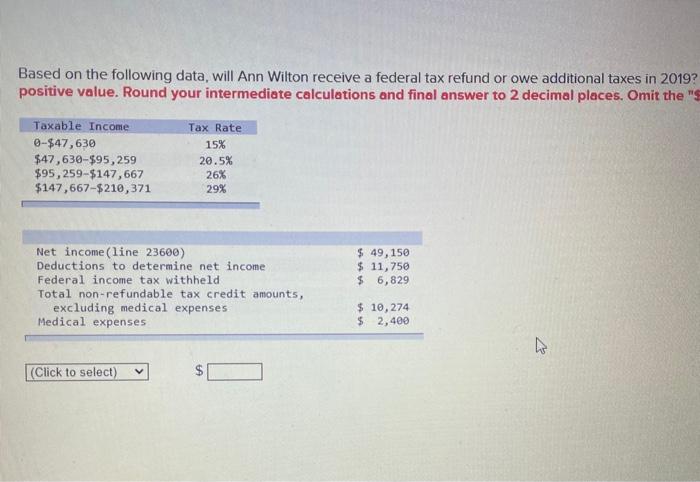

Question: Input the amount as a positive value. Round your intermediate calculations and final answer to 2 decimal places. (The answer should start with refund.) Based

Based on the following data, will Ann Wilton receive a federal tax refund or owe additional taxes in 2019? positive value. Round your intermediate calculations and final answer to 2 decimal places. Omit the "S Taxable Income 0-$47,630 $47,630-$95,259 $95, 259-$147,667 $147,667-$210,371 Tax Rate 15% 20.5% 26% 29% $ 49, 150 $ 11,750 $ 6,829 Net income (line 23600) Deductions to determine net income Federal income tax withheld Total non-refundable tax credit amounts, excluding medical expenses Medical expenses $ 10,274 $ 2,400 a (Click to select)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts