Question: Information: Required: 1) 2a) 2b) Problem 14-5A Installment notes LO C1 On November 1, 2019, Norwood borrows $420,000 cash from a bank by signing a

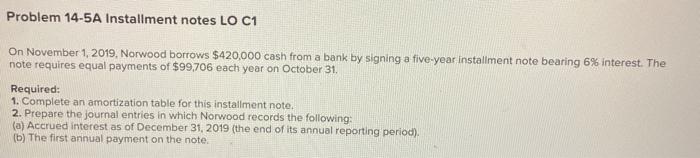

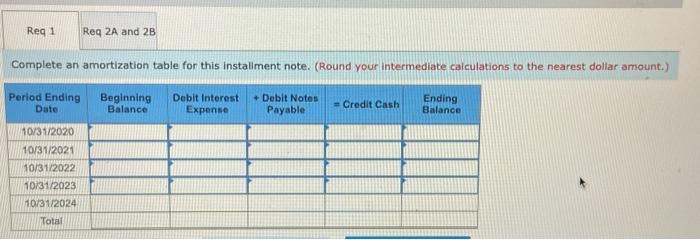

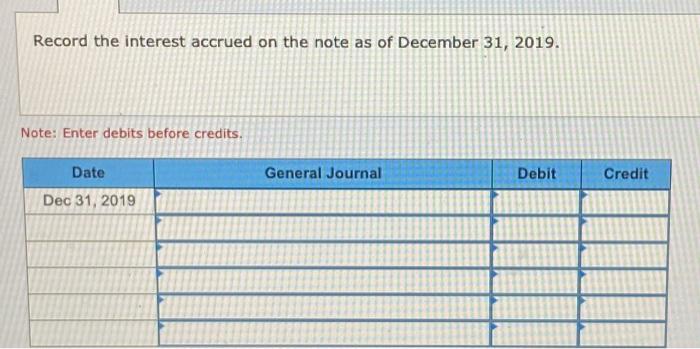

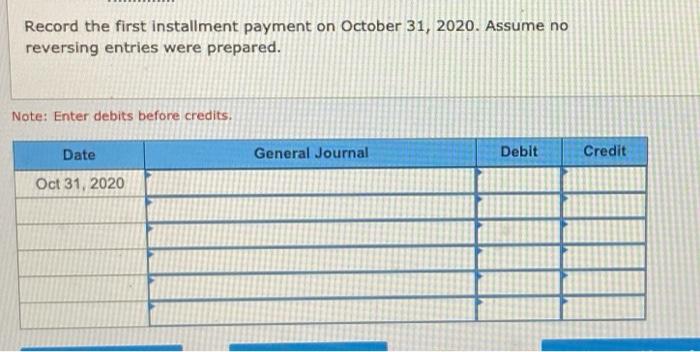

Problem 14-5A Installment notes LO C1 On November 1, 2019, Norwood borrows $420,000 cash from a bank by signing a five-year installment note bearing 6% interest. The note requires equal payments of $99,706 each year on October 31, Required: 1. Complete an amortization table for this installment note. 2. Prepare the journal entries in which Norwood records the following: (a) Accrued interest as of December 31, 2019 (the end of its annual reporting period). (b) The first annual payment on the note. Reg 1 Req 2A and 2B Complete an amortization table for this installment note. (Round your intermediate calculations to the nearest dollar amount.) Period Ending Date Beginning Balance Debit interest Expense + Debit Notes Payable - Credit Cash Ending Balance 10/31/2020 10/31/2021 10/31/2022 10/31/2023 10/31/2024 Total Record the interest accrued on the note as of December 31, 2019. Note: Enter debits before credits. General Journal Debit Credit Date Dec 31, 2019 Record the first installment payment on October 31, 2020. Assume no reversing entries were prepared. Note: Enter debits before credits. Date General Journal Debit Credit Oct 31, 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts