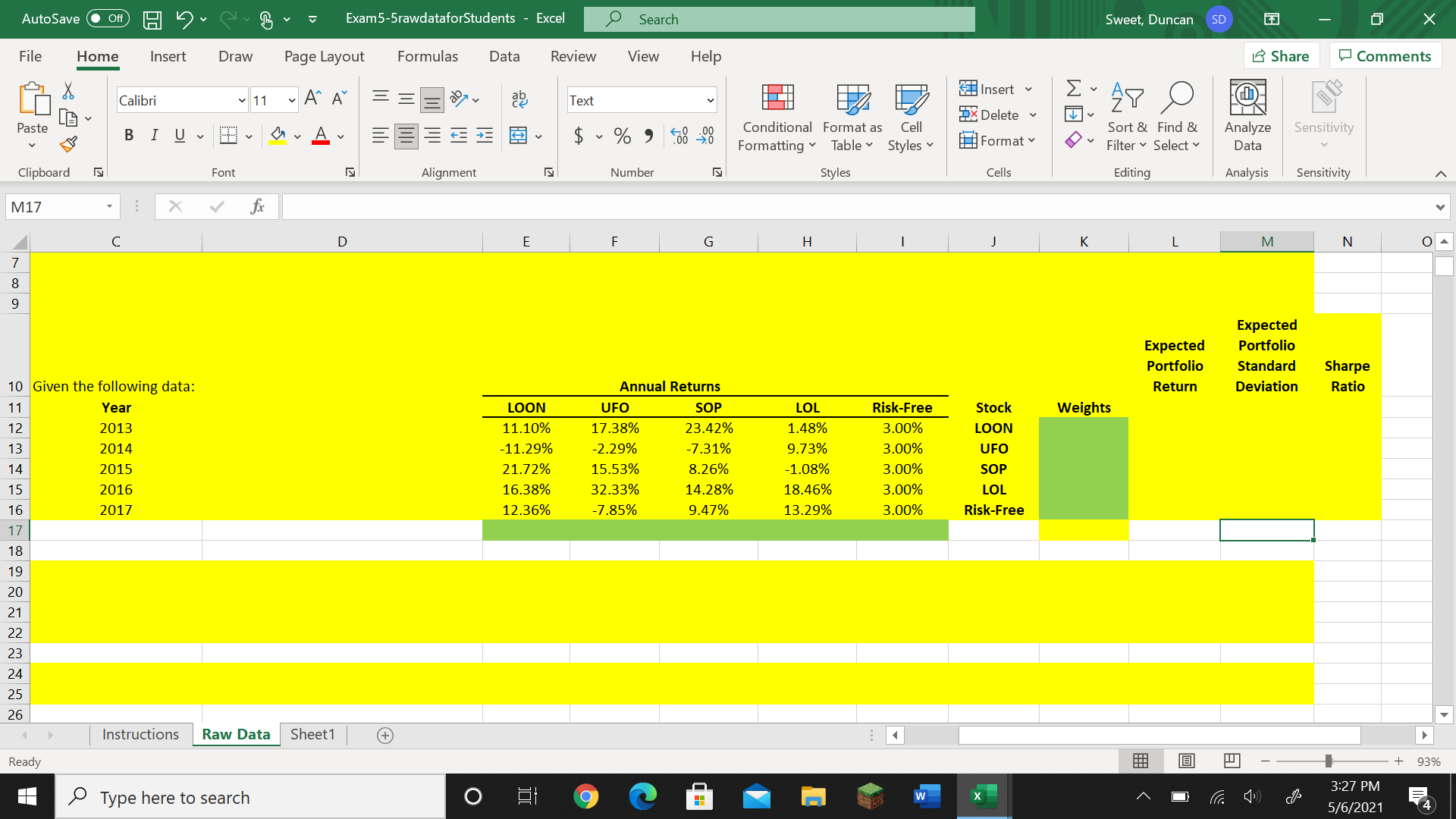

Question: Initially setting K12:k16 weights to 20% each, obtain the optimal weightings for these cells if you use solver and seek to maximize the expected return

Initially setting K12:k16 weights to 20% each, obtain the optimal weightings for these cells if you use solver and seek to maximize the expected return of the portfolio (L11) subject to the constraints of all weights summed to 100%.What is the weight for UFO?

need the work

Exam5-5rawdataforStudents - Excel Sweet, Duncan SD X AutoSave . Off ) Search File Home Insert Draw Page Layout Formulas Data Review View Help Share Comments Insert Calibri 11 ~ AA ab Text " AY x Delete LA Sort & Find & Analyze Sensitivity Paste Conditional Format as Cell BIUV $ ~ % 9 00 20 Formatting Table ~ Styles Format Filter ~ Select Data Number Styles Cells Editing Analysis Sensitivity Clipboard Font Alignment M17 X Y D E F G H K L M N OA C 00 Expected Expected Portfolio Portfolio Standard Sharpe Deviation Ratio 10 Given the following data: Annual Returns Return 11 UFC LOL Risk-Free Stock Year LOON SOP Weights 2013 11.10% 17.38% 23.42% 1.48% 3.00% LOON 12 13 2014 11.29% 2.29% -7.31% 9.73% 3.00% UFO 2015 21.72% 15.53% 8.26% 1.08% 3.00% SOP 14 15 2016 16.38% 32.33% 14.28% 18.46% 3.00% LOL 16 2017 12.36% -7.85% 9.47% 13.29% 3.00% Risk-Free 17 18 19 20 21 22 23 24 25 26 Instructions Raw Data Sheet1 + + 93% Ready 3:27 PM Type here to search O w X O 5/6/2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts