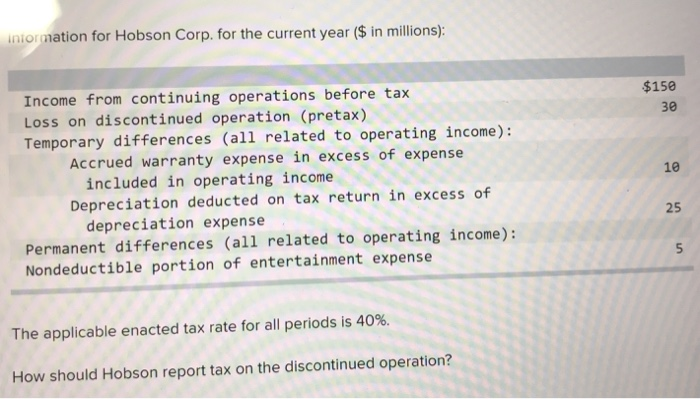

Question: inior mation for Hobson Corp. for the current year ($ in millions): Income from continuing operations before tax Loss on discontinued operation (pretax) Temporary differences

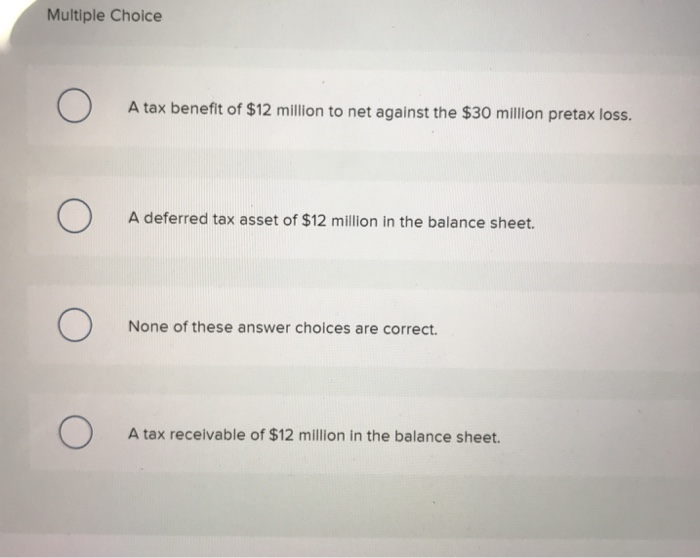

inior mation for Hobson Corp. for the current year ($ in millions): Income from continuing operations before tax Loss on discontinued operation (pretax) Temporary differences (all related to operating income): $150 30 Accrued warranty expense in excess of expense included in operating income 10 Depreciation deducted on tax return in excess of depreciation expense 25 Permanent differences (all related to operating income): Nondeductible portion of entertainment expense The applicable enacted tax rate for all periods is 40%. How should Hobson report tax on the discontinued operation? Multiple Choice A tax benefit of $12 million to net against the $30 million pretax loss. A deferred tax asset of $12 million in the balance sheet. None of these answer choices are correct A tax receivable of $12 million in the balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts