Question: Info obtained on _ _ _ _ _ _ 4 / 2 7 / 2 0 2 5 _ _ _ _ _ _ _

Info obtained on

from Yahoo Finance

Price

Shares Outstanding

Beta Y Monthly

Annual Dividend Rate

Next Year growth

STD Jan

STD Jan

LTD Jan

LTD Jan

Interest expense

from the annual report

Tax rate

from Morningstar.com

ROE

Payout ratio

from excel doc

Risk free

Market premium

Calculations:

Dividend growth rate

historical dividends g attach the excel document

Sustainable growth rate g

Total debt

Total debt

Cost of equity

CAPM

Ce

DDM

Using analysts estimate Ce

Using historical data Ce

Using sustainable growth rate Ce

What cost of equity are you using and why? You may choose one of the four options or use an average of two or more.

We are using an average of the CAPM and the DDM based on analysts growth resulting in a total cost of equity of We chose this approach because both models provide valuable insights: CAPM reflects marketbased risk through beta while DDM incorporates companyspecific growth. Since the firm pays dividends expected to grow at a constant rate, the constantgrowth model is appropriate. When both CAPM and DDM are applicable, the best estimate of cost of equity is the average of the two.

Cost of debt

Cd

Aftertax Cd

Weights

Total Debt

Mk value of equity

We

Wd

WACC

Welrarlimes.

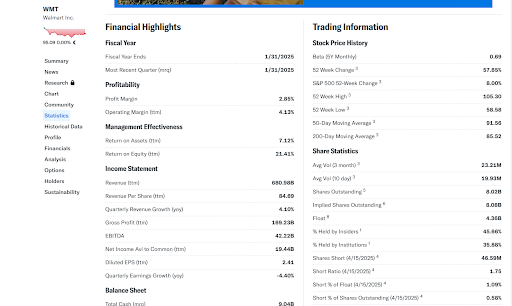

Financial Highlights

Fiseal Year

Profitalility

Frote Mayin

Opentring Margin ran

Managemen! Effectiveness

Betumas Astives info

Wetum an Eqaty tim

Inoame Statement

Sorwove find

Rewana Per Share tiri

Quan Proftns

:

EBITOA

Nat Insare Ral sa Carmen itmi

D

Chined EPSOMT

Oaanloly Eomines Browth yay

Balance Sheet

Total Canh Inos

Trading Information

Stack Prics Histsey

Sham Statistics

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock