Question: Initial Thread: Read Case 19: Johnson & Johnson, found in the back of your Strategic Management textbook (page C128). Using your textbook content, industry experience,

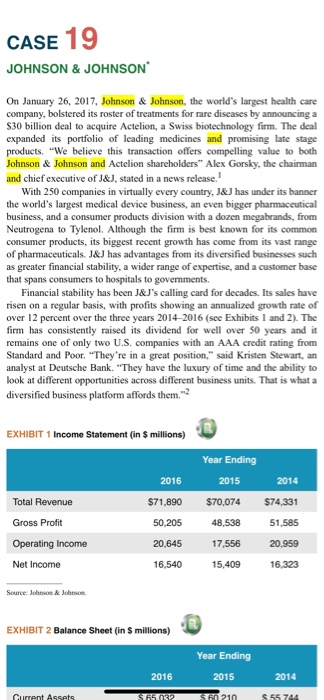

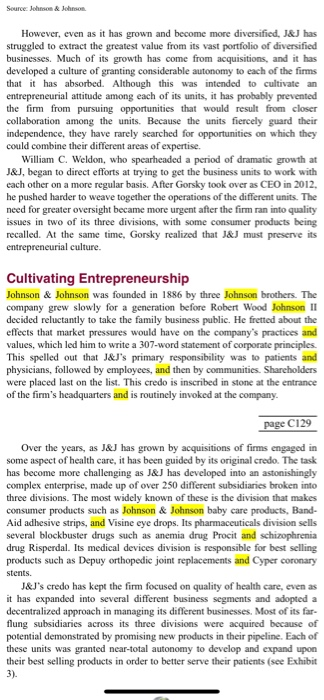

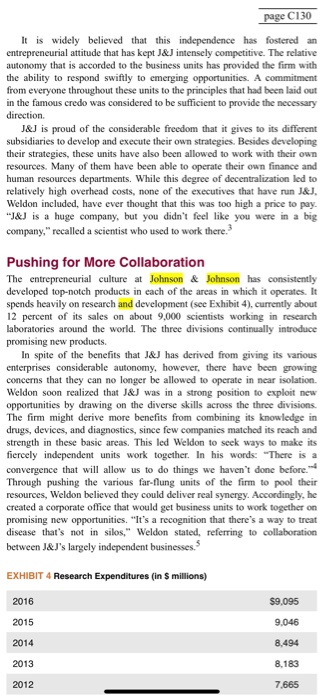

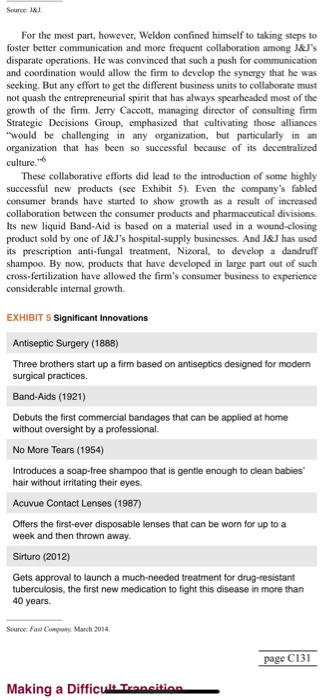

Initial Thread: Read Case 19: "Johnson & Johnson", found in the back of your Strategic Management textbook (page C128). Using your textbook content, industry experience, and the case assigned, answer the following questions in an initial thread of at least 300 words. No minimum references are required, but any references should be cited appropriately in proper APA format. 1. What are some of the important mechanisms Johnson & Johnson uses for promoting ethics in their firm? 2. Based on the videos and the case, would you define Johnson & Johnson as integrity organization or a compliance organization organization, or both? Explain your answer. 3. Identify two CEOs whose leadership you admire. What is it about their skills, attributes, and effective use of power that causes you to admire them? CASE 19 JOHNSON & JOHNSON On January 26, 2017, Johnson & Johnson, the world's largest health care company, bolstered its roster of treatments for rare diseases by announcing a $30 billion deal to acquire Actelion, a Swiss biotechnology form. The deal expanded its portfolio of leading medicines and promising late stage products. "We believe this transaction offers compelling value to both Johnson & Johnson and Actelion shareholders Alex Gorsky, the chairman and chief executive of J&J, stated in a news release.! With 250 companies in virtually every country, J&J has under its banner the world's largest medical device business, an even bigger pharmaceutical business, and a consumer products division with a dozen megabrands, from Neutrogena to Tylenol. Although the firm is best known for its common consumer products, its biggest recent growth has come from its vast range of pharmaceuticals. J&J has advantages from its diversified businesses such as greater financial stability, a wider range of expertise, and a customer base that spans consumers to hospitals to governments. Financial stability has been J&J's calling card for decades. Its sales have risen on a regular basis, with profits showing an annualized growth rate of over 12 percent over the three years 20142016 (see Exhibits 1 and 2). The firm has consistently raised its dividend for well over 50 years and it remains one of only two U.S. companies with an AAA credit rating from Standard and Poor. "They're in a great position," said Kristen Stewart, an analyst at Deutsche Bank. "They have the luxury of time and the ability to look at different opportunities across different business units. That is what a diversified business platform affords them."2 EXHIBIT 1 Income Statement (in 5 millions) 2014 2016 $71,890 Year Ending 2015 $70,074 48,538 $74,331 50.205 51,585 Total Revenue Gross Profit Operating Income Net Income 17,556 20.959 20,645 16,540 15.409 16,323 Source: Johnson & Johnson EXHIBIT 2 Balance Sheet (in 5 millions) Year Ending 2016 2015 2014 Current Assets $65032 Sin 210 S55 744 Source: Johnson & Johnson However, even as it has grown and become more diversified, J&J has struggled to extract the greatest value from its vast portfolio of diversified businesses. Much of its growth has come from acquisitions, and it has developed a culture of granting considerable autonomy to each of the firms that it has absorbed. Although this was intended to cultivate an entrepreneurial attitude among each of its units, it has probably prevented the fimm from pursuing opportunities that would result from closer collaboration among the units. Because the units fiercely guard their independence, they have rarely searched for opportunities on which they could combine their different areas of expertise. William C. Weldon, who spearheaded a period of dramatic growth at J&J, began to direct efforts at trying to get the business units to work with each other on a more regular basis. After Gorsky took over as CEO in 2012, he pushed harder to weave together the operations of the different units. The need for greater oversight became more urgent after the firm ran into quality issues in two of its three divisions, with some consumer products being recalled. At the same time, Gorsky realized that J&J must preserve its entrepreneurial culture. Cultivating Entrepreneurship Johnson & Johnson was founded in 1886 by three Johnson brothers. The company grew slowly for a generation before Robert Wood Johnson 11 decided reluctantly to take the family business public. He fretted about the effects that market pressures would have on the company's practices and values, which led him to write a 307-word statement of corporate principles. This spelled out that J&J's primary responsibility was to patients and physicians, followed by employees, and then by communities. Shareholders were placed last on the list. This credo is inscribed in stone at the entrance of the firm's headquarters and is routinely invoked at the company. page C129 Over the years, as J&J has grown by acquisitions of firms engaged in some aspect of health care, it has been guided by its original credo. The task has become more challenging as J&J has developed into an astonishingly complex enterprise, made up of over 250 different subsidiaries broken into three divisions. The most widely known of these is the division that makes consumer products such as Johnson & Johnson baby care products, Band- Aid adhesive strips, and Visine eye drops. Its pharmaceuticals division sells several blockbuster drugs such as anemia drug Procit and schizophrenia drug Risperdal. Its medical devices division is responsible for best selling products such as Depuy orthopedic joint replacements and Cyper coronary stents. J&J's credo has kept the firm focused on quality of health care, even as it has expanded into several different business segments and adopted a decentralized approach in managing its different businesses. Most of its far- flung subsidiaries across its three divisions were acquired because of potential demonstrated by promising new products in their pipeline. Each of these units was granted near-total autonomy to develop and expand upon their best selling products in order to better serve their patients (see Exhibit 3). drug Risperdal. Its medical devices division is responsible for best selling products such as Depuy orthopedic joint replacements and Cyper coronary stents. J&J's credo has kept the firm focused on quality of health care, even as it has expanded into several different business segments and adopted a decentralized approach in managing its different businesses. Most of its far- flung subsidiaries across its three divisions were acquired because of potential demonstrated by promising new products in their pipeline. Each of these units was granted near-total autonomy to develop and expand upon their best selling products in order to better serve their patients (see Exhibit 3). EXHIBIT 3 Segment Information Source: page C130 It is widely believed that this independence has fostered an entrepreneurial attitude that has kept J&J intensely competitive. The relative autonomy that is accorded to the business units has provided the firm with the ability to respond swiftly to emerging opportunities. A commitment from everyone throughout these units to the principles that had been laid out in the famous credo was considered to be sufficient to provide the necessary direction. J&J is proud of the considerable freedom that it gives to its different subsidiaries to develop and execute their own strategies. Besides developing their strategies, these units have also been allowed to work with their own resources. Many of them have been able to operate their own finance and human resources departments. While this degree of decentralization led to relatively high overhead costs, none of the executives that have run J&J, Weldon included, have ever thought that this was too high a price to pay "J&J is a huge company, but you didn't feel like you were in a big page C130 It is widely believed that this independence has fostered an entrepreneurial attitude that has kept J&J intensely competitive. The relative autonomy that is accorded to the business units has provided the firm with the ability to respond swiftly to emerging opportunities. A commitment from everyone throughout these units to the principles that had been laid out in the famous credo was considered to be sufficient to provide the necessary direction. J&J is proud of the considerable freedom that it gives to its different subsidiaries to develop and execute their own strategies. Besides developing their strategies, these units have also been allowed to work with their own resources. Many of them have been able to operate their own finance and human resources departments. While this degree of decentralization led to relatively high overhead costs, none of the executives that have run J&J, Weldon included, have ever thought that this was too high a price to pay "J&J is a huge company, but you didn't feel like you were in a big company," recalled a scientist who used to work there. Pushing for More Collaboration The entrepreneurial culture at Johnson & Johnson has consistently developed top-notch products in each of the areas in which it operates. It spends heavily on research and development (see Exhibit 4), currently about 12 percent of its sales on about 9,000 scientists working in research laboratories around the world. The three divisions continually introduce promising new products. In spite of the benefits that J&J has derived from giving its various enterprises considerable autonomy, however, there have been growing concerns that they can no longer be allowed to operate in near isolation. Weldon soon realized that J&J was in a strong position to exploit new opportunities by drawing on the diverse skills across the three divisions. The firm might derive more benefits from combining its knowledge in drugs, devices, and diagnostics, since few companies matched its reach and strength in these basic areas. This led Weldon to seek ways to make its fiercely independent units work together. In his words: "There is a convergence that will allow us to do things we haven't done before. Through pushing the various far-flung units of the firm to pool their resources, Weldon believed they could deliver real synergy. Accordingly, he created a corporate office that would get business units to work together on promising new opportunities. "It's a recognition that there's a way to treat disease that's not in silos," Weldon stated, referring to collaboration between J&J's largely independent businesses. EXHIBIT 4 Research Expenditures (in 5 millions) 2016 $9,095 2015 9.046 2014 8.494 2013 8.183 2012 7,665 Source: Ja For the most part, however, Weldon confined himself to taking steps to foster better communication and more frequent collaboration among J&J's disparate operations. He was convinced that such a push for communication and coordination would allow the firm to develop the synergy that he was seeking. But any effort to get the different business units to collaborate must not quash the entrepreneurial spirit that has always spearheaded most of the growth of the firm. Jerry Caccott, managing director of consulting firm Strategic Decisions Group, emphasized that cultivating those alliances "would be challenging in any organization, but particularly in an organization that has been so successful because of its decentralized culture. 6 These collaborative efforts did lead to the introduction of some highly successful new products (sce Exhibit 5). Even the company's fabled consumer brands have started to show growth as a result of increased collaboration between the consumer products and pharmaceutical divisions. Its new liquid Band-Aid is based on a material used in a wound-closing product sold by one of J&J's hospital-supply businesses. And J&J has used its prescription anti-fungal treatment, Nizoral, to develop a dandruff shampoo. By now, products that have developed in large part out of such cross-fertilization have allowed the firm's consumer business to experience considerable internal growth EXHIBIT 5 Significant Innovations Antiseptic Surgery (1888) Three brothers start up a firm based on antiseptics designed for modern surgical practices. Band-Aids (1921) Debuts the first commercial bandages that can be applied at home without oversight by a professional. No More Tears (1954) Introduces a soap-free shampoo that is gentle enough to clean babies' hair without irritating their eyes. Acuvue Contact Lenses (1987) Offers the first-ever disposable lenses that can be worn for up to a week and then thrown away. Sirturo (2012) Gets approval to launch a much-needed treatment for drug-resistant tuberculosis, the first new medication to fight this disease in more than 40 years. Source: Fast Con March 2014 page C131 Making a Difficult Transition page C131 Making a Difficult Transition As Johnson & Johnson sought more interaction among its business units, it ran into problems with quality control with two of its divisions. Its medical devices division ran into problems with its newest artificial hip. It recalled the device, amidst rumors that company executives may have concealed information out of concern for firm profits. These problems were compounded by serious issues that arose with the consumer products division, which led to the biggest children's drug recall of all time. Quality problems had arisen before, but they were usually fixed in a routine manner inside the units. Analysts suggest that problems at subsidiary McNeil may have been exacerbated in 2006 when J&J decided to combine it with the newly acquired consumer health care unit from Pfizer The firm believed that it could achieve S500 to $600 million in annual savings by merging the two units together. After the merger, McNeil was also transferred from the heavily regulated pharmaceutical division to the marketing driven consumer products division, which was not subjected to the same level of quality control. Much of the blame for such stumbles fell on Weldon, who stepped down as CEO in April 2012 after presiding over one of the most tumultuous decades in the firm's history. Critics said the company's once vaunted attention to quality had slipped under his watch. Weldon, who had started out as sales representative at the firm, was believed to have been obsessed with meeting tough performance targets, even by cutting costs that might affect quality. Erik Gordon, who teaches business at the University of Michigan, elaborated on this cost-cutting philosophy: "We will make our numbers for the analysts, period. 7 In April 2012, J&J appointed Gorsky to lead the way out of the difficulties. Gorsky had been with the firm since 1988, holding positions in its pharmaceutical businesses across Europe, Africa, and the Middle East before leaving for a few years to work at Novartis. Shortly after his return to J&J in 2008, he took over its medical devices unit that was being investigated about its faulty hip replacements. Because of his extensive background with the firm, Gorsky was regarded as the ideal person to take the job. When Gorksy took over as CEO, it was expected that he would sort out the quality problems that had recently surfaced at the firm. But because he was a consummate insider, having run the two biggest of its three divisions, it was assumed he would do it without major changes. However, shortly after he settled into his job as CEO, Gorsky began to challenge the firm's once-sacrosanct principle of giving complete autonomy to its 250-odd units. In his view, decentralization that fostered creativity should not allow these different units to be completely disconnected. Gorksy wanted to push further than Weldon had to get the various units of the firm to work together to find synergies, to cross-fertilize ideas, and to reap cost savings that could be reinvested in the business. Pushing for Tighter Integration In order to tie the units more closely together, Gorsky lured Sandi Peterson from Bayer and gave her the position of group worldwide chairman. The newly created position gave Peterson sweeping responsibly to oversee technology across the that the very nature of Pushing for Tighter Integration In order to tie the units more closely together, Gorsky lured Sandi Peterson from Bayer and gave her the position of group worldwide chairman. The newly created position gave Peterson sweeping responsibly to oversee technology across the entire firm. Gorsky believed that the very nature of the job required him to hire an outsider who had not had much exposure to J&J's existing culture. Because decentralization had allowed the business units to make all of their own decisions, there had been no consistency in their different practices. Gorsky wanted to bring order to this unwieldy machine. "Sometimes a customer doesn't want to deal with 250 J&J's," he said. Peterson began feverishly working to align everything from HR policy to procurement processes from the 250 business units, which had been making their own decisions independently. She covered everything from the timing of financial forecasts to employee car policies, consolidating all of the firm's data, such as about all of its 120,000 employees, to a single HR database. Peterson claimed that her efforts would allow the company to save about $1 billion. She processed as much data per day as eBay, warehousing about 500 terabytes of data. According to Peterson, this represented "25 times as much data as resides in the IRS data warehouse. An even more significant effort had already been initiated by Paul Stoffels three years earlier when he was appointed J&J's global head of pharmaceuticals. All of the units that operated within the pharmaceutical division had also operated with complete autonomy. J&J's seven different drug R&D organizations had operated in completely siloed fashion. In some cases, multiple companies pursued the development of the same drugs and cach had its own system for handling clinical or regulatory development. Stoffels began to merge all of the units under his purview into one group and organized it to target 11 diseases. In the process, 12 of the division's 25 facilities were shuttered and nearly 200 projects were slashed. This new integrated unit developed a streamlined development process, a highly coordinated system that Stoffels calls Accererando. Under this model, global teams-statisticians in China, data managers in India, regulatory folks in Europe work 24/7 to speed drugs to market. The assembly-line approach has cut months, and in some cases years, off development time. Seventeen drug approvals in 10 years put J&J in a league of its own. "No other company has come close to that," said Bernard Munos, a pharmaceutical innovation consultant. 10 a page C132 Stoffels has accomplished more than just reduce the time needed to bring drugs to market. He has begun to look for ideas from all sources, whether it is from any of J&J's own business units or from entrepreneurs or scientists outside the firm. He has set up four innovation centers in bio-tech clusters in Cambridge, MA: Menlo Park, CA; London; and Shanghai, where scientific entrepreneurs can interact with J&J's own drug and technology scouts. His flexible approach with these outsiders lets J&J work with them more casually and helps build stronger relationships. Since 2013, the firm has reviewed more than 3,400 opportunities through these centers, leading to 200 partnerships. to 200 partnerships Is There a Cure Ahead? Gorsky's biggest challenge came from a demand that Johnson & Johnson might be better off if it was broken off into smaller companies, perhaps along the lines of its different divisions. There were growing concerns about the ability of the conglomerate to provide sufficient supervision to all of its subsidiaries that were spread all over the globe. Gorsky dismissed the proposal, claiming that J&J drew substantial benefits from the diversified nature of its businesses. Given the enormous shifts in the health care industry and the large number of government and institutional customers and partners involved, he believed that the firm's huge scale could be a rare asset for negotiating deals. Gorsky did concede, however, that the firm will have to be more selective, careful, and decisive about the products that it pursues. Since he took over, J&J has begun to divest some of its lower growth businesses and reduce annual costs by $1 billion. The firm had just completed the sale of Cordis, which makes medical devices such as stents and catheters. J&J, which helped to develop the roughly $5 billion global market for cardiac stents, announced that it was shifting its focus to other medical technologies that showed more potential for growth. As he plotted a future course for Johnson & Johnson, Gorsky realized that although much of the firm's success had always resulted from the relative autonomy granted to each of its businesses, he must continue to emphasize ongoing collaboration among them to pursue emerging opportunities. As recent problems had demonstrated, it was also critical for J&J to maintain and develop sufficient quality control across its vast business. The health care giant must manage its diversified portfolio of companies to keep growing without creating issues that could pose any further threats to its reputation. This is a company that was purer than Caesar's wife, this was the gold standard, and all of a sudden it just seems like things are breaking down," said William Trombetta, a professor of pharmaceutical marketing at Saint Joseph's University in Philadephia." ENDNOTES 1. Chad Bray Johnson & Johnson Says It Will Acquire Actelon. New York Times, January 27, 2017.p. BS. 2. Erika Fry. Can Big Still Be Beautiful? Fortune, August 1, 2016.p.84. 3. Katie Thomas & Reed Abelson. I&J Chief to Resign One Role New York Times, February 22. 2012,p.BR 4. Katie Thomas, I&U's Next Chief Is Steeped in Sales Culture. New York Times, February 24, 2012.p.B.I. 5. Peter Loftus & Shirley S. Wang. J&J Sales Show Health Care Feels the Pinch Wall Street Journal, January 21, 2009, p.Bl. 6. Avery Johnson. J&T Consumer Play Paces Growth. Wall Street Journal, January 24, 2007, p. A3 7. New York Times, February 24, 2012. p. B.6. 8. Forte, August 1, 2016, p. 86 9. Ibid. p. 87. 10. Ibid. p. 88 11. Natasha Singer. Hip Implants Are Recalled by J&J Unit. New York Times, August 27,2010, . BI Initial Thread: Read Case 19: "Johnson & Johnson", found in the back of your Strategic Management textbook (page C128). Using your textbook content, industry experience, and the case assigned, answer the following questions in an initial thread of at least 300 words. No minimum references are required, but any references should be cited appropriately in proper APA format. 1. What are some of the important mechanisms Johnson & Johnson uses for promoting ethics in their firm? 2. Based on the videos and the case, would you define Johnson & Johnson as integrity organization or a compliance organization organization, or both? Explain your answer. 3. Identify two CEOs whose leadership you admire. What is it about their skills, attributes, and effective use of power that causes you to admire them