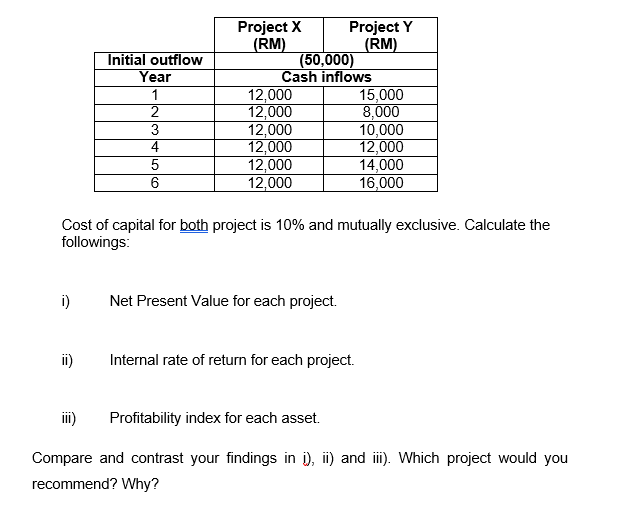

Question: Initial outflow Year 1 Project X Project Y (RM) (RM) (50,000) Cash inflows 12,000 15,000 12,000 8,000 12,000 10,000 12,000 12,000 12,000 14,000 12,000 16,000

Initial outflow Year 1 Project X Project Y (RM) (RM) (50,000) Cash inflows 12,000 15,000 12,000 8,000 12,000 10,000 12,000 12,000 12,000 14,000 12,000 16,000 2 3 4 5 6 Cost of capital for both project is 10% and mutually exclusive. Calculate the followings: i) Net Present Value for each project. Internal rate of return for each project. i) Profitability index for each asset. Compare and contrast your findings in D), ii) and iii). Which project would you recommend? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts