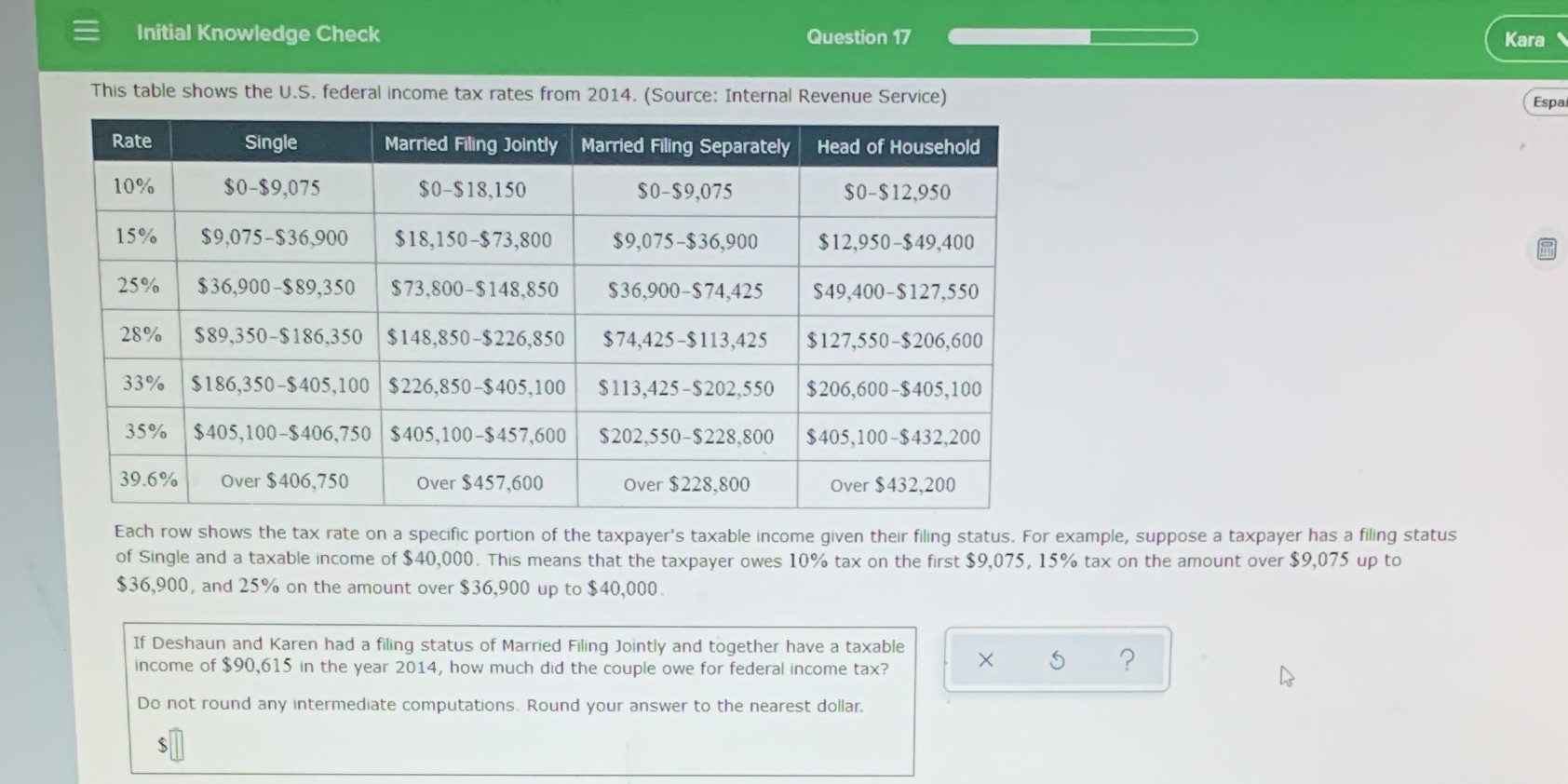

Question: Initial Knowledge Check Question 17 Kara This table shows the U.S. federal income tax rates from 2014. (Source: Internal Revenue Service) Espa Rate Single Married

Initial Knowledge Check Question 17 Kara This table shows the U.S. federal income tax rates from 2014. (Source: Internal Revenue Service) Espa Rate Single Married Filing Jointly Married Filing Separately Head of Household 10% $0-$9,075 $0-$18,150 $0-$9,075 $0-$12,950 15% $9,075-$36,900 $18,150-$73,800 $9,075-$36,900 $12,950-$49,400 25% $36,900-$89,350 $73,800-$148,850 $36,900-$74,425 $49,400-$127,550 28% $89,350-$186,350 $148,850-$226,850 $74,425-$113,425 $127,550-$206,600 33% $186,350-$405,100 $226,850-$405,100 $113,425-$202,550 $206,600-$405,100 35% $405,100-$406,750 $405,100-$457,600 $202,550-$228,800 $405,100-$432,200 39.6% Over $406,750 Over $457,600 Over $228,800 Over $432,200 Each row shows the tax rate on a specific portion of the taxpayer's taxable income given their filing status. For example, suppose a taxpayer has a filing status of Single and a taxable income of $40,000. This means that the taxpayer owes 10% tax on the first $9,075, 15% tax on the amount over $9,075 up to $36,900, and 25% on the amount over $36,900 up to $40,000 If Deshaun and Karen had a filing status of Married Filing Jointly and together have a taxable income of $90,615 in the year 2014, how much did the couple owe for federal income tax? X ? Do not round any intermediate computations. Round your answer to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts