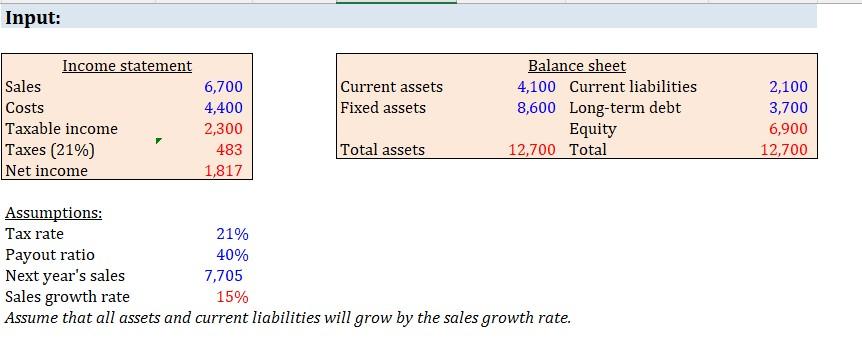

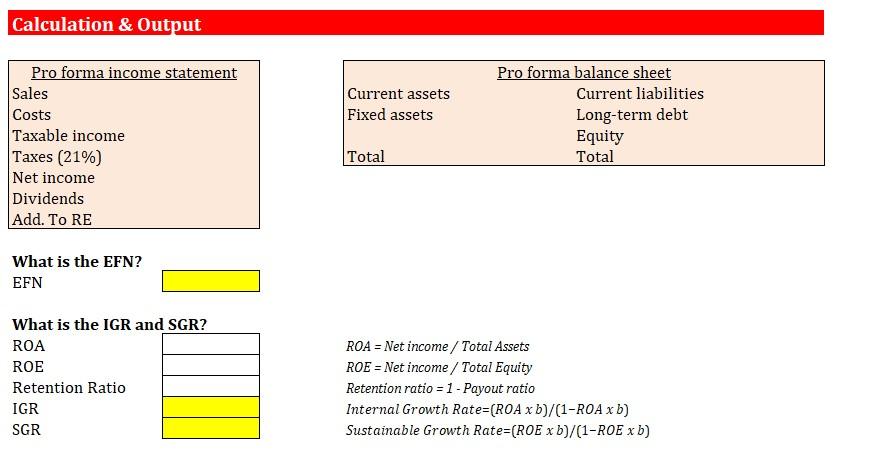

Question: Input: Assume that all assets and current liabilities will grow by the sales growth rate. Calculation & Output begin{tabular}{|l|} hline Pro forma income statement

Input: Assume that all assets and current liabilities will grow by the sales growth rate. Calculation \& Output \begin{tabular}{|l|} \hline Pro forma income statement \\ Sales \\ Costs \\ Taxable income \\ Taxes (21%) \\ Net income \\ Dividends \\ Add. To RE \\ \hline \end{tabular} \begin{tabular}{|ll|} \hline Current assets & Pro forma balance sheet \\ Fixed assets & Current liabilities \\ & Long-term debt \\ Total & Equity \\ Total \\ \hline \end{tabular} What is the EFN? EFN What is the IGR and SGR? ROA= Net income / Total Assets ROE= Net income / Total Equity Retention ratio =1 - Payout ratio Internal Growth Rate=(ROAxb)/(1ROAxb) Sustainable Growth Rate =(ROExb)/(1ROExb)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts