Question: INOWS WINu tis eomeet Incorrect for the work you have completed so fer. It does not In an inherted S100,000 with the stipulation that he

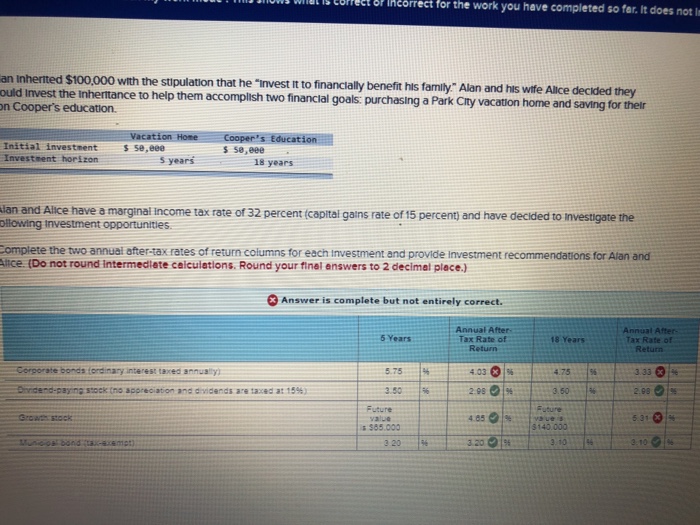

INOWS WINu tis eomeet Incorrect for the work you have completed so fer. It does not In an inherted S100,000 with the stipulation that he "invest t to financially benefit his family" Alan and his wife Allce decided ould invest n Cooper's education the iInhertance to help them accomplish two financial goals: purchasing a Park City vac ation home and saving for their Vacat 5e,eee s tducation on Home Initial investnent Investment horizon s se,eee 5 years 18 years ian and Alice have a marginai income tax rate of 32 percent (capital gains rate of 15 percent) and have decided to investigate the ollowing investment opportunities Complete the two annuai after-tax rates of return columns for each investment and provide investment recommendations for Alan and ce (Do not round intermedilate ceiculations. Round your finel enswers to 2 decimal place.) Answer is complete but not entirely correct. Annual After- Tax Rate of Return Annual After Tax Rate of Return 5 Years 18 Years 4.03 3 298 3.33 e 298 Corporate bonds iondinary interest taxed annualy 5.75 1% 3.506 4.75 3.50 Future value 3140.000 320 | 20 T9 2-10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts