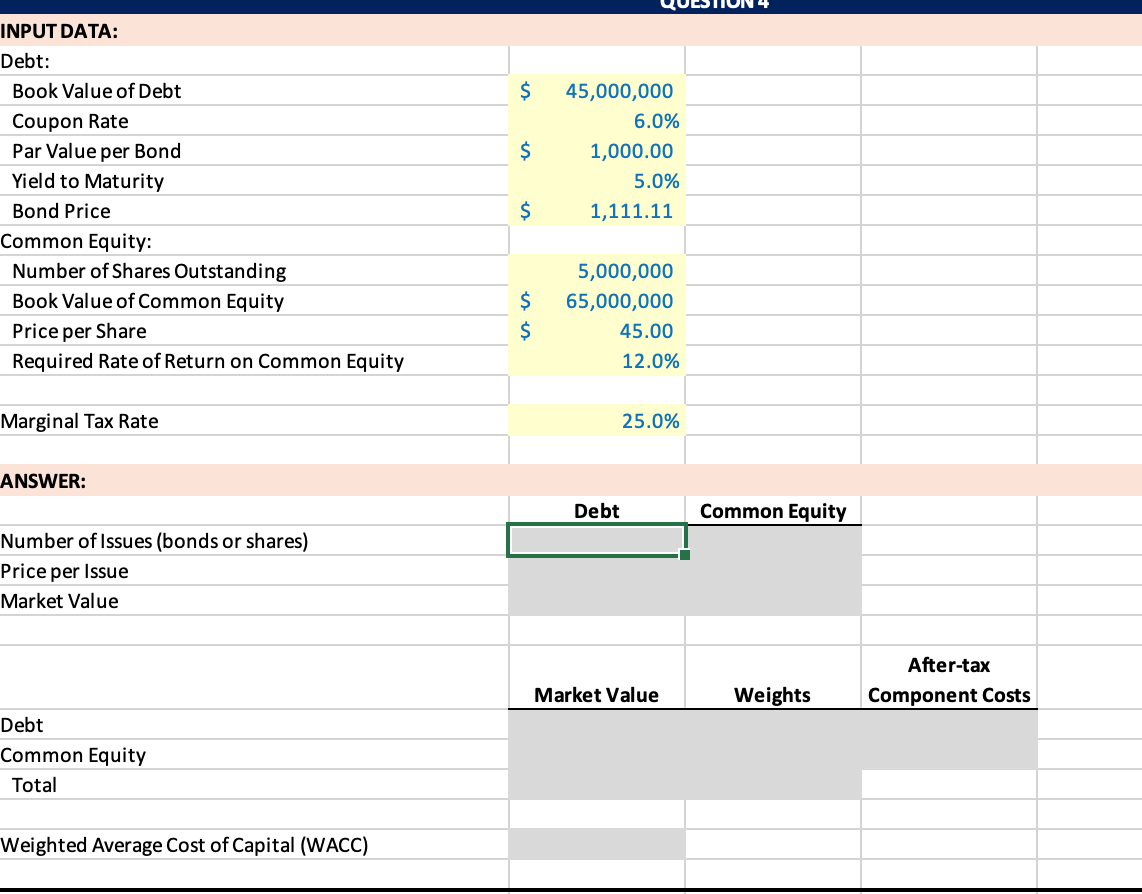

Question: $ $ INPUT DATA: Debt: Book Value of Debt Coupon Rate Par Value per Bond Yield to Maturity Bond Price Common Equity: Number of Shares

$ $ INPUT DATA: Debt: Book Value of Debt Coupon Rate Par Value per Bond Yield to Maturity Bond Price Common Equity: Number of Shares Outstanding Book Value of Common Equity Price per Share Required Rate of Return on Common Equity 45,000,000 6.0% 1,000.00 5.0% 1,111.11 $ $ $ 5,000,000 65,000,000 45.00 12.0% Marginal Tax Rate 25.0% ANSWER: Debt Common Equity Number of Issues (bonds or shares) Price per Issue Market Value After-tax Component Costs Market Value Weights Debt Common Equity Total Weighted Average Cost of Capital (WACC)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts