Question: Initial Purchase % Increase (Decrease) Investment Name Symbol Date Price Paid AveragePricePaid Quantity LastPrice ProfitLoss MarketValue 1.20.23 from Purchase price Amazon AMZN 1.20.23 9,946.56 $

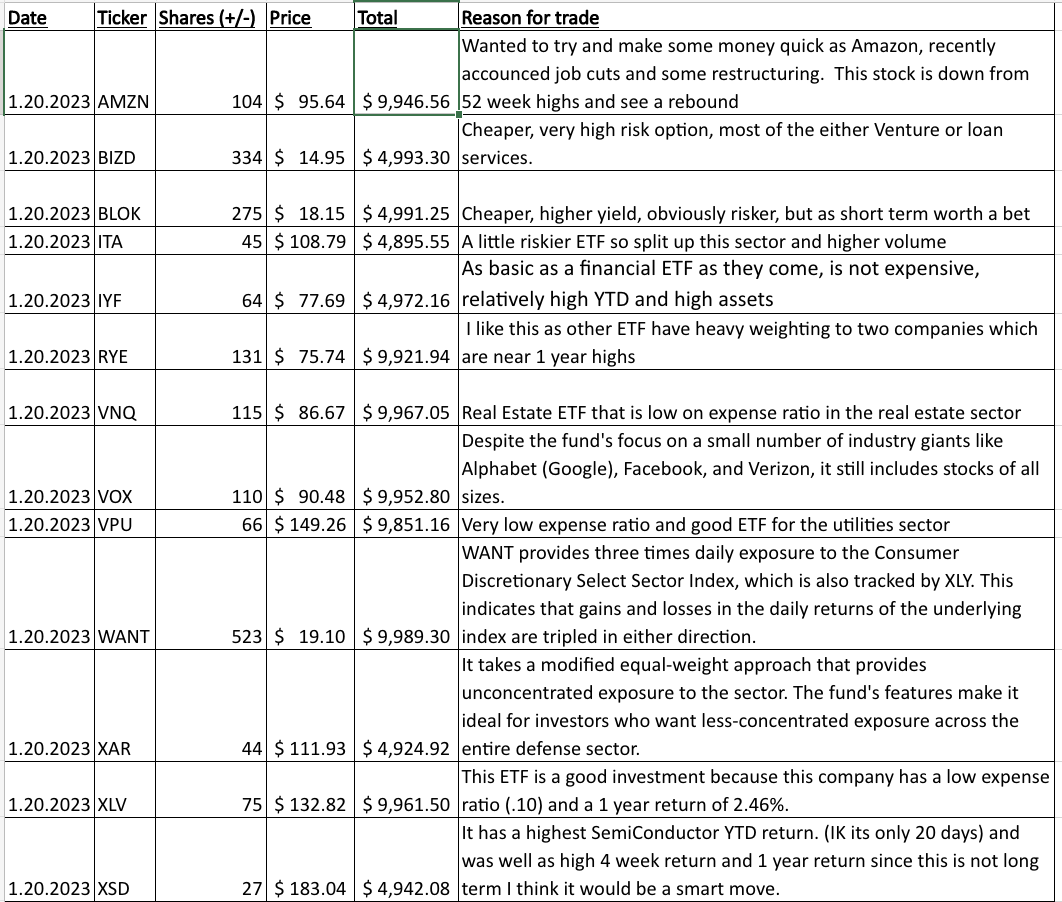

Initial Purchase % Increase (Decrease) Investment Name Symbol Date Price Paid AveragePricePaid Quantity LastPrice ProfitLoss MarketValue 1.20.23 from Purchase price Amazon AMZN 1.20.23 9,946.56 $ 95.64 104 $ 97.25 $ 167.44 $ 10,114.00 1.68% VanEck BDC Income ETF BIZD 1.20.23 4,993.30 14.95 334 $ 15.07 40.08 $ 5,033.38 0.80% Amplify Transformational Data Sharing ETF BLOK 1.20.23 4,991.25 18.15 275 $ 18.44 $ 79.75 $ 5,071.00 1.60% iShares U.S. Aerospace & Defense ETF ITA 1.20.23 4,895.55 108.79 45 $ 109.35 25.20 $ 4,920.75 0.51% iShares U.S. Financials ETF IYF 1.20.23 4,972.16 77.69 64 $ 78.36 $ 42.88 $ 5,015.04 0.86% Invesco S&P 500 Equal Weight Energy ETF RYE 1.20.23 9,921.94 75.74 131 $ 75.65 $ (11.79) $ 9,910.15 -0.12% Vanguard Real Estate Index Fund ETF VNQ 1.20.23 9,967.05 86.67 115 $ 87.69 $ 117.30 $ 10,084.35 1.18% Vanguard Communication Services ETF VOX 1.20.23 9,952.80 90.48 110 $ 91.26 $ 85.80 $ 10,038.60 0.86% Vanguard Utilities ETF VPU 1.20.23 9,851.16 149.26 66 $ 150.87 $ 106.26 $ 9,957.42 1.08% Direxion Daily Consumer Discretionary Bull 3X Shares WANT 1.20.23 9,989.30 19.10 523 $ 19.69 $ 308.57 $ 10,297.87 3.09% SPDR S&P Aerospace & Defense ETF XAR 1.20.23 4,924.92 111.93 44 $ 112.55 $ 27.28 $ 4,952.20 0.55% Health Care Select Sector SPDR XLV 1.20.23 9,961.50 132.82 75 $ 133.91 $ 81.75 $ 10,043.25 0.82% SPDR Semiconductors ETF XSD 1.20.23 4,942.08 183.04 27 $ 185.98 79.38 $ 5,021.46 1.61% Totals 99,309.57 $ 1,176.07 $ 1,149.90 $ 100,459.47 1.16% CashDate Ticker Shares (+l-l Price Reason for trade Wanted to try and make some money quick as Amazon, recently accounced job cuts and some restructuring. This stock is down from S 95.64 5 9,946.56 .52 week highs and see a rebound Cheaper, very high risk option, most of the either Venture or loan 1.20.2023 BIZD 334 S 14.95 5 4,993.30 services. 1.20.2023 BLOK 275 S 18.15 5 4,991.25 Cheaper, higher yield, obviously risker, but as short term worth a bet 1.20.2023 ITA 45 S 108.79 5 4,895.55 A little riskier ETF so split up this sector and higher volume As basic as a nancial ETF as they come, is not expensive, 1.20.2023 IYF 64 S 77.69 $4,972.16 relatively high YTD and high assets I like this as other ETF have heavy weighting to two companies which 1.20.2023 RYE 131 S 75.74 5 9,921.94 are near 1 year highs 1.20.2023 VNQ 115 S 86.67 5 9,967.05 Real Estate ETF that is low on expense ratio in the real estate sector Despite the fund's focus on a small number of industry giants like Alphabet (Googlel, Facebook, and Verizon, it still includes stocks of all 1.20.2023 VOX 110 S 90.48 5 9,952.80 sizes. 1.20.2023 VPU 66 S 149.26 5 9,851.16 Very lowr expense ratio and good ETF forthe utilities sector WANT provides three times daily exposure to the Consumer Discretionary Select Sector Index, which is also tracked by XLY. This indicates that gains and losses in the daily returns of the underlying 1.20.2023 WANT 523 S 19.10 5 9,989.30 index are tripled in either direction. It takes a modified equal-weight approach that provides unconcentrated exposure to the sector. The fund's features make it ideal for investors who want less-concentrated exposure across the 1.20.2023 XAR 44 S 111.93 5 4,924.92 entire defense sector. This ETF is a good investment because this company has a lovvr expense 1.20.2023 KW 75 S 132.82 5 9,961.50 ratio (.10) and a 1 year return of 2.46%. It has a highest SemiConductor YTD return. (IK its only 20 days) and was well as high 4 week return and 1 year return since this is not long 1.20.2023 XSD 27 S 183.04 5 4,942.08 term I think it would be a smart move

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts