Question: Input into the spreadsheet will include: 1. Current age (5 yrs - child just turned 5) of child. Cell A1 2. Current cost (S30,000 for

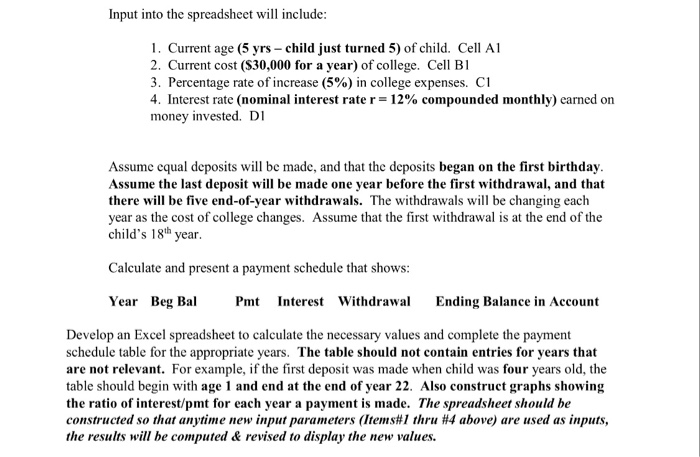

Input into the spreadsheet will include: 1. Current age (5 yrs - child just turned 5) of child. Cell A1 2. Current cost (S30,000 for a year) of college. Cell Bl 3, Percentage rate of increase (5%) in college expenses. Cl 4. Interest rate (nominal interest rate r = 12% compounded monthly) earned on money invested. DI Assume equal deposits will be made, and that the deposits began on the first birthday. Assume the last deposit will be made one year before the first withdrawal, and that there will be five end-of-year withdrawals. The withdrawals will be changing each year as the cost of college changes. Assume that the first withdrawal is at the end of the child's 18th year Calculate and present a payment schedule that shows: Year Beg Ba Pmt Interest Withdrawa Ending Balance in Account Develop an Excel spreadsheet to calculate the necessary values and complete the payment schedule table for the appropriate years. The table should not contain entries for years that are not relevant. For example, if the first deposit was made when child was four years old, the table should begin with age 1 and end at the end of year 22. Also construct graphs showing the ratio of interest/pmt for each year a payment is made. The spreadsheet should be constructed so that anytime new input parameters (Items#1 thru #4 above) are used as inputs, the results will be computed & revised to display the new values

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts