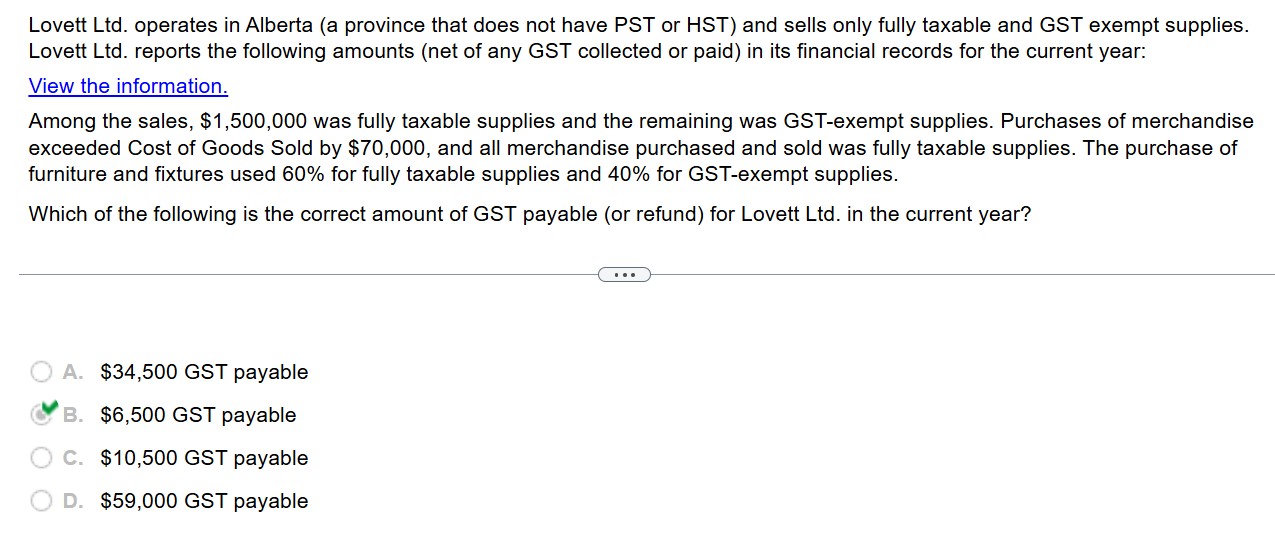

Question: Information Sales $ 2 , 5 5 0 , 0 0 0 Cost of Goods Sold $ 1 , 1 0 0 , 0 0

Information

Sales

$

Cost of Goods Sold

$

Depreciation expense

$

Salaries and wages

$

Capital expenditures

$ Lovett Ltd operates in Alberta a province that does not have PST or HST and sells only fully taxable and GST exempt supplies. Lovett Ltd reports the following amounts net of any GST collected or paid in its financial records for the current year:

View the information.

Among the sales, $ was fully taxable supplies and the remaining was GSTexempt supplies. Purchases of merchandise exceeded Cost of Goods Sold by $ and all merchandise purchased and sold was fully taxable supplies. The purchase of furniture and fixtures used for fully taxable supplies and for GSTexempt supplies.

Which of the following is the correct amount of GST payable or refund for Lovett Ltd in the current year?

A$ GST payable

B$ GST payable

C$ GST payable

D$ GST payable

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock