Question: Information Using the following information based on expected sales to forecast the monthly cash collections, accounts receivable balance, monthly cash disbursements, net cash flows, and

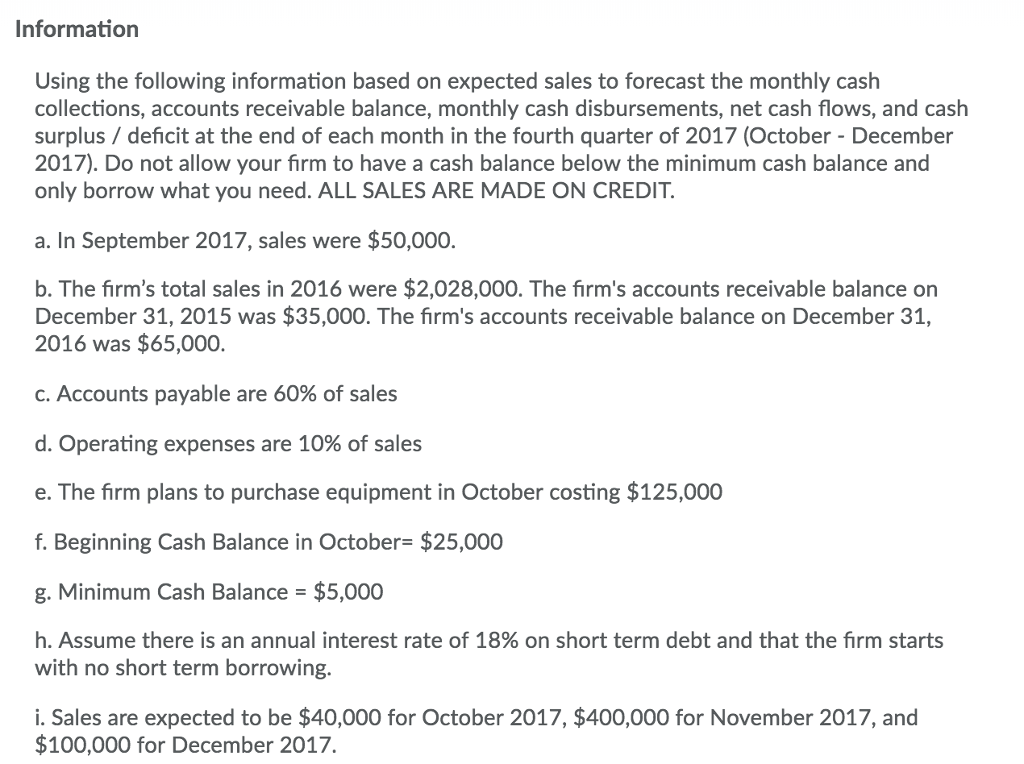

Information Using the following information based on expected sales to forecast the monthly cash collections, accounts receivable balance, monthly cash disbursements, net cash flows, and cash surplus / deficit at the end of each month in the fourth quarter of 2017 (October - December 2017). Do not allow your firm to have a cash balance below the minimum cash balance and only borrow what you need. ALL SALES ARE MADE ON CREDIT a. In September 2017, sales were $50,000 b. The firm's total sales in 2016 were $2,028,000. The firm's accounts receivable balance on December 31, 2015 was $35,000. The firm's accounts receivable balance on December 31, 2016 was $65,000. C. Accounts payable are 60% of sales d. Operating expenses are 10% of sales e. The firm plans to purchase equipment in October costing $125,000 f. Beginning Cash Balance in October= $25,000 g. Minimum Cash Balance = $5,000 Assume there is an annual interest rate of 18% on short term debt and that the firm starts with no short term borrowing. i. Sales are expected to be $40,000 for October 2017, $400,000 for November 2017, and $100,000 for December 2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts