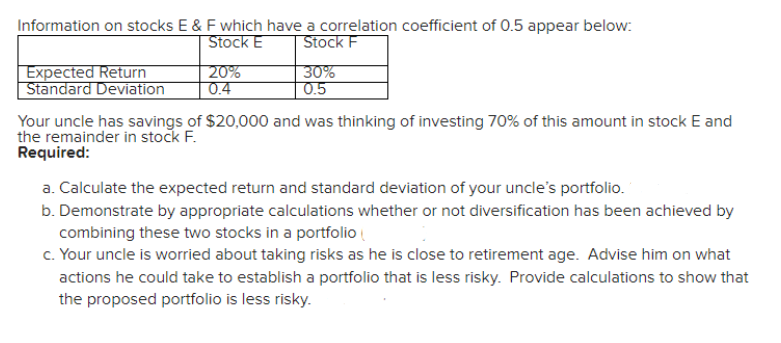

Question: Information on stocks E & F which have a correlation coefficient of 0.5 appear below: Your uncle has savings of $20,000 and was thinking of

Information on stocks E \& F which have a correlation coefficient of 0.5 appear below: Your uncle has savings of $20,000 and was thinking of investing 70% of this amount in stock E and the remainder in stock F. Required: a. Calculate the expected return and standard deviation of your uncle's portfolio. b. Demonstrate by appropriate calculations whether or not diversification has been achieved by combining these two stocks in a portfolio c. Your uncle is worried about taking risks as he is close to retirement age. Advise him on what actions he could take to establish a portfolio that is less risky. Provide calculations to show that the proposed portfolio is less risky

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts