Question: Insert Draw Design Layout Calibri (Bo.. 12 A A BIU xx A References Aa A Av Mailings V Telu A Paragraph Styles Dictate Sensitivity Task

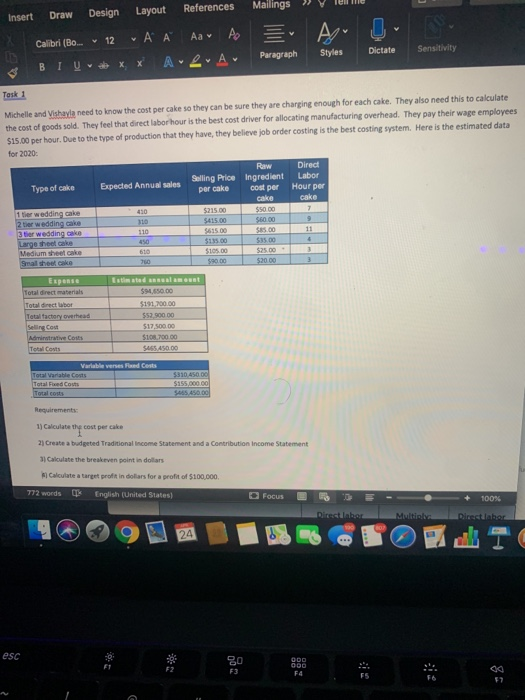

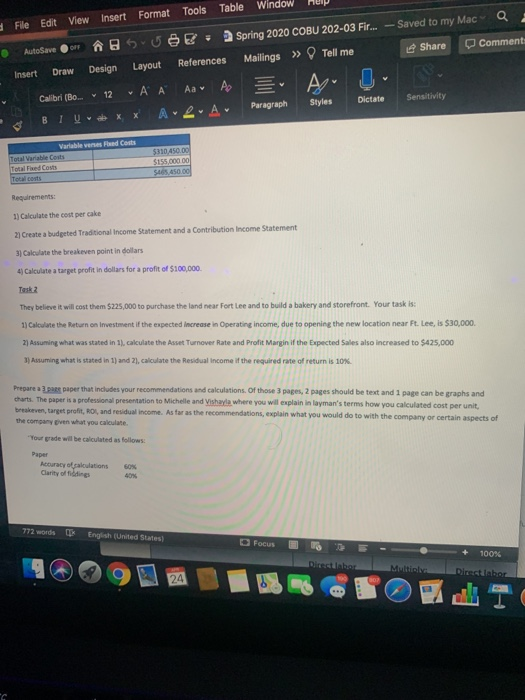

Insert Draw Design Layout Calibri (Bo.. 12 A A BIU xx A References Aa A Av Mailings V Telu A Paragraph Styles Dictate Sensitivity Task 1 Michelle and Vishaylaneed to know the cost per cake so they can be sure they are charging enough for each cake. They also need this to calculate the cost of goods sold. They feel that direct labor hour is the best cost driver for allocating manufacturing overhead. They pay their wage employees $15.00 per hour. Due to the type of production that they have, they believe job order costing is the best costing system. Here is the estimated data for 2020: Type of cake Expected Annual sales Selling Price per cake Raw Ingredient cost per cake $50 DO S60.00 SI5.00 Direct Labor Hour per cake 7 $415.00 61500 11 3 tier wedding cake Medium she cake $10.00 000 760 $20. 00 3 Expense Total direct materials Total direct labor Total factory overhead Estimated salment $1,550.00 $191,700.00 $52.90000 517,500.00 SIO 700.00 SU$S450.00 Total Costs beesfeest Total Variable costs Total Fed Costs Requirements: 1) Calculate the cost per cake 2) Create a budgeted Traditional income Statement and a Contribution Income Statement Calculate the breakeven point in dollars Calculate a target profit in dollars for a profit of $100.000 772 words English (United States) Focus + 100% i nestlabor Director Multic File Edit View Insert Format Tools Table Window AutoSaver S U B : Spring 2020 COBU 202-03 Fir... -Saved to my Maca Insert Draw Design Layout References Mailings >> V Tell me Share Comment: Calibri (B. 12 A A Aa A A BIL x x A A Paragraph Styles Dictate Sensitivity Variable verses and Costs Total Variable Costs Total Fed Costs Total costs $310450.00 $155.000.00 S . 450.00 Requirements: 1) Calculate the cost per cake 2Create a budgeted Traditional Income Statement and a Contribution Income Statement 3) Calculate the breakeven point in dollars 4) Calculate a target profit in dollars for a profit of $100,000 Task 2 They believe it will cost them $225,000 to purchase the land near Fort Lee and to build a bakery and storefront. Your task is: 1) Calculate the Return on investment if the expected increase in Operating income, due to opening the new location near Ft. Lee, is $30,000 21 Assuming what was stated in 1), calculate the Asset Turnover Rate and Profit Margin of the Expected Sales also increased to $425,000 3) Asuming what is stated in 1) and 2), calculate the Residual income of the required rate of return is 10% Prepare apare paper that includes your recommendations and calculations of those 3 pages, 2 pages should be text and 1 page can be graphs and charts. The paper is a professional presentation to Michelle and Vishayla where you will explainin layman's terms how you calculated cost per unit, breakeven, target profit, RO, and residual income. As far as the recommendations, explain what you would do to with the company or certain aspects of the company even what you calculate "Your grade will be calculated as follows: Paper Accuracy of calculations Clarity of things 60% 772 words English (United States Focus E- Dacabar + 100% Multi Director

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts