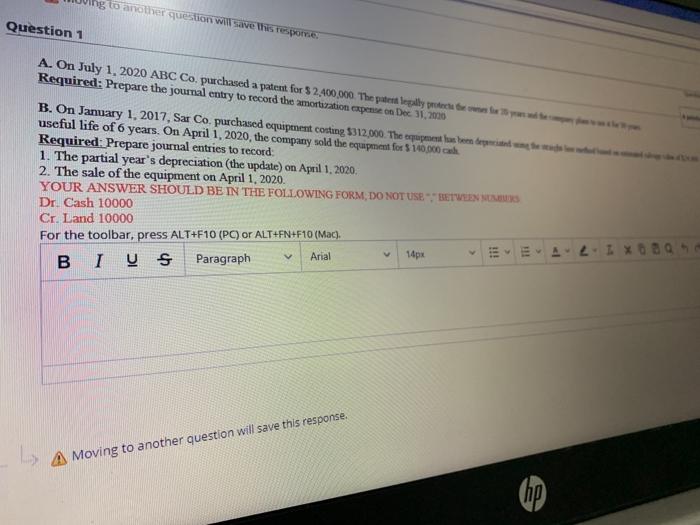

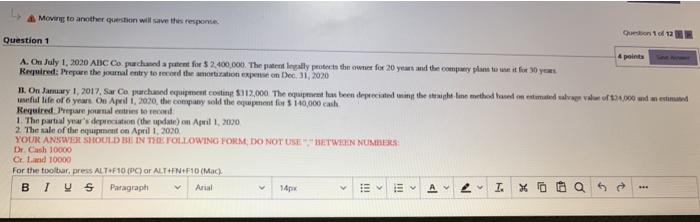

Question: ing to another question will save this tempore Question 1 A. On July 1, 2020 ABC Co. purchased a patent for $2,400,000. The patent legally

ing to another question will save this tempore Question 1 A. On July 1, 2020 ABC Co. purchased a patent for $2,400,000. The patent legally protectie Required: Prepare the journal entry to record the amortization expense on Dec 31, 20 B. On January 1, 2017, Sar Co. purchased equipment conting $312,000. The expense deputete useful life of 6 years. On April 1, 2020, the company sold the equipment for $100.000 Required: Prepare journal entries to record 1. The partial year's depreciation (the update) on April 1, 2020 2. The sale of the equipment on April 1, 2020. YOUR ANSWER SHOULD BE IN THE FOLLOWING FORM, DO NOT USE BETWEEN NOG Dr. Cash 10000 Cr. Land 10000 For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac), Arial 14px BI S Paragraph 089 L. A Moving to another question will save this response. Moving to another question will save the response Qurbono 12 Question 1 points A. On July 1, 2020 ABC Copurchased aptent for $2.400,000. The parentally protects the owner for 20 years and the compwy plans to wait for 30 years Required:Prepare the journal entry to read the amortization on Dec 31, 2020 1. On mwy 1, 2017. Swapurchased equipment costing $112.000 The equipments been depreciated using the right time the hand om erstunated lower value of 134.00 und man estintos meful life of 6 years on April 1, 2020, the company sold the equipment for $140,000 cash Required are owners to red 1. The partial year's depreciation (the update on Amil 12000 2. The sale of the equipment on April 1, 2020 YOUR ANSWE SHOULD BE IN THE FOLLOWING FORM DO NOT USE "BETWEIN NUMBERS Dr. Cash 10000 C Land 10000 For the toolbar, press ALT-E10 () or ALT+N+F 10 (Mac) Paragraph Aral 14px I. 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts