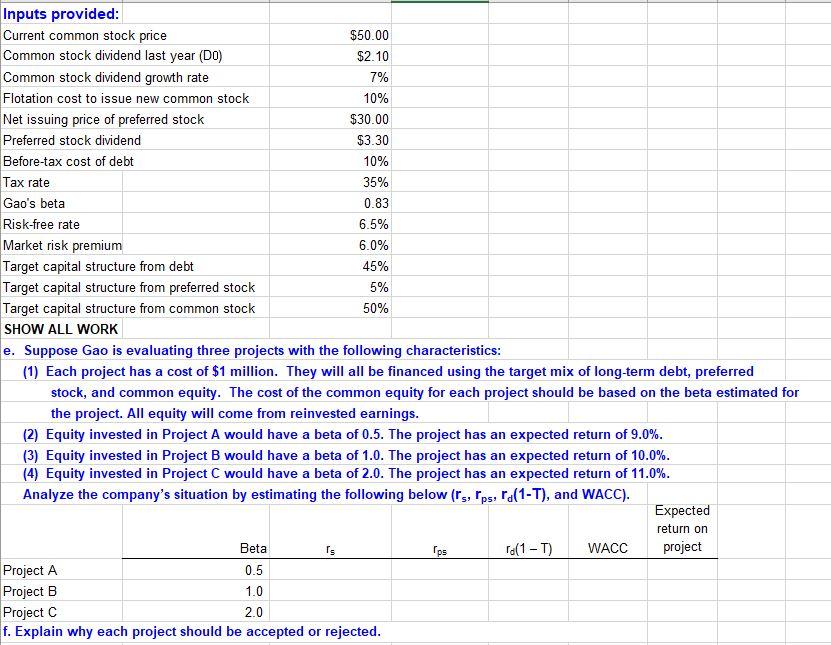

Question: Inputs provided: Current common stock price $50.00 Common stock dividend last year (DO) $2.10 Common stock dividend growth rate 7% Flotation cost to issue new

Inputs provided: Current common stock price $50.00 Common stock dividend last year (DO) $2.10 Common stock dividend growth rate 7% Flotation cost to issue new common stock 10% Net issuing price of preferred stock $30.00 Preferred stock dividend $3.30 Before-tax cost of debt 10% Tax rate 35% Gao's beta 0.83 Risk-free rate 6.5% Market risk premium 6.0% Target capital structure from debt 45% Target capital structure from preferred stock 5% Target capital structure from common stock 50% SHOW ALL WORK e. Suppose Gao is evaluating three projects with the following characteristics: (1) Each project has a cost of $1 million. They will all be financed using the target mix of long-term debt, preferred stock, and common equity. The cost of the common equity for each project should be based on the beta estimated for the project. All equity will come from reinvested earnings. (2) Equity invested in Project A would have a beta of 0.5. The project has an expected return of 9.0%. (3) Equity invested in Project B would have a beta of 1.0. The project has an expected return of 10.0%. (4) Equity invested in Project C would have a beta of 2.0. The project has an expected return of 11.0%. Analyze the company's situation by estimating the following below (rs, lps, rd(1-T), and WACC). Expected return on Beta Ips Id(1-T) WACC project Project A 0.5 Project B 1.0 Project C 2.0 f. Explain why each project should be accepted or rejected. Is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts