Question: Initial project cost: $2,350,000 for an automatic packaging machine. Constant annual Weighted Average Cost of Capital (WACC): 9.40% Annual project cash flows as of December

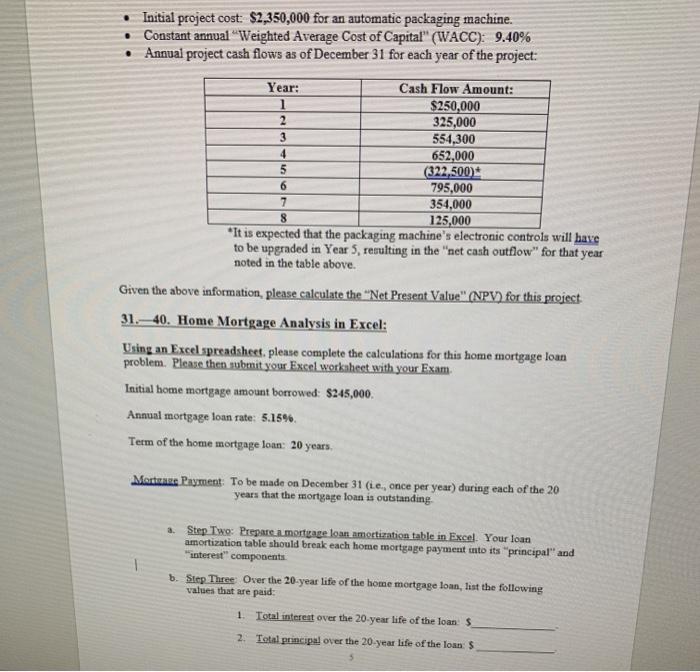

Initial project cost: $2,350,000 for an automatic packaging machine. Constant annual "Weighted Average Cost of Capital" (WACC): 9.40% Annual project cash flows as of December 31 for each year of the project: 6 7 8 Year: Cash Flow Amount: $250,000 2 325,000 3 554,300 4 652,000 5 (322,500 795,000 354,000 125,000 *It is expected that the packaging machine's electronic controls will have to be upgraded in Year 5, resulting in the "net cash outflow" for that year noted in the table above. Given the above information, please calculate the Net Present Value (NPV) for this project 31.40. Home Mortgage Analysis in Excel: Using an Excel spreadsheet, please complete the calculations for this home mortgage loan problem. Please then submit your Excel worksheet with your Exam. Initial home mortgage amount borrowed: $245,000 Annual mortgage loan rate: 5.15% Term of the home mortgage loan: 20 years, Mortenze Payment: To be made on December 31 (te, once per year) during each of the 20 years that the mortgage loan is outstanding 3 Step Two: Prepare a mortgage loan amortization table in Excel. Your loan amortization table should break each home mortgage payment into its "principal" and "interest" components b. Step Three Over the 20-year life of the home mortgage loan, list the following values that are paid Total interest over the 20-year life of the loans 2. Total principal over the 20-year life of the loan $ 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts