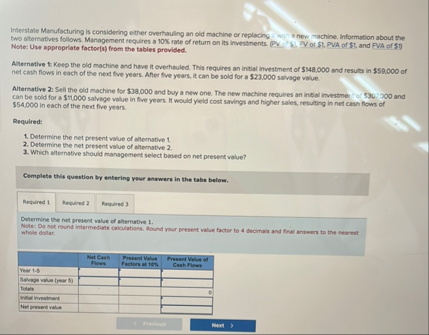

Question: Inferstate Manufocturing is considering either overtauling an old machine or replacing isith s new machine, Information about the two a ternatives follows. Manogement requires a

Inferstate Manufocturing is considering either overtauling an old machine or replacing isith s new machine, Information about the two a ternatives follows. Manogement requires a S rase of return on its investments. PV $ PV of $ PVA of $ and FVA of $ Note: Use appropriate factors from the tables provided.

Alernathe fikep the old machine and have it overhauled. This requires an initial investment of $ and results in $ of net cash flows in each of the next flve years. Aher five years, it can be sold for a $ salvage value.

Alternative : Sell the old machine for $ and buy a new one. The new machine requires an inkel investmer :c $ and Can be soid for a $ salvage value in flive years. It would yeld coat savings and higher sales, resulting in net cash flows of $ in each of the neat five years.

Required:

Determine the net present walue of alternative

Determine the net present value of alternative

Which alternative should management select based on net present value?

Cemplete this question by entering yeur anawers in the tabs below.

Required

OUREminet he net present value of alternative

Note: Do not round intermediate calculations, llound your presest value factor to decimalr and final andeers to the seareat whele dollar.

tableYear Nat Cash now,Prevent Value Factorn at Present Vive of Canh FiowSaluage ralue iear fotarintial investont,,,Nuti present valum,,,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock