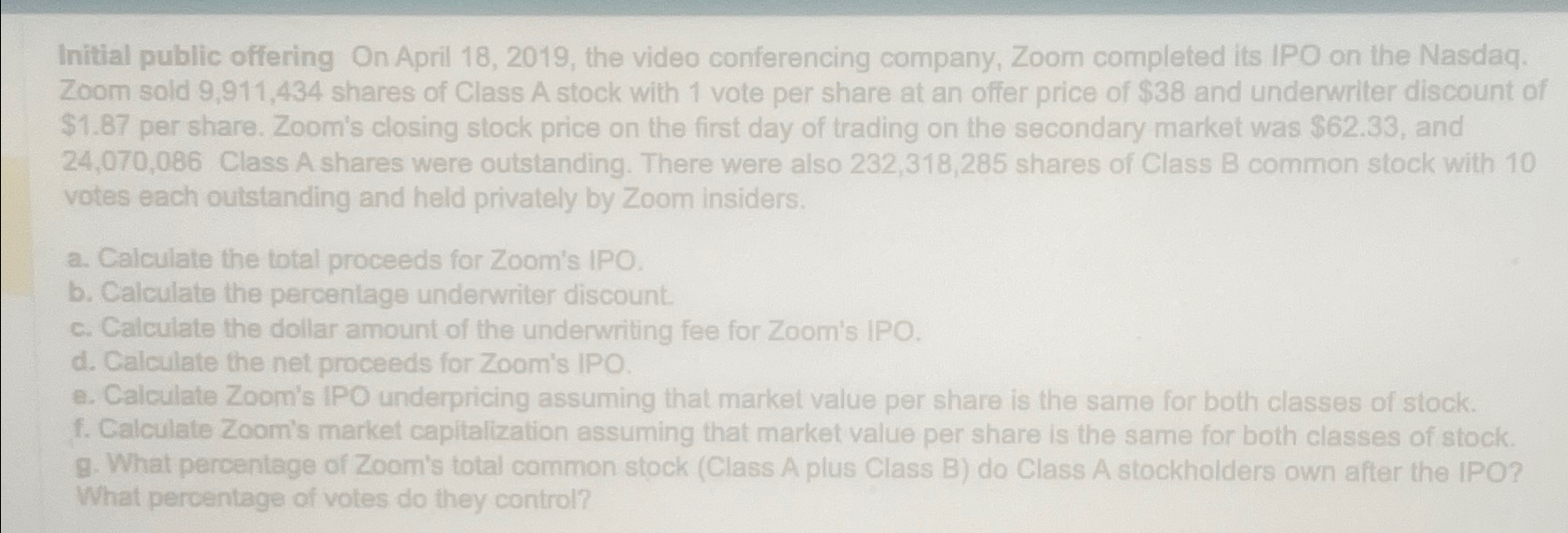

Question: Initial public offering On April 1 8 , 2 0 1 9 , the video conferencing company, Zoom completed its IPO on the Nasdaq. Zoom

Initial public offering On April the video conferencing company, Zoom completed its IPO on the Nasdaq. Zoom sold shares of Class A stock with vote per share at an offer price of $ and underwriter discount of $ per share. Zoom's closing slock price on the first day of trading on the secondary market was $ and Class A shares were outslanding. There were also shares of Class B common stock with votes each outstanding and held privately by Zoom insiders.

a Calculate the intal nroceede for Zonm's IPO.

b Calculate the percenlage underwriter discount.

c Catculate the dollar amount of the underwriting fee for Zoom's IPO.

d Calculate the net proceeds for Zoom's IPO.

Calcinte Zoom's IDO underpricing assuming that market value per share is the same for both classes of slock.

f Calculate Zoom's market capitalization assuming that market value per share is the same for both classes of stock. Whet percentage of Zoom's total common stock Class A plus Class B do Class A stockholders own after the IPO? What percentage of votes do they control?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock