Question: Initial imvestmeat: Basic calculation Cushing Partners is considering the purchase of a new grading machine to replace the existing one. The existing machine was purchased

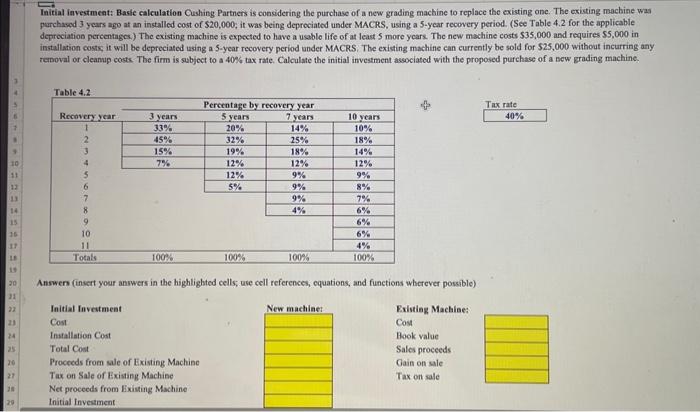

Initial imvestmeat: Basic calculation Cushing Partners is considering the purchase of a new grading machine to replace the existing one. The existing machine was purchased 3 years ago at an installed cost of 520,000 ; it was being deprociated under MACRS, using a 5-year recovery period. (See Table 4.2 for the applicable deprcciation pereentages.) The existing machipe is expected to have a usablo life of at least 5 more years. The new machine costs $35,000 and requires $5,000 in installation costs, it will be depreciated using a 5-year recovery period under MACRS. The existing machine can curreotly be sold for 525,000 without incurring any removal of cleanup costs. The firm is subjoct to a 40% tax rate. Calculate the initial investment associated with the proposed purchase of a new grading machine. Tax rate 40% Answen (insert your answers in the highlighted cells; ase cell references, equations, and functions wherever possible)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts