Question: . . . . Initial Investment at t=0, $1.2M Life of store, 10 years Revenues, $1.3M Variable cost rate, 60% Fixed costs, inc., $25K of

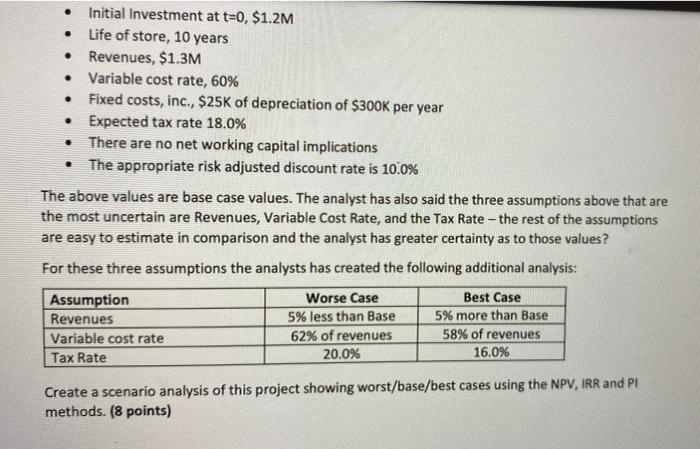

. . . . Initial Investment at t=0, $1.2M Life of store, 10 years Revenues, $1.3M Variable cost rate, 60% Fixed costs, inc., $25K of depreciation of $300K per year Expected tax rate 18.0% There are no net working capital implications The appropriate risk adjusted discount rate is 10.0% The above values are base case values. The analyst has also said the three assumptions above that are the most uncertain are Revenues, Variable Cost Rate, and the Tax Rate - the rest of the assumptions are easy to estimate in comparison and the analyst has greater certainty as to those values ? For these three assumptions the analysts has created the following additional analysis: Assumption Worse Case Best Case Revenues 5% less than Base 5% more than Base Variable cost rate 62% of revenues 58% of revenues Tax Rate 20.0% 16.0% Create a scenario analysis of this project showing worst/base/best cases using the NPV, IRR and PI methods. (8 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts