Question: Inflation Linked Bond - Question : Suppose a bond with a three-year maturity, par value of $1 000, and a coupon rate of 4%. We

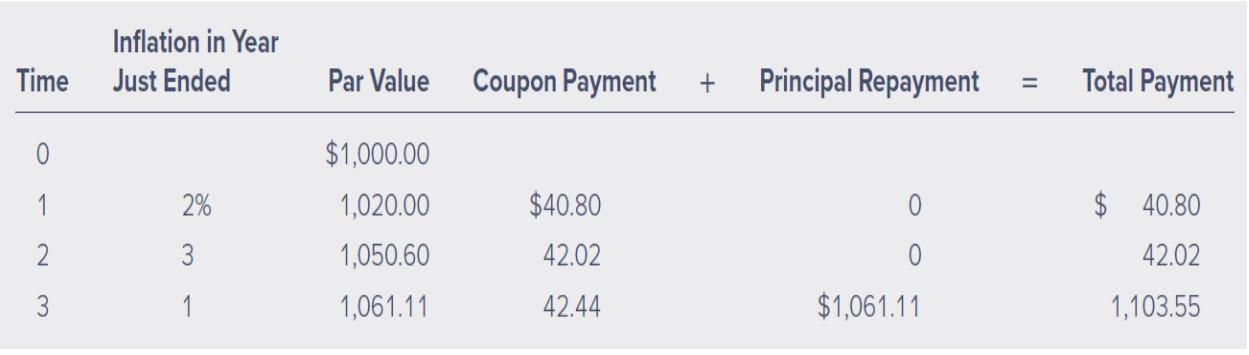

Inflation Linked Bond - Question: Suppose a bond with a three-year maturity, par value of $1 000, and a coupon rate of 4%. We assume the bond makes annual coupon payments, and inflation turns out to be 2%, 3%, and 1% in the next three years.

What is the nominal return and real return on this bond? (Note: The question refers to the entire period of the bond - thanks)

\begin{tabular}{cccccc} Time & Inflation in Year Just Ended & Par Value & Coupon Payment + & Principal Repayment = & Total Payment \\ \hline 0 & & $1,000.00 & & & \\ 1 & 1,020.00 & $40.80 & 0 & $0.80 \\ 2 & 2% & 1,050.60 & 42.02 & 0 & 42.02 \\ 3 & 3 & 1,061.11 & 42.44 & $1,061.11 & 1,103.55 \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts