Question: Infosys plc is a computer software development company, which is considering an acquisition of Logiclo plc, a software distribution company. Infosys has been advised by

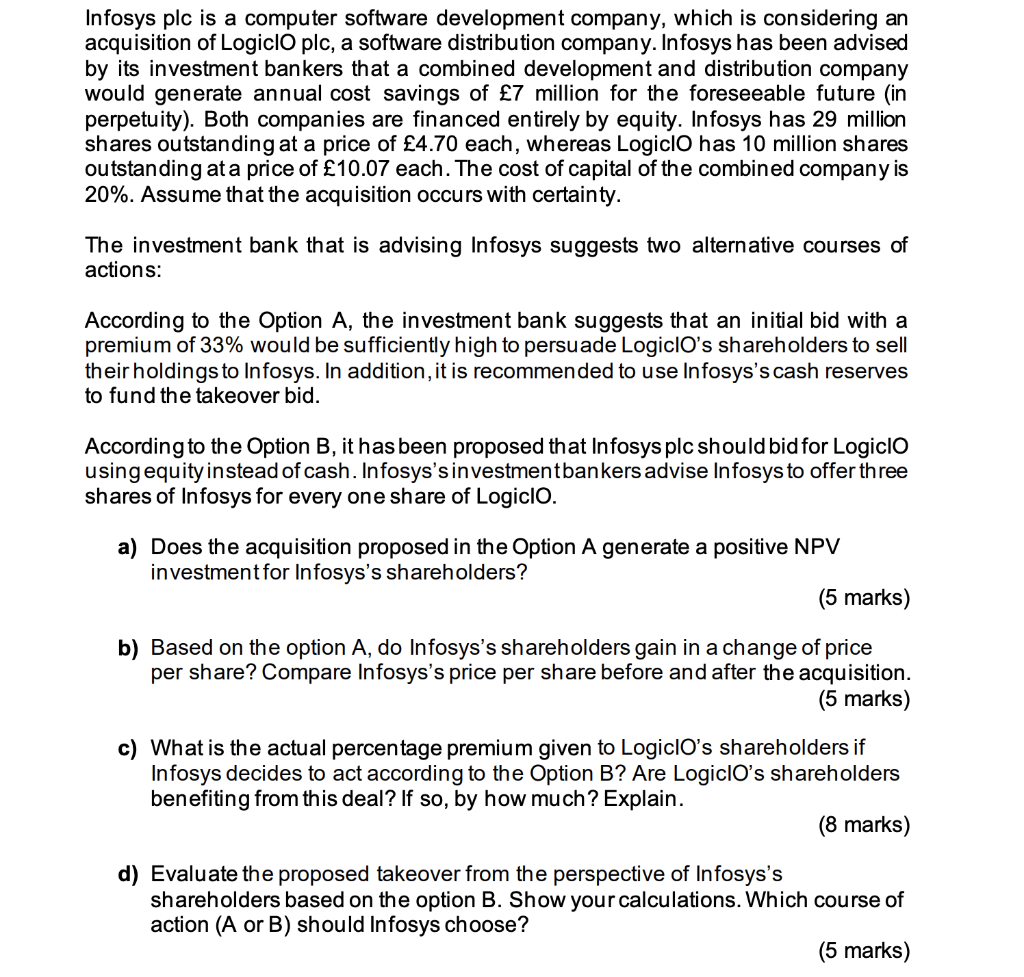

Infosys plc is a computer software development company, which is considering an acquisition of Logiclo plc, a software distribution company. Infosys has been advised by its investment bankers that a combined development and distribution company would generate annual cost savings of 7 million for the foreseeable future (in perpetuity). Both companies are financed entirely by equity. Infosys has 29 million shares outstanding at a price of 4.70 each, whereas Logiclo has 10 million shares outstanding at a price of 10.07 each. The cost of capital of the combined company is 20%. Assume that the acquisition occurs with certainty. The investment bank that is advising Infosys suggests two alternative courses of actions: According to the Option A, the investment bank suggests that an initial bid with a premium of 33% would be sufficiently high to persuade LogiclO's shareholders to sell their holdings to Infosys. In addition, it is recommended to use Infosys's cash reserves to fund the takeover bid. According to the Option B, it has been proposed that Infosys plc should bid for Logiclo using equity instead of cash. Infosys'sinvestmentbankers advise Infosys to offer three shares of Infosys for every one share of Logiclo. a) Does the acquisition proposed in the Option A generate a positive NPV investment for Infosys's shareholders? (5 marks) b) Based on the option A, do Infosys's shareholders gain in a change of price per share? Compare Infosys's price per share before and after the acquisition. (5 marks) c) What is the actual percentage premium given to Logiclo's shareholders if Infosys decides to act according to the Option B? Are LogiclO's shareholders benefiting from this deal? If so, by how much? Explain. (8 marks) d) Evaluate the proposed takeover from the perspective of shareholders based on the option B. Show your calculations. Which course of action (A or B) should Infosys choose

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts