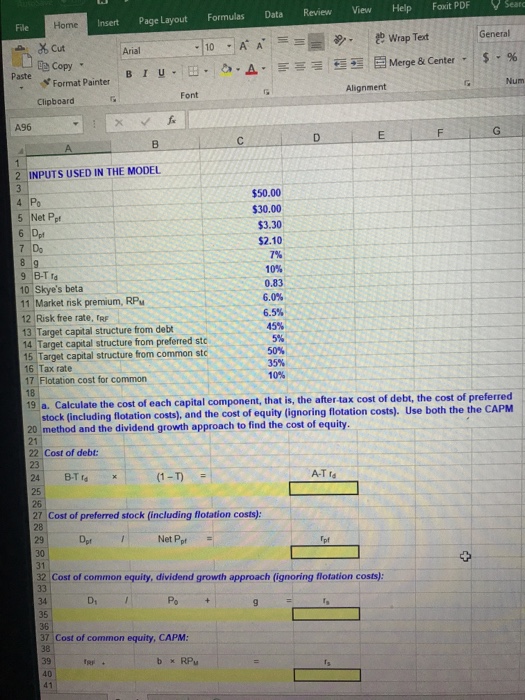

Question: Insert Page Layout Formulas Data Review View Help Foxit PDF Searo General Cut Copy Format Painter Arial Paste Num Font Alignment Clipboard A96 2 INPUTS

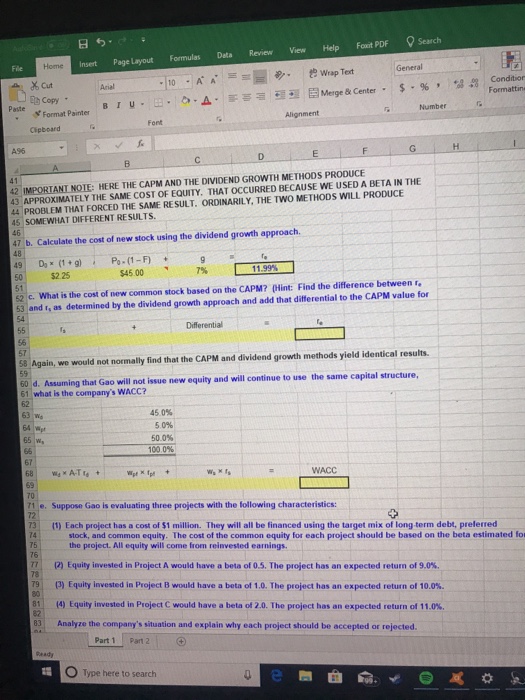

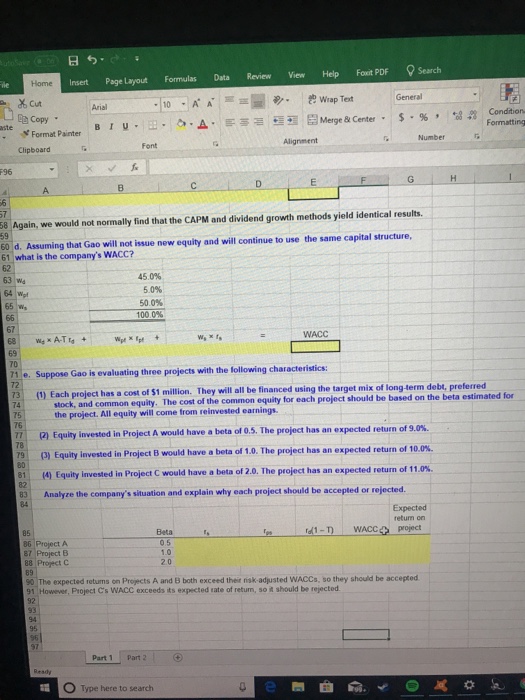

Insert Page Layout Formulas Data Review View Help Foxit PDF Searo General Cut Copy Format Painter Arial Paste Num Font Alignment Clipboard A96 2 INPUTS USED IN THE MODEL $50.00 30.00 $3.30 $2.10 4 Po 5 Net Ppt 7 Do 9 B-T a 10 Skye's beta 11 Market risk premium, RP 12 Risk free rate, RF 10% 0.83 6.0% 6.5% 45% 13 Target capital structure from debt 14 Target capital structure from preferred stc 15 Target capital structure from common stc 16 Tax rate 17 Flotation cost for common 18 19 a. Calculate the cost of each capital component, that is, the after-tax cost of debt, the cost of preferred 50% 35% 10% stock (including flotation costs), and the cost of equity (ignoring flotation costs) . Use both the the CAPM 20 method and the dividend growth approach to find the cost of equity. 22 Cost of debt: 24 B-T (1) 27 Cost of preferred stock (including flotation costs): A-T fa 28 29D Net Po 30 31 32 Cost of common equity, dividend growth approach (ignoring flotation costs): Di 35 36 37 Cost of common equity, CAPM: 38 39 40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts