Question: Information Question 1 Question 2 Question 3 Thank you :-) During January 2022, the following transactions occurred. (Coronado Company uses the perpetual inventory system.) 1.

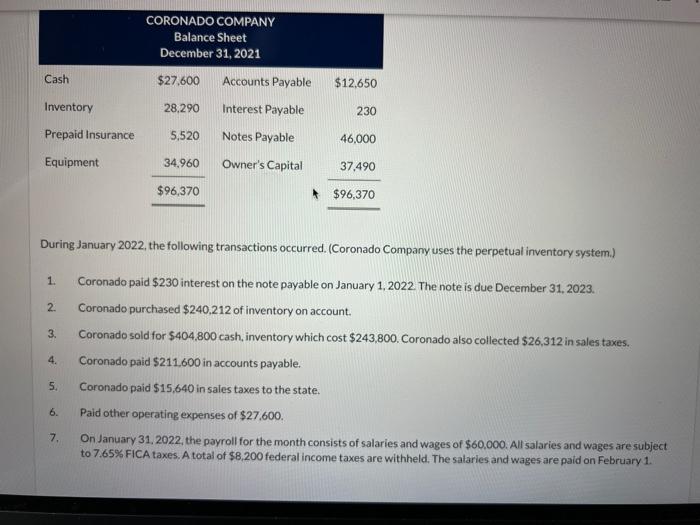

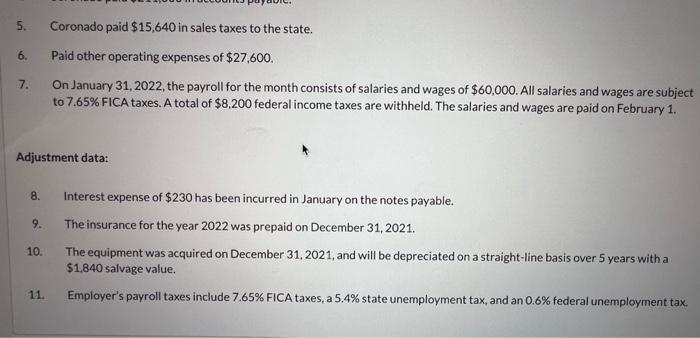

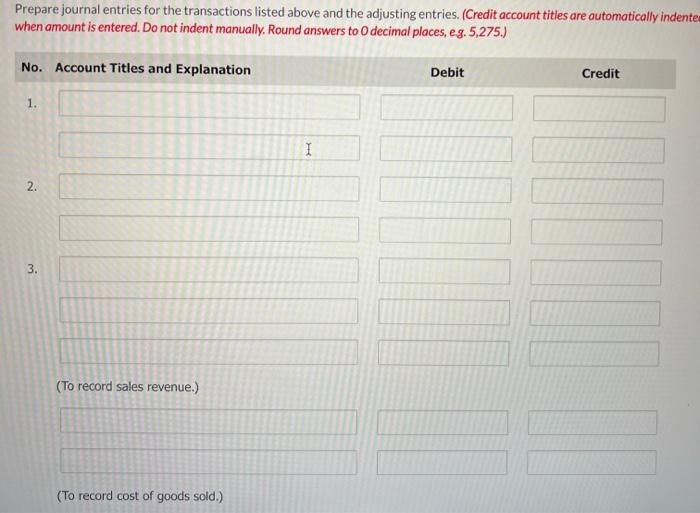

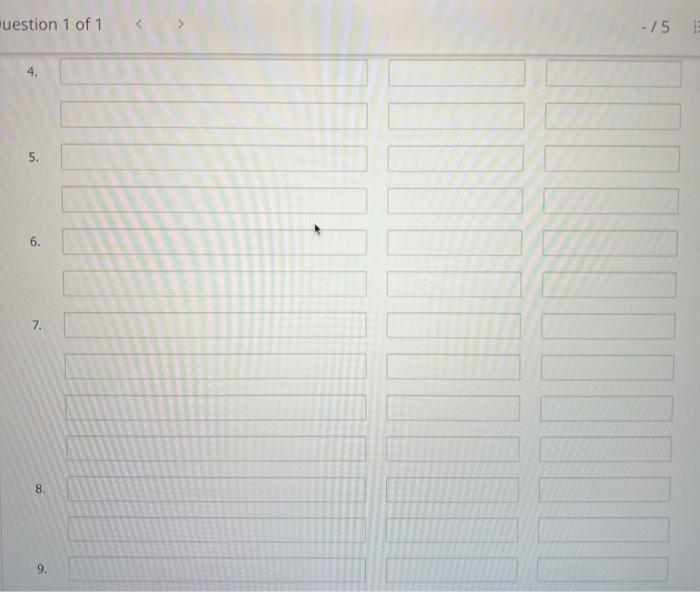

During January 2022, the following transactions occurred. (Coronado Company uses the perpetual inventory system.) 1. Coronado paid $230 interest on the note payable on January 1,2022 . The note is due December 31,2023. 2. Coronado purchased $240,212 of inventory on account. 3. Coronado sold for $404,800 cash, inventory which cost $243,800. Coronado also collected $26,312 in sales taxes. 4. Coronado paid $211,600 in accounts payable. 5. Coronado paid $15,640 in sales taxes to the state. 6. Paid other operating expenses of $27,600. 7. On January 31, 2022, the payroll for the month consists of salaries and wages of $60,000. All salaries and wages are subject to 7.65% FICA taxes. A total of $8,200 federal income taxes are withheld. The salaries and wages are paid on February 1 . 5. Coronado paid $15,640 in sales taxes to the state. 6. Paid other operating expenses of $27,600. 7. On January 31, 2022, the payroll for the month consists of salaries and wages of $60,000. All salaries and wages are subject to 7.65\% FICA taxes. A total of $8,200 federal income taxes are withheld. The salaries and wages are paid on February 1 . Adjustment data: 8. Interest expense of $230 has been incurred in January on the notes payable. 9. The insurance for the year 2022 was prepaid on December 31,2021. 10. The equipment was acquired on December 31,2021 , and will be depreciated on a straight-line basis over 5 years with a $1.840 salvage value. 11. Employer's payroll taxes include 7.65% FICA taxes, a 5.4% state unemployment tax, and an 0.6% federal unemployment tax. Prepare journal entries for the transactions listed above and the adjusting entries. (Credit account titles are automatically indent when amount is entered. Do not indent manually. Round answers to 0 decimal places, eg. 5,275.) uestion 1 of 1 15 4. 5. 6. 7. 8. 9. 10. 11. repare an adiusted trial balance at January 31, 2022. (Round answers to 0 decimal places. e.9. 5.275.) Question 1 of 1 15 CORONADO COMPANY Income Statement $ During January 2022, the following transactions occurred. (Coronado Company uses the perpetual inventory system.) 1. Coronado paid $230 interest on the note payable on January 1,2022 . The note is due December 31,2023. 2. Coronado purchased $240,212 of inventory on account. 3. Coronado sold for $404,800 cash, inventory which cost $243,800. Coronado also collected $26,312 in sales taxes. 4. Coronado paid $211,600 in accounts payable. 5. Coronado paid $15,640 in sales taxes to the state. 6. Paid other operating expenses of $27,600. 7. On January 31, 2022, the payroll for the month consists of salaries and wages of $60,000. All salaries and wages are subject to 7.65% FICA taxes. A total of $8,200 federal income taxes are withheld. The salaries and wages are paid on February 1 . 5. Coronado paid $15,640 in sales taxes to the state. 6. Paid other operating expenses of $27,600. 7. On January 31, 2022, the payroll for the month consists of salaries and wages of $60,000. All salaries and wages are subject to 7.65\% FICA taxes. A total of $8,200 federal income taxes are withheld. The salaries and wages are paid on February 1 . Adjustment data: 8. Interest expense of $230 has been incurred in January on the notes payable. 9. The insurance for the year 2022 was prepaid on December 31,2021. 10. The equipment was acquired on December 31,2021 , and will be depreciated on a straight-line basis over 5 years with a $1.840 salvage value. 11. Employer's payroll taxes include 7.65% FICA taxes, a 5.4% state unemployment tax, and an 0.6% federal unemployment tax. Prepare journal entries for the transactions listed above and the adjusting entries. (Credit account titles are automatically indent when amount is entered. Do not indent manually. Round answers to 0 decimal places, eg. 5,275.) uestion 1 of 1 15 4. 5. 6. 7. 8. 9. 10. 11. repare an adiusted trial balance at January 31, 2022. (Round answers to 0 decimal places. e.9. 5.275.) Question 1 of 1 15 CORONADO COMPANY Income Statement $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts