Question: Information used for the 2 questions Need the right answer dont use AI - One-year zero selling for $92.29 - Two-year 11% coupon $1,000 par

Information used for the 2 questions Need the right answer dont use AI

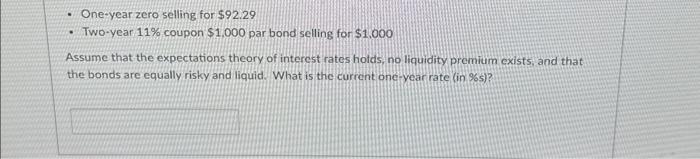

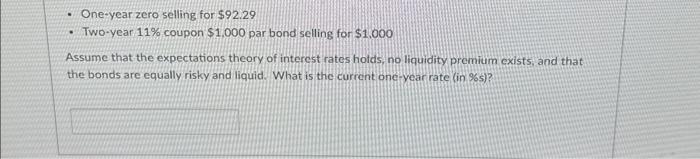

- One-year zero selling for $92.29 - Two-year 11% coupon $1,000 par bond selling for $1,000 Assume that the expectations theory of interest rates hotds, no liquidity premium exists, and that the bonds are equally risky and liquid. What is the current one-year rate (in \%s)? What is the implied one-year rate (in \%s) for the second year

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock