Question: INFO: Variable manufacturing overhead costs incurred $464,230 Variable manufacturing overhead cost rate $6 per standard machine-hour Fixed manufacturing overhead costs incurred $146,700 Fixed manufacturing overhead

INFO:

Variable manufacturing overhead costs incurred

$464,230

Variable manufacturing overhead cost rate

$6 per standard machine-hour

Fixed manufacturing overhead costs incurred

$146,700

Fixed manufacturing overhead costs budgeted

$140,000

Denominator level in machine-hours

70,000

Standard machine-hour allowed per unit of output

1.2

Units of output

65,200

Actual machine-hours used

76,100

Ending work-in-process inventory

0

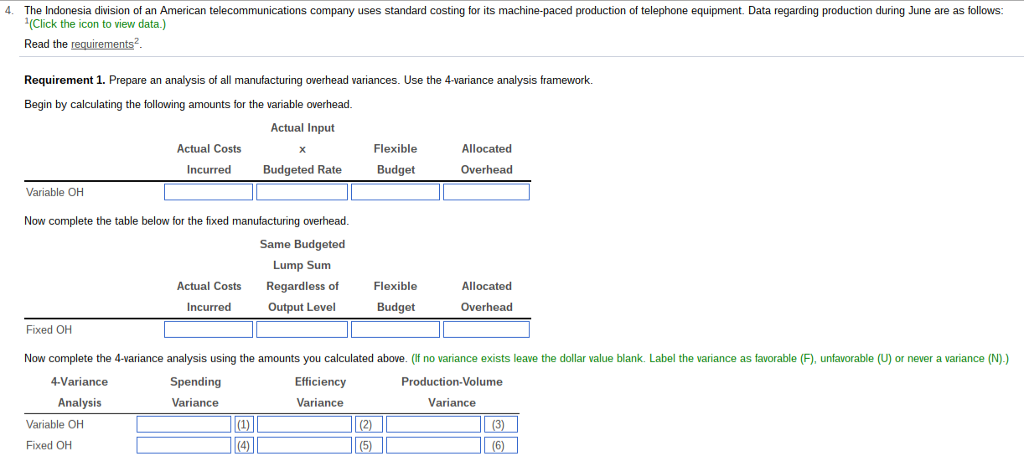

4. he Indonesia division of an American telecommunications company uses standard costing for its machine-paced production of telephone equipment. Data regarding production during June are as follows: 1(Click the icon to view data.) Read the requirements Requirement 1. Prepare an analysis of all manufacturing overhead variances. Use the 4-variance analysis framework. Begin by calculating the following amounts for the variable overhead. Actual Input Actual Costs Flexible Allocated Incurred Budgeted Rate Budge Overhead Variable OH Now complete the table below for the fixed manufacturing overhead. Same Budgeted Lump sum Actual Costs Regardless of Flexible Allocated Output Level Overhead Incurred Budget Fixed OH Now complete the 4-variance analysis using the amounts you calculated above (f no variance exists leave the dollar value blank. Label the variance as favorable (F), unfavorable (U) or never a variance (N Efficiency 4-Variance Spending Production-Volume Analysis Variance Variance Variance Variable OH Fixed OH

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts