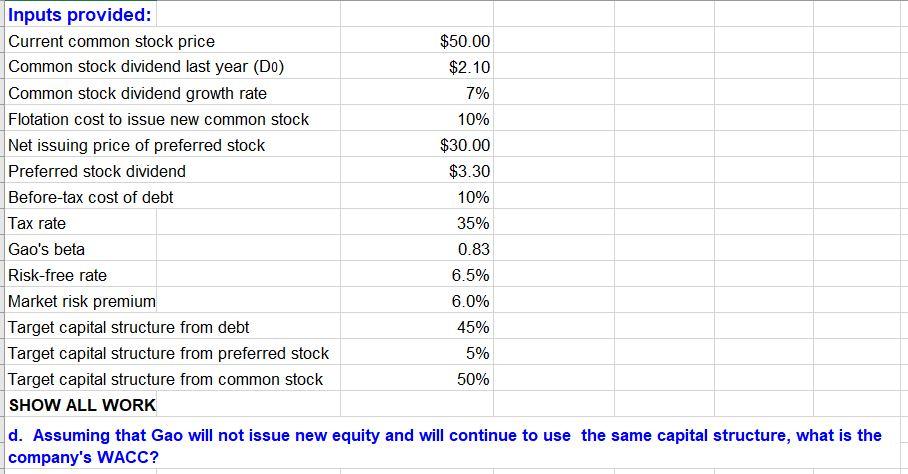

Question: Inputs provided: Current common stock price $50.00 Common stock dividend last year (Do) $2.10 Common stock dividend growth rate 7% Flotation cost to issue new

Inputs provided: Current common stock price $50.00 Common stock dividend last year (Do) $2.10 Common stock dividend growth rate 7% Flotation cost to issue new common stock 10% Net issuing price of preferred stock $30.00 Preferred stock dividend $3.30 Before-tax cost of debt 10% Tax rate 35% Gao's beta 0.83 Risk-free rate 6.5% Market risk premium 6.0% Target capital structure from debt 45% Target capital structure from preferred stock 5% Target capital structure from common stock 50% SHOW ALL WORK d. Assuming that Gao will not issue new equity and will continue to use the same capital structure, what is the company's WACC? 4o will not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts