Question: Information needed for Qeustion-7 : Stock-A has an expected return of 12% and a standard deviation of 40%. Stock-B has an expected return of 18%

Information needed for Qeustion-7 : Stock-A has an expected return of 12% and a standard deviation of 40%. Stock-B has an expected return of 18% and a standard deviation of 60%. The correlation coefficient between stocks A and B is 0.2. What are the expected return and standard deviation of a portfolio invested 30% in Stock A and 70% in Stock B?

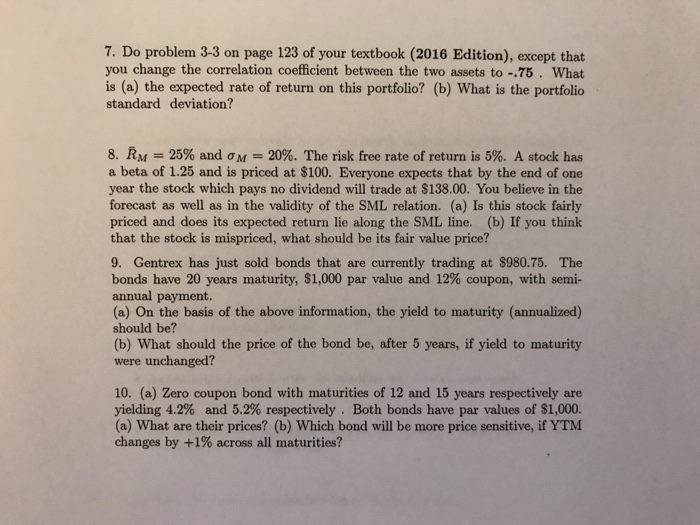

7. Do problem 3-3 on page 123 of your textbook (2016 Edition), except that you change the correlation coefficient between the two assets to -.75. What is (a) the expected rate of return on this portfolio? (b) What is the portfolio standard deviation? 8. RM = 25% and M = 20%. The risk free rate of return is 5%. A stock has a beta of 1.25 and is priced at $100. Everyone expects that by the end of one year the stock which pays no dividend will trade at $138.00. You believe in the forecast as well as in the validity of the SML relation. (a) Is this stock fairly priced and does its expected return lie along the SML line. (b) If you think that the stock is mispriced, what should be its fair value price? 9. Gentrex has just sold bonds that are currently trading at $980.75. The bonds have 20 years maturity, $1,000 par value and 12% coupon, with semi- annual payment. (a) On the basis of the above information, the yield to maturity (annualized) should be? (b) What should the price of the bond be, after 5 years, if yield to maturity were unchanged? 10. (a) Zero coupon bond with maturities of 12 and 15 years respectively are yielding 4.2% and 5.2% respectively . Both bonds have par values of $1,000. (a) What are their prices? (b) Which bond will be more price sensitive, if YTM changes by +1% across all maturities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts