Question: Insert Table Chart Text Shape Media Comment Show your work on paper or excel. You are offered the opportunity of lifetime; a financially challenged property

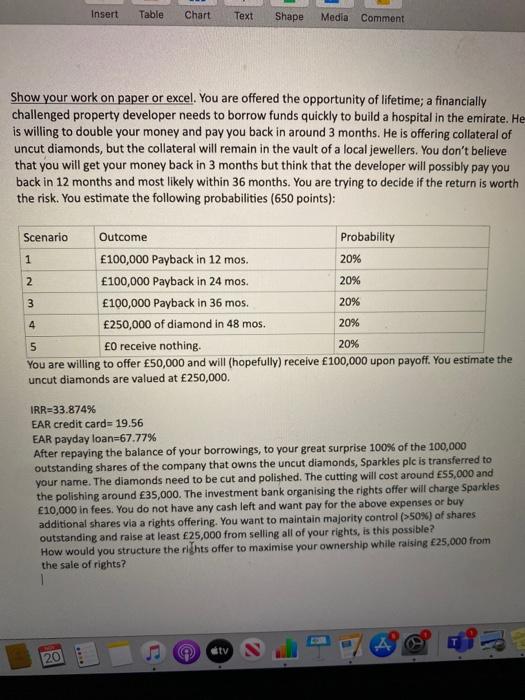

Insert Table Chart Text Shape Media Comment Show your work on paper or excel. You are offered the opportunity of lifetime; a financially challenged property developer needs to borrow funds quickly to build a hospital in the emirate. He is willing to double your money and pay you back in around 3 months. He is offering collateral of uncut diamonds, but the collateral will remain in the vault of a local jewellers. You don't believe that you will get your money back in 3 months but think that the developer will possibly pay you back in 12 months and most likely within 36 months. You are trying to decide if the return is worth the risk. You estimate the following probabilities (650 points): 1 2 3 20% Scenario Outcome Probability 100,000 Payback in 12 mos. 20% 100,000 Payback in 24 mos. 20% 100,000 Payback in 36 mos . 250,000 of diamond in 48 mos. 20% 5 0 receive nothing 20% You are willing to offer 50,000 and will (hopefully) receive 100,000 upon payoff. You estimate the uncut diamonds are valued at 250,000. 4 IRR=33.874% EAR credit card=19.56 EAR payday loan=67.77% After repaying the balance of your borrowings, to your great surprise 100% of the 100,000 outstanding shares of the company that owns the uncut diamonds, Sparkles plc is transferred to your name. The diamonds need to be cut and polished. The cutting will cost around 55,000 and the polishing around 35,000. The investment bank organising the rights offer will charge Sparkles 10,000 in fees. You do not have any cash left and want pay for the above expenses or buy additional shares via a rights offering. You want to maintain majority control (>50%) of shares outstanding and raise at least 25,000 from selling all of your rights, is this possible? How would you structure the rights offer to maximise your ownership while raising 25,000 from the sale of rights? A tv 20 Insert Table Chart Text Shape Media Comment Show your work on paper or excel. You are offered the opportunity of lifetime; a financially challenged property developer needs to borrow funds quickly to build a hospital in the emirate. He is willing to double your money and pay you back in around 3 months. He is offering collateral of uncut diamonds, but the collateral will remain in the vault of a local jewellers. You don't believe that you will get your money back in 3 months but think that the developer will possibly pay you back in 12 months and most likely within 36 months. You are trying to decide if the return is worth the risk. You estimate the following probabilities (650 points): 1 2 3 20% Scenario Outcome Probability 100,000 Payback in 12 mos. 20% 100,000 Payback in 24 mos. 20% 100,000 Payback in 36 mos . 250,000 of diamond in 48 mos. 20% 5 0 receive nothing 20% You are willing to offer 50,000 and will (hopefully) receive 100,000 upon payoff. You estimate the uncut diamonds are valued at 250,000. 4 IRR=33.874% EAR credit card=19.56 EAR payday loan=67.77% After repaying the balance of your borrowings, to your great surprise 100% of the 100,000 outstanding shares of the company that owns the uncut diamonds, Sparkles plc is transferred to your name. The diamonds need to be cut and polished. The cutting will cost around 55,000 and the polishing around 35,000. The investment bank organising the rights offer will charge Sparkles 10,000 in fees. You do not have any cash left and want pay for the above expenses or buy additional shares via a rights offering. You want to maintain majority control (>50%) of shares outstanding and raise at least 25,000 from selling all of your rights, is this possible? How would you structure the rights offer to maximise your ownership while raising 25,000 from the sale of rights? A tv 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts