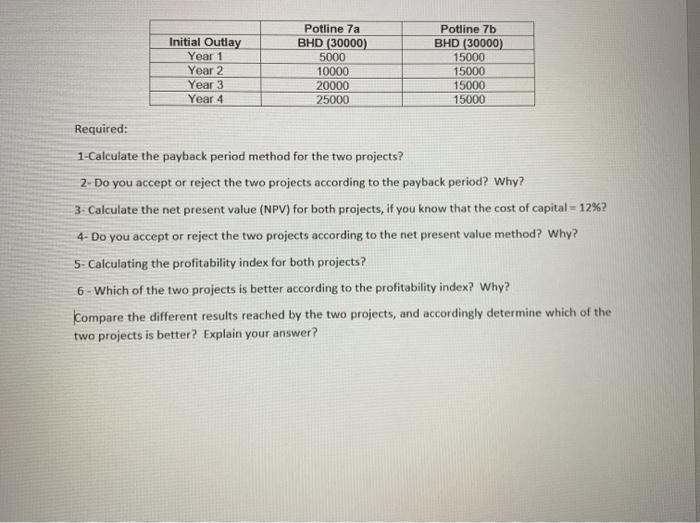

Question: Initial Outlay Year 1 Year 2 Year 3 Year 4 Potline 7a BHD (30000) 5000 10000 20000 25000 Potline 7b BHD (30000) 15000 15000 15000

Initial Outlay Year 1 Year 2 Year 3 Year 4 Potline 7a BHD (30000) 5000 10000 20000 25000 Potline 7b BHD (30000) 15000 15000 15000 15000 Required: 1-Calculate the payback period method for the two projects? 2. Do you accept or reject the two projects according to the payback period? Why? 3- Calculate the net present value (NPV) for both projects, if you know that the cost of capital = 12%? 4- Do you accept or reject the two projects according to the net present value method? Why? 5- Calculating the profitability index for both projects? 6. Which of the two projects is better according to the profitability index? Why? Kompare the different results reached by the two projects, and accordingly determine which of the two projects is better? Explain your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts