Question: Information provided by Emma: Please note that each student will be working with a slightly different set of information There is a unique set of

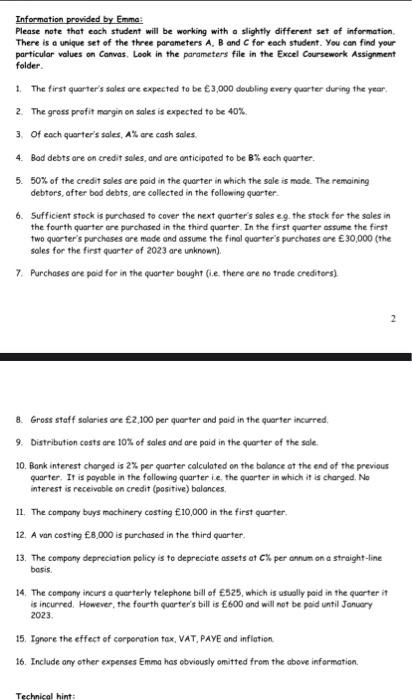

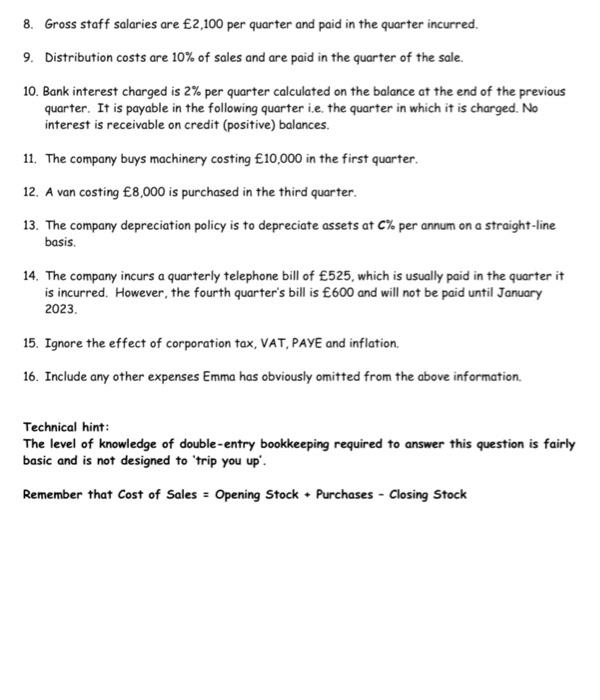

Information provided by Emma: Please note that each student will be working with a slightly different set of information There is a unique set of the three parameters A, B and C for each student. You can find your particular values on Canvas. Look in the parameters file in the Excel Coursework Assignment folder. 1. The first quarter's sales are expected to be 3,000 doubling every quarter during the year, 2. The gross profit margin on sales is expected to be 40% 3. Of each quarter's sales, A% are cash sales. 4. Bod debts are on credit sales, and are anticipated to be Beach quarter. 5. 50% of the credit sales are paid in the quarter in which the sales made. The remaining debtors, after bod debts, are collected in the following quarter 6. Sufficient stock is purchased to cover the next quarter's sales eg. the stock for the sales in the fourth quarter ore purchased in the third quarter. In the first quarter assume the first two quarter's purchases are made and assume the final quarter's purchases are 30,000 (the sales for the first quarter of 2023 are unknown). 7. Purchases are paid for in the quarter bought (le, there are no trade creditors) 8. Gross staff salaries are 2,100 per quarter and paid in the quarter incurred 9. Distribution costs are 10% of sales and are paid in the quarter of the sole 10. Bank interest charged is 2% per quarter calculated on the balance at the end of the previous quarter. It is payable in the following quarter ie the quarter in which it is charged. Ne interest is receivable on credit (positive) balances 11. The company buys machinery costing 10,000 in the first quarter. 12. A van costing 8,000 is purchased in the third quarter. 13. The company depreciation policy is to depreciate assets at C per annun on a straight-line basis 14. The company incurs a quarterly telephone bill of 525, which is usually paid in the quarter it is incurred. However, the fourth quarter's bill is 600 and will not be paid until January 2023 15. Ignore the effect of corporation tax, VAT, PAYE and inflation 16. Include any other expenses Emma has obviously omitted from the above information Technical hint: 8. Gross staff salaries are 2,100 per quarter and paid in the quarter incurred. 9. Distribution costs are 10% of sales and are paid in the quarter of the sale. 10. Bank interest charged is 2% per quarter calculated on the balance at the end of the previous quarter. It is payable in the following quarter i.e. the quarter in which it is charged. No interest is receivable on credit (positive) balances. 11. The company buys machinery costing 10,000 in the first quarter. 12. A van costing 8,000 is purchased in the third quarter. 13. The company depreciation policy is to depreciate assets at 0% per annum on a straight-line basis. 14. The company incurs a quarterly telephone bill of 525, which is usually paid in the quarter it is incurred. However, the fourth quarter's bill is 600 and will not be paid until January 2023 15. Ignore the effect of corporation tax, VAT, PAYE and inflation 16. Include any other expenses Emma has obviously omitted from the above information. Technical hint: The level of knowledge of double-entry bookkeeping required to answer this question is fairly basic and is not designed to "trip you up. Remember that cost of Sales - Opening Stock Purchases - Closing Stock Information provided by Emma: Please note that each student will be working with a slightly different set of information There is a unique set of the three parameters A, B and C for each student. You can find your particular values on Canvas. Look in the parameters file in the Excel Coursework Assignment folder. 1. The first quarter's sales are expected to be 3,000 doubling every quarter during the year, 2. The gross profit margin on sales is expected to be 40% 3. Of each quarter's sales, A% are cash sales. 4. Bod debts are on credit sales, and are anticipated to be Beach quarter. 5. 50% of the credit sales are paid in the quarter in which the sales made. The remaining debtors, after bod debts, are collected in the following quarter 6. Sufficient stock is purchased to cover the next quarter's sales eg. the stock for the sales in the fourth quarter ore purchased in the third quarter. In the first quarter assume the first two quarter's purchases are made and assume the final quarter's purchases are 30,000 (the sales for the first quarter of 2023 are unknown). 7. Purchases are paid for in the quarter bought (le, there are no trade creditors) 8. Gross staff salaries are 2,100 per quarter and paid in the quarter incurred 9. Distribution costs are 10% of sales and are paid in the quarter of the sole 10. Bank interest charged is 2% per quarter calculated on the balance at the end of the previous quarter. It is payable in the following quarter ie the quarter in which it is charged. Ne interest is receivable on credit (positive) balances 11. The company buys machinery costing 10,000 in the first quarter. 12. A van costing 8,000 is purchased in the third quarter. 13. The company depreciation policy is to depreciate assets at C per annun on a straight-line basis 14. The company incurs a quarterly telephone bill of 525, which is usually paid in the quarter it is incurred. However, the fourth quarter's bill is 600 and will not be paid until January 2023 15. Ignore the effect of corporation tax, VAT, PAYE and inflation 16. Include any other expenses Emma has obviously omitted from the above information Technical hint: 8. Gross staff salaries are 2,100 per quarter and paid in the quarter incurred. 9. Distribution costs are 10% of sales and are paid in the quarter of the sale. 10. Bank interest charged is 2% per quarter calculated on the balance at the end of the previous quarter. It is payable in the following quarter i.e. the quarter in which it is charged. No interest is receivable on credit (positive) balances. 11. The company buys machinery costing 10,000 in the first quarter. 12. A van costing 8,000 is purchased in the third quarter. 13. The company depreciation policy is to depreciate assets at 0% per annum on a straight-line basis. 14. The company incurs a quarterly telephone bill of 525, which is usually paid in the quarter it is incurred. However, the fourth quarter's bill is 600 and will not be paid until January 2023 15. Ignore the effect of corporation tax, VAT, PAYE and inflation 16. Include any other expenses Emma has obviously omitted from the above information. Technical hint: The level of knowledge of double-entry bookkeeping required to answer this question is fairly basic and is not designed to "trip you up. Remember that cost of Sales - Opening Stock Purchases - Closing Stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts