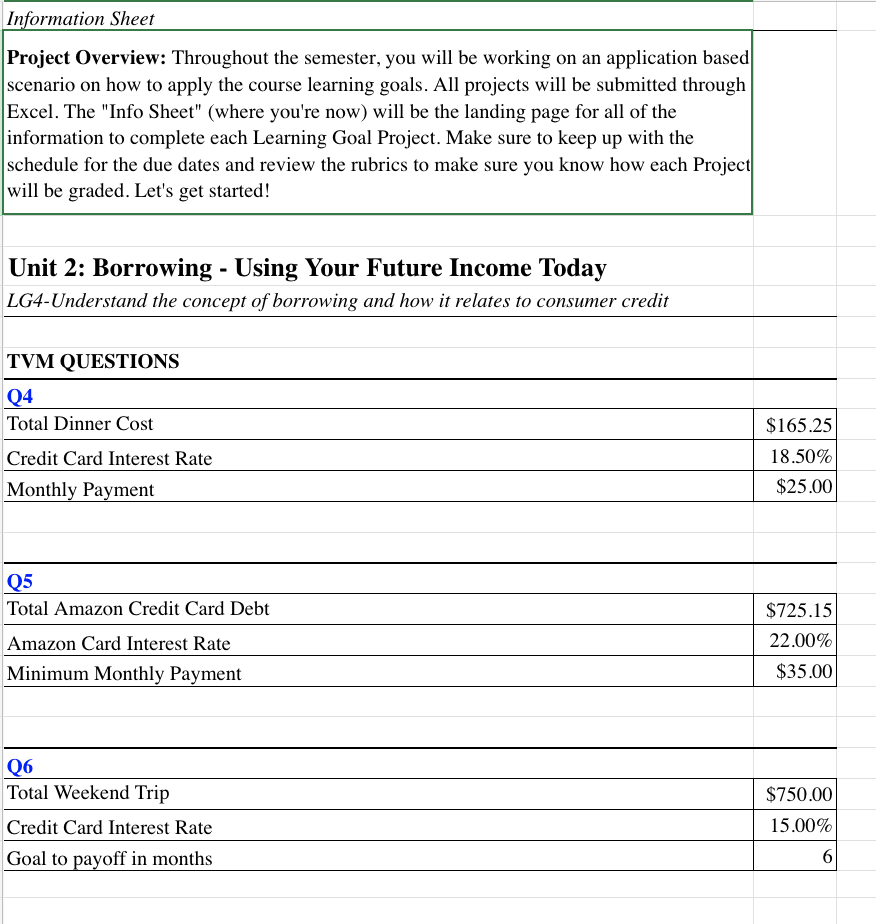

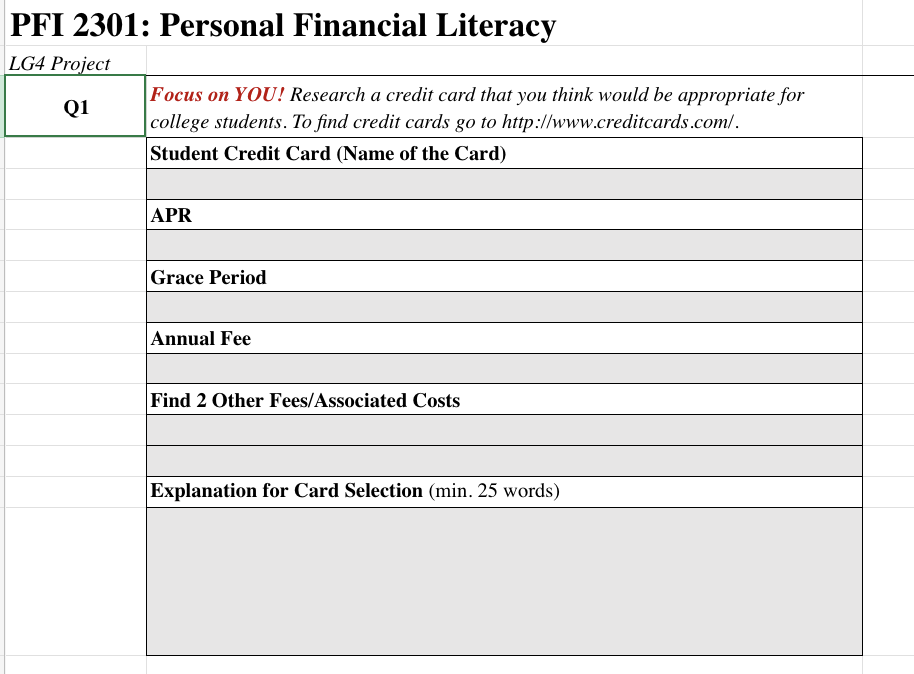

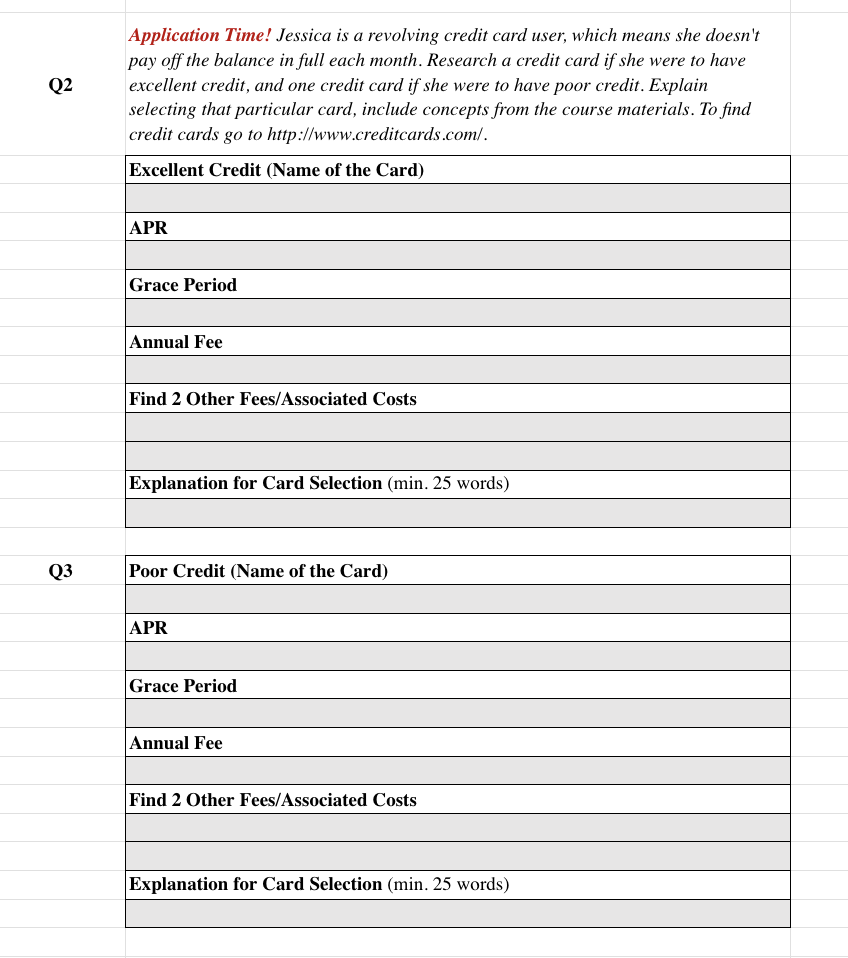

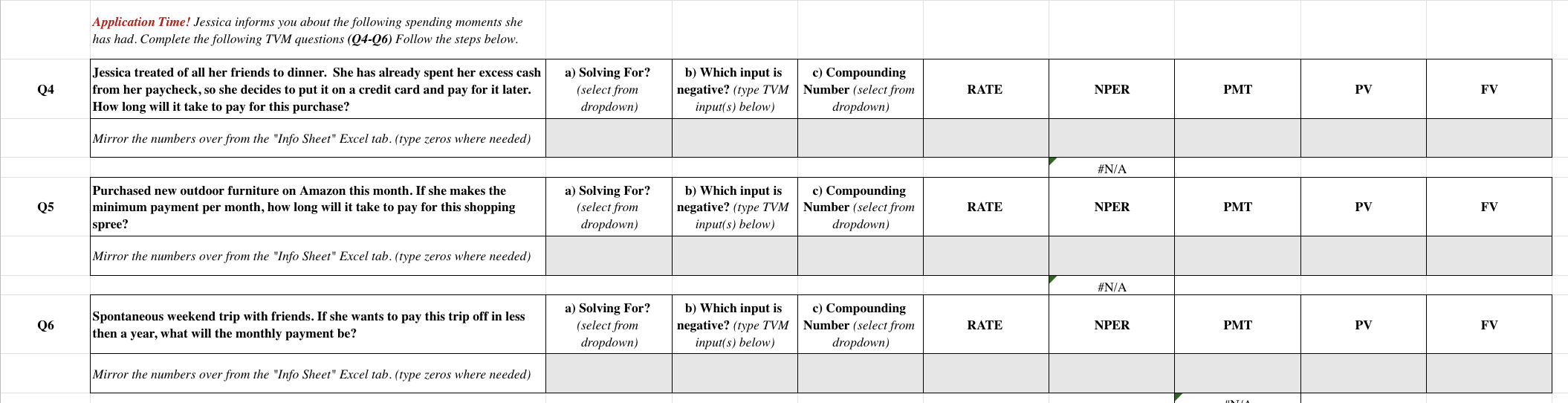

Question: Information Sheet Project Overview: Throughout the semester, you will be working on an application based scenario on how to apply the course learning goals. All

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts