Question: Information maybe needed: Please type the answer by computer so I can see it clearly, thank you!!! Company (Newton Limited) is a watch manufacturing firm

Information maybe needed:

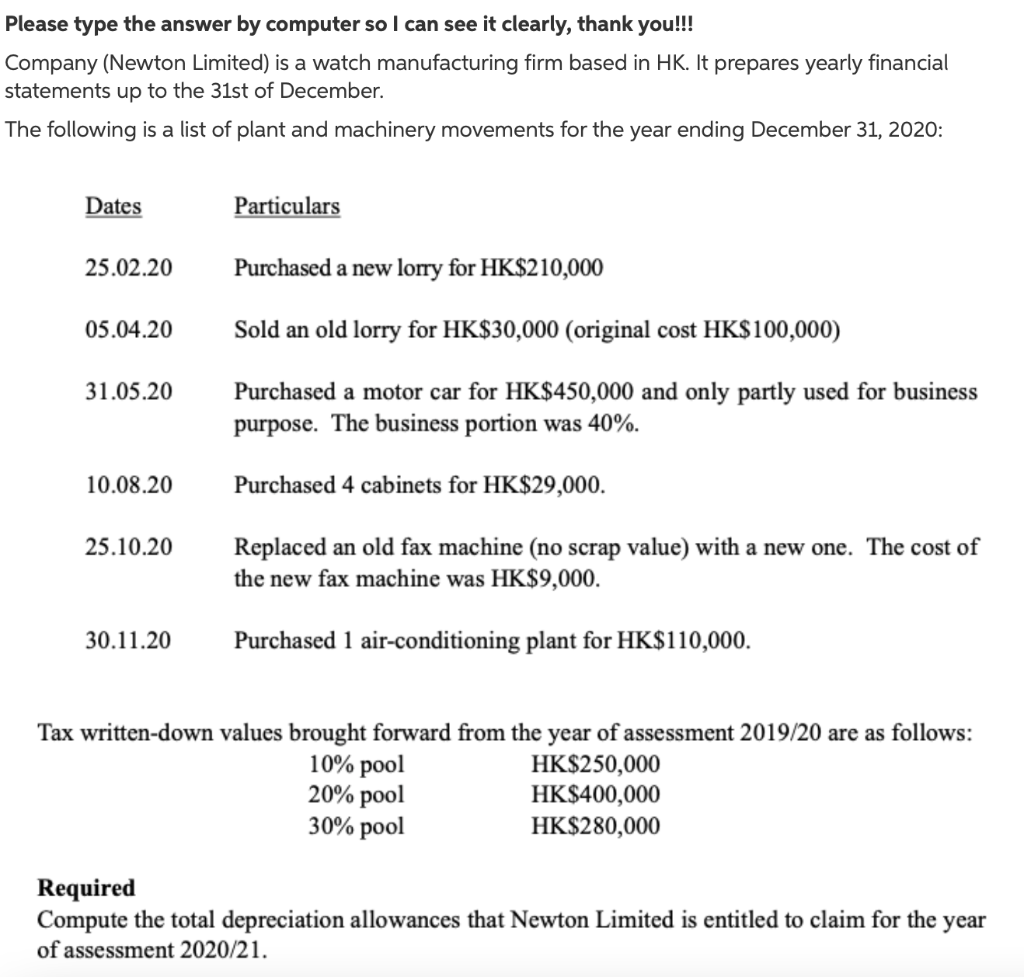

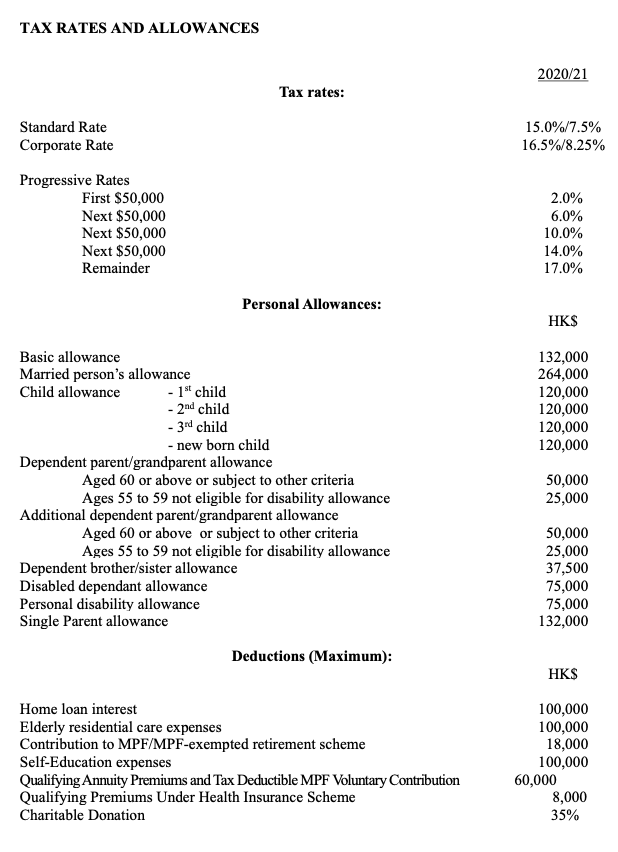

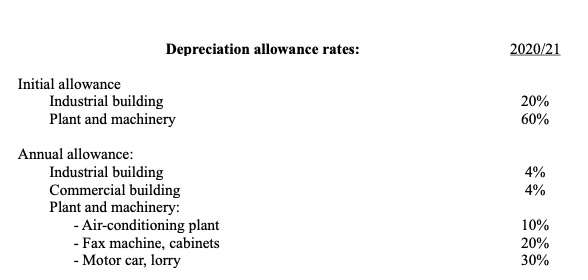

Please type the answer by computer so I can see it clearly, thank you!!! Company (Newton Limited) is a watch manufacturing firm based in HK. It prepares yearly financial statements up to the 31st of December. The following is a list of plant and machinery movements for the year ending December 31, 2020: Dates Particulars 25.02.20 Purchased a new lorry for HK$210,000 05.04.20 Sold an old lorry for HK$30,000 (original cost HK$100,000) 31.05.20 Purchased a motor car for HK$450,000 and only partly used for business purpose. The business portion was 40%. 10.08.20 Purchased 4 cabinets for HK$29,000. 25.10.20 Replaced an old fax machine (no scrap value) with a new one. The cost of the new fax machine was HK$9,000. 30.11.20 Purchased 1 air-conditioning plant for HK$110,000. Tax written-down values brought forward from the year of assessment 2019/20 are as follows: 10% pool HK$250,000 20% pool HK$400,000 30% pool HK$280,000 Required Compute the total depreciation allowances that Newton Limited is entitled to claim for the year of assessment 2020/21. TAX RATES AND ALLOWANCES Standard Rate Corporate Rate Progressive Rates Tax rates: First $50,000 Next $50,000 Next $50,000 Next $50,000 Remainder Personal Allowances: Basic allowance Married person's allowance Child allowance - 1st child - 2nd child - 3rd child - new born child Dependent parent/grandparent allowance Aged 60 or above or subject to other criteria Ages 55 to 59 not eligible for disability allowance Additional dependent parent/grandparent allowance Aged 60 or above or subject to other criteria Ages 55 to 59 not eligible for disability allowance Dependent brother/sister allowance Disabled dependant allowance Personal disability allowance Single Parent allowance Deductions (Maximum): Home loan interest Elderly residential care expenses Contribution to MPF/MPF-exempted retirement scheme Self-Education expenses Qualifying Annuity Premiums and Tax Deductible MPF Voluntary Contribution Qualifying Premiums Under Health Insurance Scheme Charitable Donation 2020/21 15.0%/7.5% 16.5%/8.25% 2.0% 6.0% 10.0% 14.0% 17.0% HK$ 132,000 264,000 120,000 120,000 120,000 120,000 50,000 25,000 50,000 25,000 37,500 75,000 75,000 132,000 HK$ 100,000 100,000 18,000 100,000 8,000 35% 60,000 Initial allowance Annual allowance: Depreciation allowance rates: Industrial building Plant and machinery Industrial building Commercial building Plant and machinery: - Air-conditioning plant - Fax machine, cabinets - Motor car, lorry 2020/21 20% 60% 4% 4% 10% 20% 30% Please type the answer by computer so I can see it clearly, thank you!!! Company (Newton Limited) is a watch manufacturing firm based in HK. It prepares yearly financial statements up to the 31st of December. The following is a list of plant and machinery movements for the year ending December 31, 2020: Dates Particulars 25.02.20 Purchased a new lorry for HK$210,000 05.04.20 Sold an old lorry for HK$30,000 (original cost HK$100,000) 31.05.20 Purchased a motor car for HK$450,000 and only partly used for business purpose. The business portion was 40%. 10.08.20 Purchased 4 cabinets for HK$29,000. 25.10.20 Replaced an old fax machine (no scrap value) with a new one. The cost of the new fax machine was HK$9,000. 30.11.20 Purchased 1 air-conditioning plant for HK$110,000. Tax written-down values brought forward from the year of assessment 2019/20 are as follows: 10% pool HK$250,000 20% pool HK$400,000 30% pool HK$280,000 Required Compute the total depreciation allowances that Newton Limited is entitled to claim for the year of assessment 2020/21. TAX RATES AND ALLOWANCES Standard Rate Corporate Rate Progressive Rates Tax rates: First $50,000 Next $50,000 Next $50,000 Next $50,000 Remainder Personal Allowances: Basic allowance Married person's allowance Child allowance - 1st child - 2nd child - 3rd child - new born child Dependent parent/grandparent allowance Aged 60 or above or subject to other criteria Ages 55 to 59 not eligible for disability allowance Additional dependent parent/grandparent allowance Aged 60 or above or subject to other criteria Ages 55 to 59 not eligible for disability allowance Dependent brother/sister allowance Disabled dependant allowance Personal disability allowance Single Parent allowance Deductions (Maximum): Home loan interest Elderly residential care expenses Contribution to MPF/MPF-exempted retirement scheme Self-Education expenses Qualifying Annuity Premiums and Tax Deductible MPF Voluntary Contribution Qualifying Premiums Under Health Insurance Scheme Charitable Donation 2020/21 15.0%/7.5% 16.5%/8.25% 2.0% 6.0% 10.0% 14.0% 17.0% HK$ 132,000 264,000 120,000 120,000 120,000 120,000 50,000 25,000 50,000 25,000 37,500 75,000 75,000 132,000 HK$ 100,000 100,000 18,000 100,000 8,000 35% 60,000 Initial allowance Annual allowance: Depreciation allowance rates: Industrial building Plant and machinery Industrial building Commercial building Plant and machinery: - Air-conditioning plant - Fax machine, cabinets - Motor car, lorry 2020/21 20% 60% 4% 4% 10% 20% 30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts