Question: Information for Problem 4. You are considering taking a 3-year hiatus from school to open a cupcake business. You estimate the upfront capital expenditure will

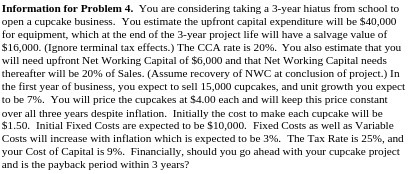

Information for Problem 4. You are considering taking a 3-year hiatus from school to open a cupcake business. You estimate the upfront capital expenditure will be $40,000 for equipment, which at the end of the 3-year project life will have a salvage value of $16,000. (Ignore terminal tax effects.) The CCA rate is 20%. You also estimate that you will need upfront Net Working Capital of $6,000 and that Net Working Capital needs thereafter will be 20% of Sales. (Assume recovery of NWC at conclusion of project.) In the first year of business, you expect to sell 15,000 cupcakes, and unit growth you expect to be 7%. You will price the cupcakes at $4.00 each and will keep this price constant over all three years despite inflation. Initially the cost to make each cupcake will be $1.50. Initial Fixed Costs are expected to be $10,000. Fixed Costs as well as Variable Costs will increase with inflation which is expected to be 3%. The Tax Rate is 25%, and your Cost of Capital is 9%. Financially, should you go ahead with your cupcake project and is the payback period within 3 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts