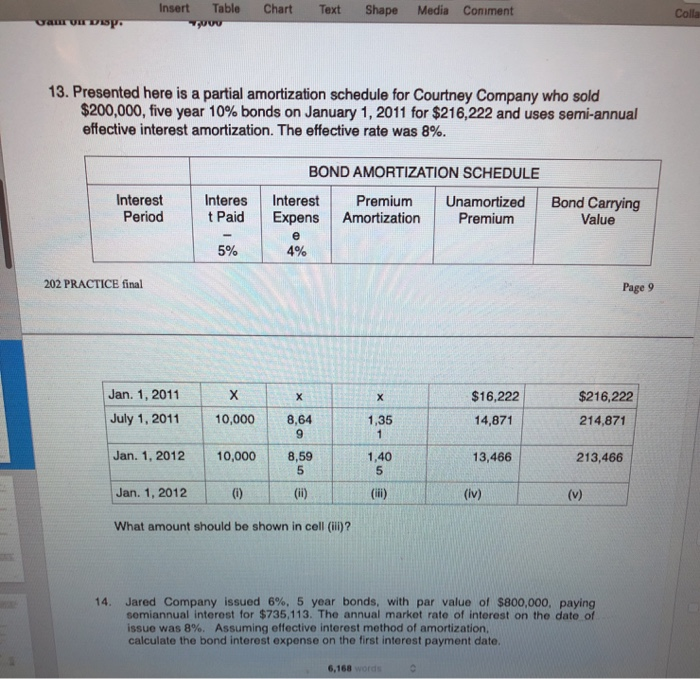

Question: Insert Chart Text Table w Shape Media Comment Colla wamp 13. Presented here is a partial amortization schedule for Courtney Company who sold $200,000, five

Insert Chart Text Table w Shape Media Comment Colla wamp 13. Presented here is a partial amortization schedule for Courtney Company who sold $200,000, five year 10% bonds on January 1, 2011 for $216,222 and uses semi-annual effective interest amortization. The effective rate was 8%. Interest Period Interes t Paid BOND AMORTIZATION SCHEDULE Interest Premium Unamortized Expens Amortization Premium e 4% Bond Carrying Value 5% 202 PRACTICE final Page 9 $16,222 $216,222 Jan. 1, 2011 July 1, 2011 10,000 8,64 9 1,35 1 14,871 214,871 Jan 1, 2012 10,000 8,59 5 1,40 5 13,466 213,466 Jan 1, 2012 (0) (1) (iv) (v) What amount should be shown in cell (i)? 14. Jared Company issued 6%, 5 year bonds, with par value of $800,000, paying semiannual interest for $735,113. The annual market rate of interest on the date of issue was 8%. Assuming effective interest method of amortization, calculate the bond interest expense on the first interest payment date. 6,168 word

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts