Question: Insert Draw Page Layout Formulas Data Review Tell me View Calibri (Body) 12 A A == 26 Wrap Text General LA Copy ~ Format ste

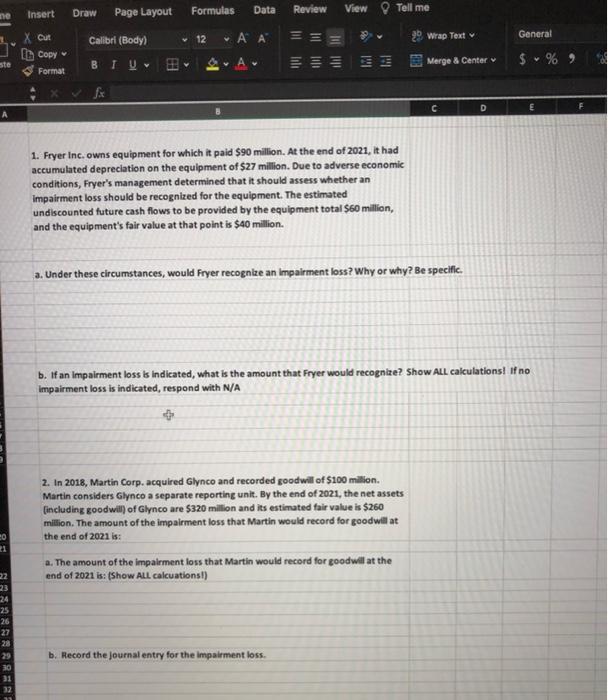

Insert Draw Page Layout Formulas Data Review Tell me View Calibri (Body) 12 A A == 26 Wrap Text General LA Copy ~ Format ste BIL $ % Merge & Center D 1. Fryer Inc. owns equipment for which it paid $90 million. At the end of 2021, it had accumulated depreciation on the equipment of $27 million. Due to adverse economic conditions, Fryer's management determined that it should assess whether an impairment loss should be recognized for the equipment. The estimated undiscounted future cash flows to be provided by the equipment total $60 million, and the equipment's fair value at that point is $40 million. a. Under these circumstances, would Fryer recognize an impairment loss? Why or why? Be specific b. If an Impairment loss is indicated, what is the amount that Fryer would recognize? Show ALL calculations! If no impairment loss is indicated, respond with N/A 2. In 2018, Martin Corp. acquired Glynco and recorded goodwill of $100 million Martin considers Glynco a separate reporting unit. By the end of 2021, the net assets (including goodwill) of Glynco are $320 million and its estimated fair value is $260 million. The amount of the impairment loss that Martin would record for goodwill at the end of 2021 is: a. The amount of the impairment loss that Martin would record for goodwill at the end of 2021 is: (Show ALL calcuations!) 24 25 26 27 b. Record the journal entry for the impairment loss. NARARE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts