Question: Input information Given the following data: Assume the date is Monday, September 13, 2021 S&P500 spot = 4,453.24 [SPX INDEX], the index has a

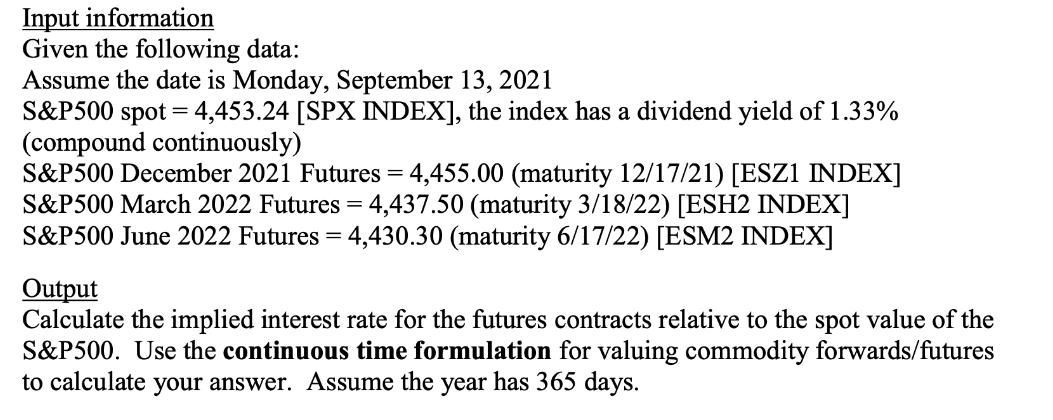

Input information Given the following data: Assume the date is Monday, September 13, 2021 S&P500 spot = 4,453.24 [SPX INDEX], the index has a dividend yield of 1.33% (compound continuously) S&P500 December 2021 Futures = 4,455.00 (maturity 12/17/21) [ESZ1 INDEX] S&P500 March 2022 Futures = 4,437.50 (maturity 3/18/22) [ESH2 INDEX] S&P500 June 2022 Futures = 4,430.30 (maturity 6/17/22) [ESM2 INDEX] Output Calculate the implied interest rate for the futures contracts relative to the spot value of the S&P500. Use the continuous time formulation for valuing commodity forwards/futures to calculate your answer. Assume the year has 365 days.

Step by Step Solution

There are 3 Steps involved in it

The implied interest rate for the December 2021 contract is 00632 The implied i... View full answer

Get step-by-step solutions from verified subject matter experts