Question: Ingrid is looking to purchase a small hardware but because of her savings and debt she cannot afford to support a struggling business. If it

Ingrid is looking to purchase a small hardware but because of her savings and debt she cannot afford to support a struggling business. If it fails she will be broke. The latest financial statements and for 2020 and 2019 which were prepared for tax purposes by a local accountant. At present, Ingrid earns a 10 percent return on her savings in a Equity Fund.

a. How liquid is the Business? Support your answer with at least five (5) computations you believe are necessary to justify your conclusion. Also indicate any other information that you would want to have in making a final determination on its liquidity.

b. In light of Ingrid's situation, should he be concerned about the solvency of the Business? Support your answer with the necessary computations (using at least three (3).

c. Has the Business demonstrated the ability to be profitable? Support your answer with the necessary computations (using at least five (5)).

d. Should Ingrid put in a bid for the Business? Support your response.

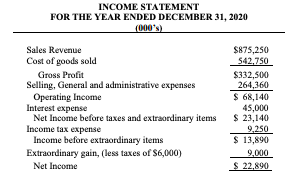

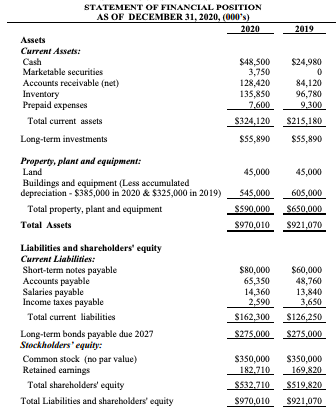

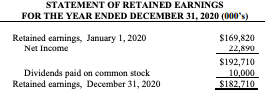

INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2020 (000's) Sales Revenue Cost of goods sold Gross Profit Selling, General and administrative expenses Operating Income Interest expense Net Income before taxes and extraordinary items Income tax expense Income before extraordinary items Extraordinary gain, (less taxes of $6,000) Net Income $875,250 542.750 $332,500 264,360 $ 68,140 45,000 $ 23,140 9.250 $ 13,890 9.000 $ 22.890 STATEMENT OF FINANCIAL POSITION AS OF DECEMBER 31, 2020, (000's) 2020 2019 Assets Current Assets: Cash $48.500 $ $24,980 Marketable securities 3,750 Accounts receivable (net) 128,420 84,120 Inventory 135,850 96,780 Prepaid expenses 7.600 9.300 Total current assets $324,120 $215,180 Long-term investments $55.890 $55,890 45,000 45,000 545,000 605,000 $590.000 $650.000 $970,010 S921,070 Property, plant and equipment: Land Buildings and equipment (Less accumulated depreciation - $385,000 in 2020 & $325,000 in 2019) Total property, plant and equipment Total Assets Liabilities and shareholders' equity Current Liabilines: Short-term notes payable Accounts payable Salaries payable Income taxes payable Total current liabilities Long-term bonds payable due 2027 Stockholders' equity: Common stock (no par value) Retained earings Total shareholders' equity Total Liabilities and shareholders' equity $80,000 $60,000 65,350 48,760 14,360 13,840 2.590 3,650 $162,300 $126,250 $275,000 $275.000 S350,000 $350,000 182.710 169.820 $532.710 $519.820 S970,010 $921,070 STATEMENT OF RETAINED EARNINGS FOR THE YEAR ENDED DECEMBER 31, 2020 (000's) Retained earnings, January 1, 2020 Net Income $169,820 22,890 $192,710 10,000 $182.710 Dividends paid on common stock Retained earnings, December 31, 2020 INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2020 (000's) Sales Revenue Cost of goods sold Gross Profit Selling, General and administrative expenses Operating Income Interest expense Net Income before taxes and extraordinary items Income tax expense Income before extraordinary items Extraordinary gain, (less taxes of $6,000) Net Income $875,250 542.750 $332,500 264,360 $ 68,140 45,000 $ 23,140 9.250 $ 13,890 9.000 $ 22.890 STATEMENT OF FINANCIAL POSITION AS OF DECEMBER 31, 2020, (000's) 2020 2019 Assets Current Assets: Cash $48.500 $ $24,980 Marketable securities 3,750 Accounts receivable (net) 128,420 84,120 Inventory 135,850 96,780 Prepaid expenses 7.600 9.300 Total current assets $324,120 $215,180 Long-term investments $55.890 $55,890 45,000 45,000 545,000 605,000 $590.000 $650.000 $970,010 S921,070 Property, plant and equipment: Land Buildings and equipment (Less accumulated depreciation - $385,000 in 2020 & $325,000 in 2019) Total property, plant and equipment Total Assets Liabilities and shareholders' equity Current Liabilines: Short-term notes payable Accounts payable Salaries payable Income taxes payable Total current liabilities Long-term bonds payable due 2027 Stockholders' equity: Common stock (no par value) Retained earings Total shareholders' equity Total Liabilities and shareholders' equity $80,000 $60,000 65,350 48,760 14,360 13,840 2.590 3,650 $162,300 $126,250 $275,000 $275.000 S350,000 $350,000 182.710 169.820 $532.710 $519.820 S970,010 $921,070 STATEMENT OF RETAINED EARNINGS FOR THE YEAR ENDED DECEMBER 31, 2020 (000's) Retained earnings, January 1, 2020 Net Income $169,820 22,890 $192,710 10,000 $182.710 Dividends paid on common stock Retained earnings, December 31, 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts